Hydrafacial Results Presentation Deck

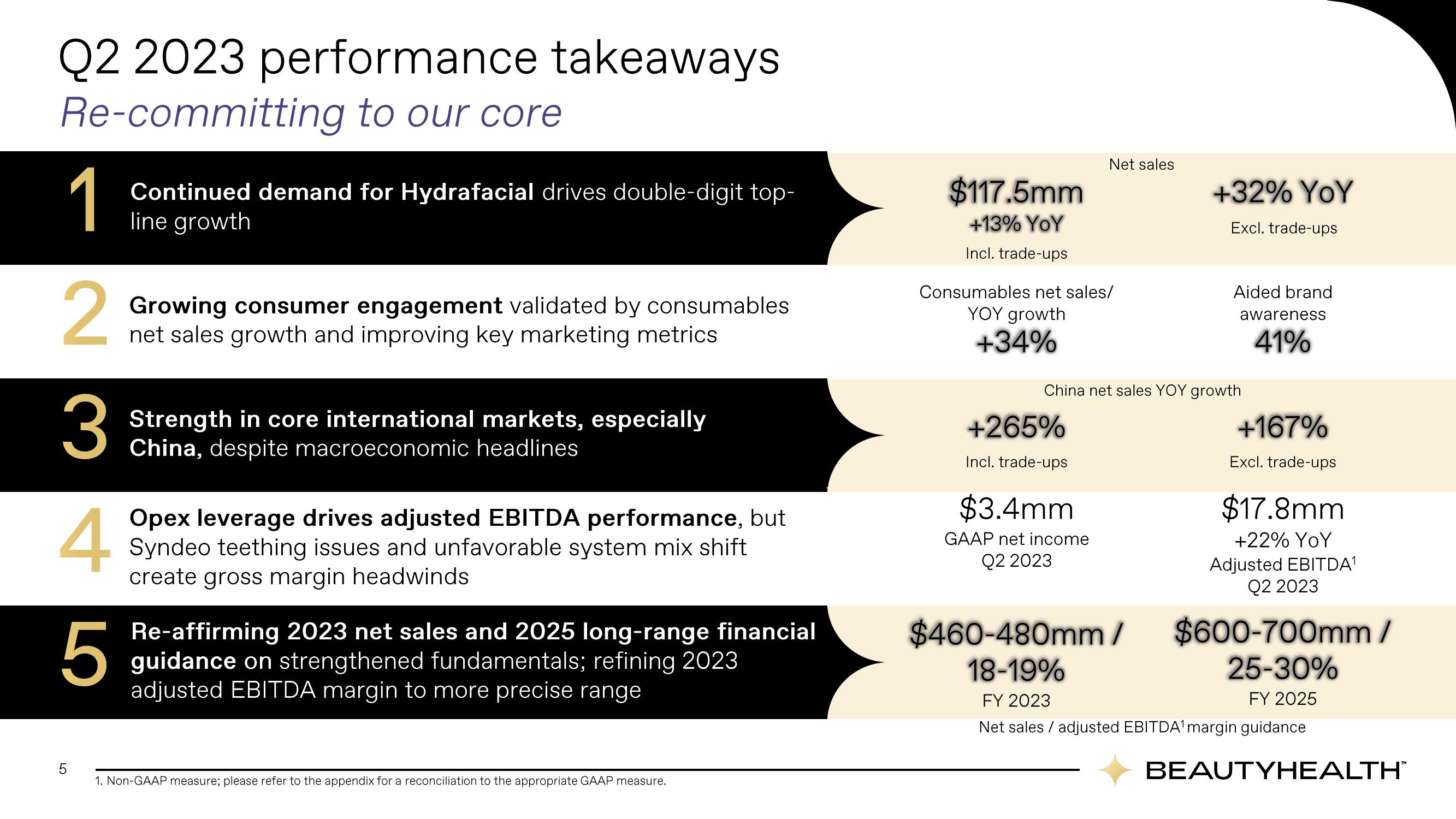

Q2 2023 performance takeaways

Re-committing to our core

1

Continued demand for Hydrafacial drives double-digit top-

line growth

2 Growing consumer engagement validated by consumables

growth and improving key marketing metrics

3

4

5

LO

5

Strength in core international markets, especially

China, despite macroeconomic headlines

Opex leverage drives adjusted EBITDA performance, but

Syndeo teething issues and unfavorable system mix shift

create gross margin headwinds

Re-affirming 2023 net sales and 2025 long-range financial

guidance on strengthened fundamentals; refining 2023

adjusted EBITDA margin to more precise range

1. Non-GAAP measure; please refer to the appendix for a reconciliation to the appropriate GAAP measure.

$117.5mm

+13% YoY

Incl. trade-ups

Consumables net sales/

YOY growth

+34%

Net sales

+265%

Incl. trade-ups

$3.4mm

GAAP net income

Q2 2023

+32% YoY

Excl. trade-ups

China net sales YOY growth

Aided brand

$460-480mm/

18-19%

awareness

41%

+167%

Excl. trade-ups

$17.8mm

+22% YoY

Adjusted EBITDA¹

Q2 2023

$600-700mm /

25-30%

FY 2023

FY 2025

Net sales / adjusted EBITDA¹ margin guidance

BEAUTYHEALTH™View entire presentation