OppFi Results Presentation Deck

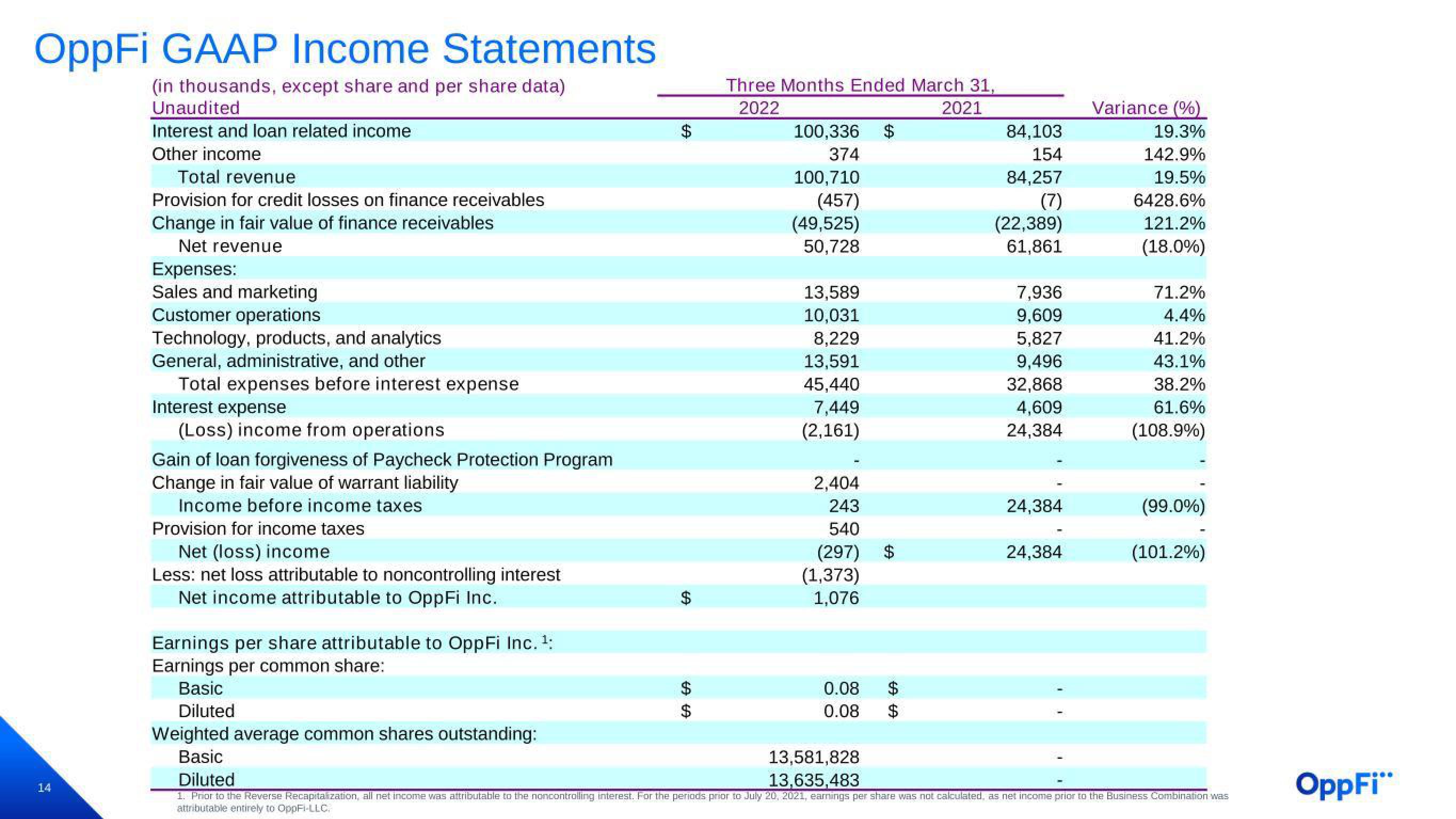

OppFi GAAP Income Statements

(in thousands, except share and per share data)

Unaudited

Interest and loan related income

Other income

14

Total revenue

Provision for credit losses on finance receivables

Change in fair value of finance receivables

Net revenue

Expenses:

Sales and marketing

Customer operations

Technology, products, and analytics

General, administrative, and other

Total expenses before interest expense

Interest expense

(Loss) income from operations

Gain of loan forgiveness of Paycheck Protection Program

Change in fair value of warrant liability

Income before income taxes

Provision for income taxes

Net (loss) income

Less: net loss attributable to noncontrolling interest

Net income attributable to OppFi Inc.

Earnings per share attributable to OppFi Inc. ¹:

Earnings per common share:

Basic

Diluted

Weighted average common shares outstanding:

Basic

69

$

$

69

$

69 69

Three Months Ended March 31,

2022

2021

100,336 $

374

100,710

(457)

(49,525)

50,728

13,589

10,031

8,229

13,591

45,440

7,449

(2,161)

2,404

243

540

(297)

(1,373)

1,076

0.08 $

69 69

0.08 $

13,581,828

13,635,483

84,103

154

84,257

(7)

(22,389)

61,861

7,936

9,609

5,827

9,496

32,868

4,609

24,384

24,384

24,384

Variance (%)

19.3%

142.9%

19.5%

6428.6%

121.2%

(18.0%)

71.2%

4.4%

41.2%

43.1%

38.2%

61.6%

(108.9%)

(99.0%)

(101.2%)

Diluted

1. Prior to the Reverse Recapitalization, all net income was attributable to the noncontrolling interest. For the periods prior to July 20, 2021, earnings per share was not calculated, as net income prior to the Business Combination was

attributable entirely to OppFi-LLC.

OppFi"View entire presentation