HSBC Investor Day Presentation Deck

£m

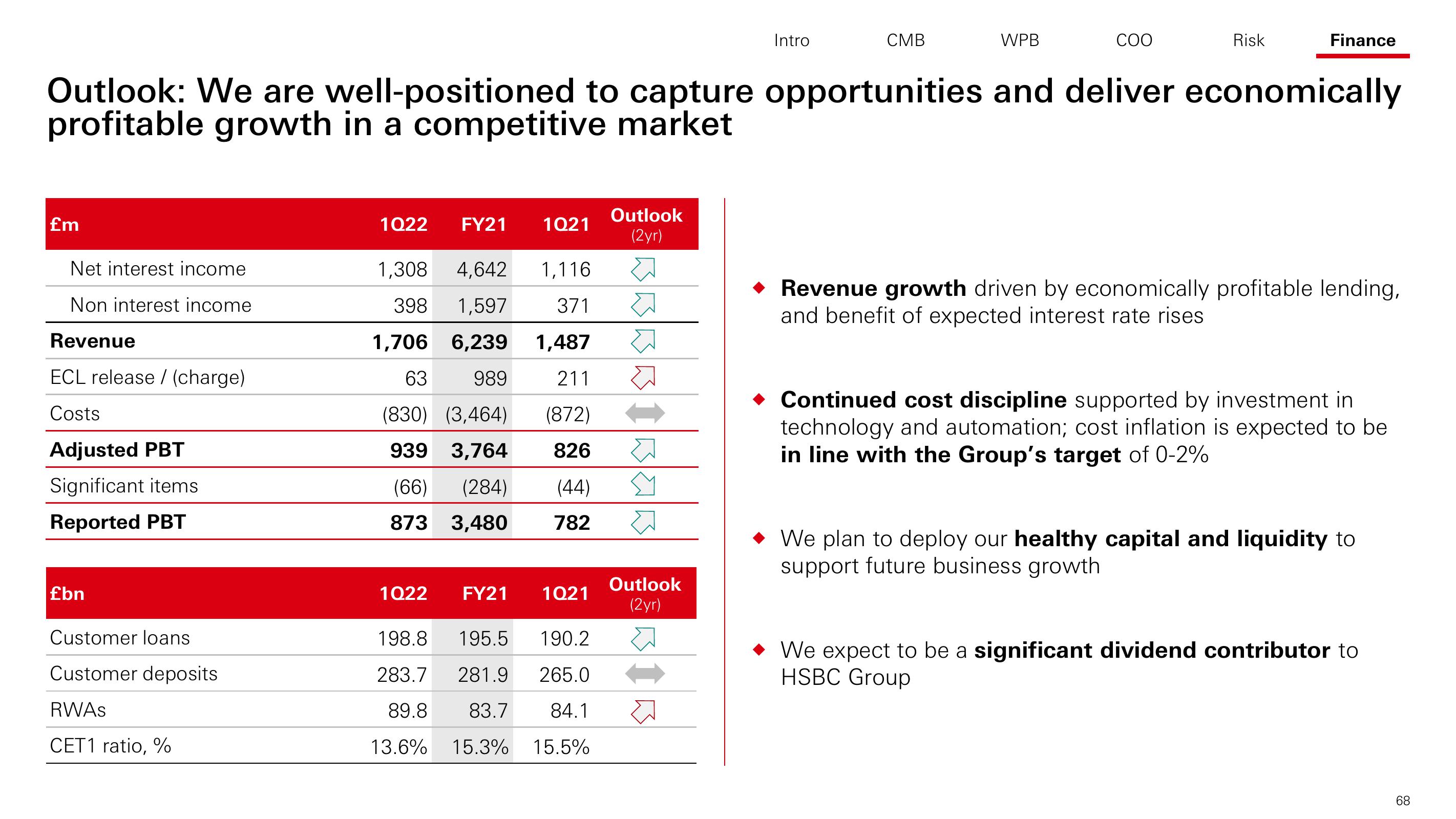

Net interest income

Non interest income

Revenue

ECL release/ (charge)

Costs

Adjusted PBT

Significant items

Reported PBT

Outlook: We are well-positioned to capture opportunities and deliver economically

profitable growth in a competitive market

£bn

Customer loans

Customer deposits

RWAS

CET1 ratio, %

1Q22

FY21 1021

1,308 4,642 1,116

398 1,597 371

1,706

6,239

1,487

63

989

211

(830) (3,464) (872)

939 3,764

826

(66) (284) (44)

873 3,480

782

1Q22 FY21 1Q21

198.8

195.5

190.2

283.7

281.9 265.0

89.8

83.7 84.1

13.6% 15.3% 15.5%

Outlook

(2yr)

»

»

M

»

Outlook

(2yr)

Intro

a

CMB

WPB

COO

Risk

Finance

◆ Revenue growth driven by economically profitable lending,

and benefit of expected interest rate rises

Continued cost discipline supported by investment in

technology and automation; cost inflation is expected to be

in line with the Group's target of 0-2%

We plan to deploy our healthy capital and liquidity to

support future business growth

We expect to be a significant dividend contributor to

HSBC Group

68View entire presentation