Massachusetts Water Resources Authority (“MWRA”) Employees’ Retirement System

Environmental, Social and Governance (ESG) Policy

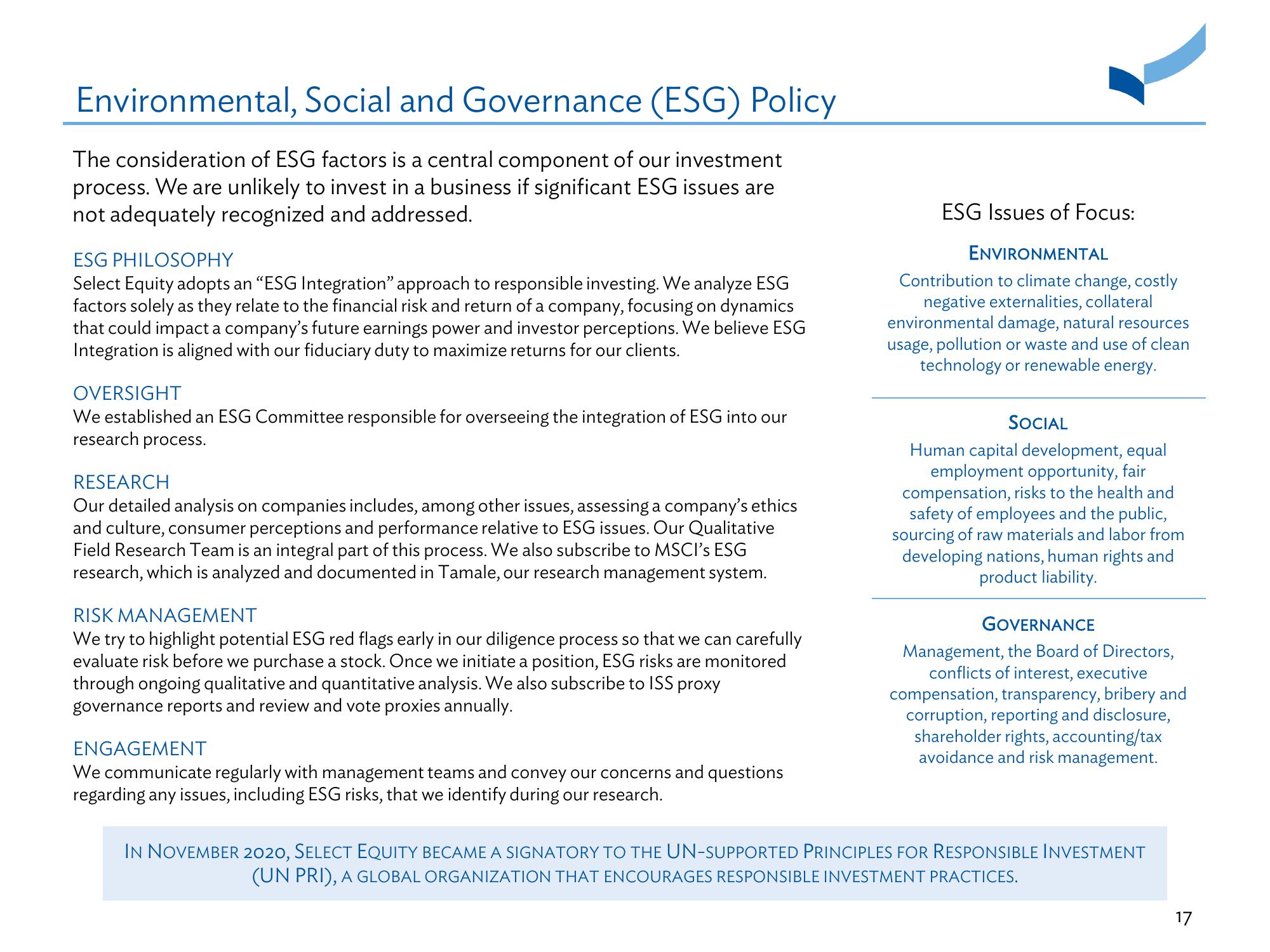

The consideration of ESG factors is a central component of our investment

process. We are unlikely to invest in a business if significant ESG issues are

not adequately recognized and addressed.

ESG PHILOSOPHY

Select Equity adopts an "ESG Integration" approach to responsible investing. We analyze ESG

factors solely as they relate to the financial risk and return of a company, focusing on dynamics

that could impact a company's future earnings power and investor perceptions. We believe ESG

Integration is aligned with our fiduciary duty to maximize returns for our clients.

OVERSIGHT

We established an ESG Committee responsible for overseeing the integration of ESG into our

research process.

RESEARCH

Our detailed analysis on companies includes, among other issues, assessing a company's ethics

and culture, consumer perceptions and performance relative to ESG issues. Our Qualitative

Field Research Team is an integral part of this process. We also subscribe to MSCI's ESG

research, which is analyzed and documented in Tamale, our research management system.

RISK MANAGEMENT

We try to highlight potential ESG red flags early in our diligence process so that we can carefully

evaluate risk before we purchase a stock. Once we initiate a position, ESG risks are monitored

through ongoing qualitative and quantitative analysis. We also subscribe to ISS proxy

governance reports and review and vote proxies annually.

ENGAGEMENT

We communicate regularly with management teams and convey our concerns and questions

regarding any issues, including ESG risks, that we identify during our research.

ESG Issues of Focus:

ENVIRONMENTAL

Contribution to climate change, costly

negative externalities, collateral

environmental damage, natural resources

usage, pollution or waste and use of clean

technology or renewable energy.

SOCIAL

Human capital development, equal

employment opportunity, fair

compensation, risks to the health and

safety of employees and the public,

sourcing of raw materials and labor from

developing nations, human rights and

product liability.

GOVERNANCE

Management, the Board of Directors,

conflicts of interest, executive

compensation, transparency, bribery and

corruption, reporting and disclosure,

shareholder rights, accounting/tax

avoidance and risk management.

IN NOVEMBER 2020, SELECT EQUITY BECAME A SIGNATORY TO THE UN-SUPPORTED PRINCIPLES FOR RESPONSIBLE INVESTMENT

(UN PRI), A GLOBAL ORGANIZATION THAT ENCOURAGES RESPONSIBLE INVESTMENT PRACTICES.

17View entire presentation