Tradeweb Results Presentation Deck

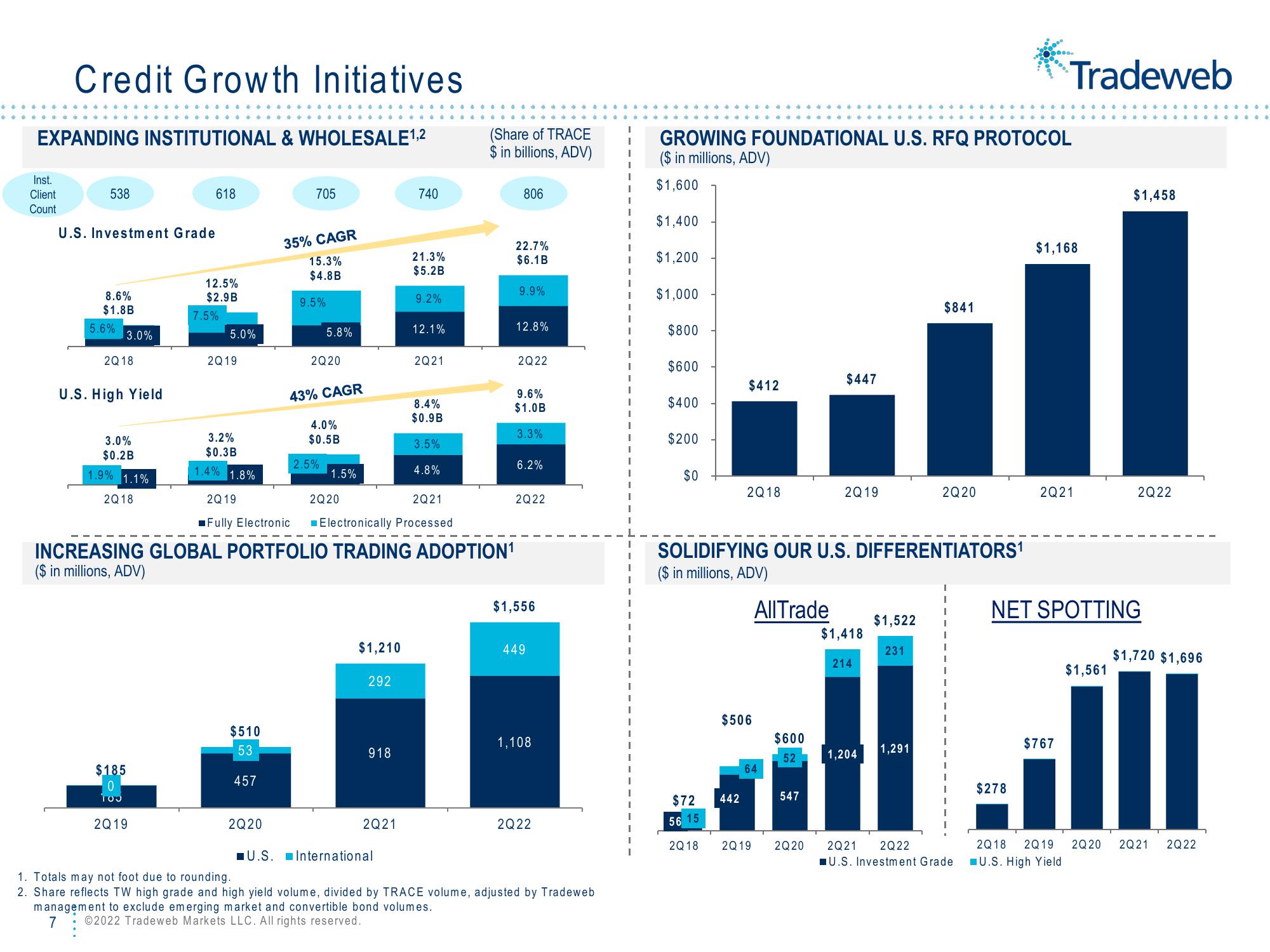

Credit Growth Initiatives

EXPANDING INSTITUTIONAL & WHOLESALE ¹,2

Inst.

Client

Count

538

U.S. Investment Grade

8.6%

$1.8B

5.6%

3.0%

2Q18

U.S. High Yield

3.0%

$0.2B

1.9% 1.1%

2Q18

618

$185

0

100

2Q19

12.5%

$2.9B

7.5%

5.0%

2Q19

3.2%

$0.3B

1.4% 1.8%

705

$510

53

457

35% CAGR

15.3%

$4.8B

2Q20

9.5%

5.8%

2Q20

43% CAGR

4.0%

$0.5B

2.5%

1.5%

2Q20

$1,210

292

918

740

2Q19

2Q21

Fully Electronic Electronically Processed

2Q21

21.3%

$5.2B

U.S. International

9.2%

INCREASING GLOBAL PORTFOLIO TRADING ADOPTION¹

($ in millions, ADV)

12.1%

2Q21

8.4%

$0.9B

3.5%

4.8%

(Share of TRACE

$ in billions, ADV)

806

22.7%

$6.1B

9.9%

12.8%

2Q22

9.6%

$1.0B

3.3%

6.2%

2Q22

$1,556

449

1,108

2Q22

1. Totals may not foot due to rounding.

2. Share reflects TW high grade and high yield volume, divided by TRACE volume, adjusted by Tradeweb

management to exclude emerging market and convertible bond volumes.

7 ©2022 Tradeweb Markets LLC. All rights reserved.

I

GROWING FOUNDATIONAL U.S. RFQ PROTOCOL

($ in millions, ADV)

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

$72

56 15

2Q18

$412

2Q18

442

$506

SOLIDIFYING OUR U.S. DIFFERENTIATORS¹

($ in millions, ADV)

All Trade

64

2Q19

$600

52

547

$447

2Q20

2Q19

$1,418

214

1,204

$1,522

231

$841

1,291

2Q20

I

2Q21 2Q22

U.S. Investment Grade

$278

Tradeweb

$1,168

2Q21

$767

NET SPOTTING

2Q18

2Q19

U.S. High Yield

$1,458

$1,561

2Q22

$1,720 $1,696

2Q 20 2Q21 2Q22View entire presentation