Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

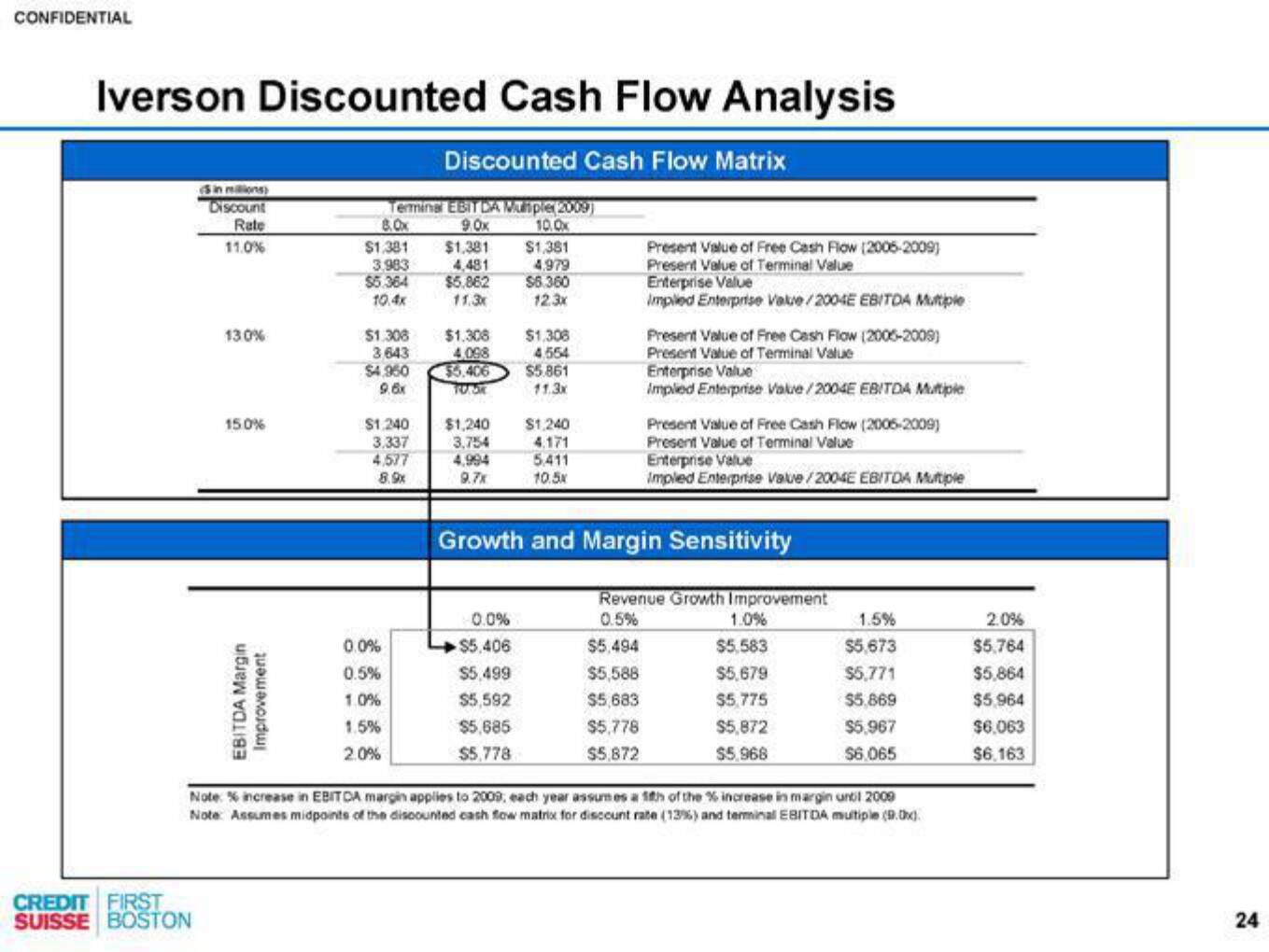

Iverson Discounted Cash Flow Analysis

Discounted Cash Flow Matrix

Sin millions)

Discount

Rate

11.0%

CREDIT FIRST

SUISSE BOSTON

130%

15.0%

EBITDA Margin

Improvement

Terminal EBITDA Multiple(2009)

8.0x

9.0x

10.0x

$1.381

3.983

$5.364

10.4x

$1.308

3,643

$4.960

9.6x

$1,240

3.337

4,577

8.9x

0.0%

0.5%

1.0%

1.5%

2.0%

$1,381

4,481

$5,862

11.3x

$1.308

$1,308

4,098

4.554

$5.406 $5.861

TOROK

11.3x

$1,381

4.979

$6.360

12.3x

$1,240 $1,240

3,754

4.171

5.411

1051

9.7x

0.0%

$5,406

$5,499

$5,592

$5,685

$5,778

Present Value of Free Cash Flow (2006-2009)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004E EBITDA Multiple

Present Value of Free Cash Flow (2006-2009)

Present Value of Terminal Value

Enterprise Value

Implied Enterprise Value/2004E EBITDA Multiple

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

Impled Enterprise Value/2004E EBITDA Multiple

Growth and Margin Sensitivity

Revenue Growth Improvement

0.5%

$5,494

$5,588

$5,683

$5,778

$5,872

1.0%

$5,583

$5,679

$5,775

$5,872

$5,968

1.5%

$5,673

$5,771

$5,869

$5,967

$6,065

Note: % increase in EBITCA margin applies to 2009, each year assumes a 1th of the % increase in margin until 2009

Note: Assumes midpoints of the discounted cash flow matrix for discount rate (13%) and terminal EBITDA multiple (90)

2.0%

$5,764

$5,864

$5,964

$6,063

$6,163

24View entire presentation