Evercore Investment Banking Pitch Book

Confidential - Preliminary and Subject to Change

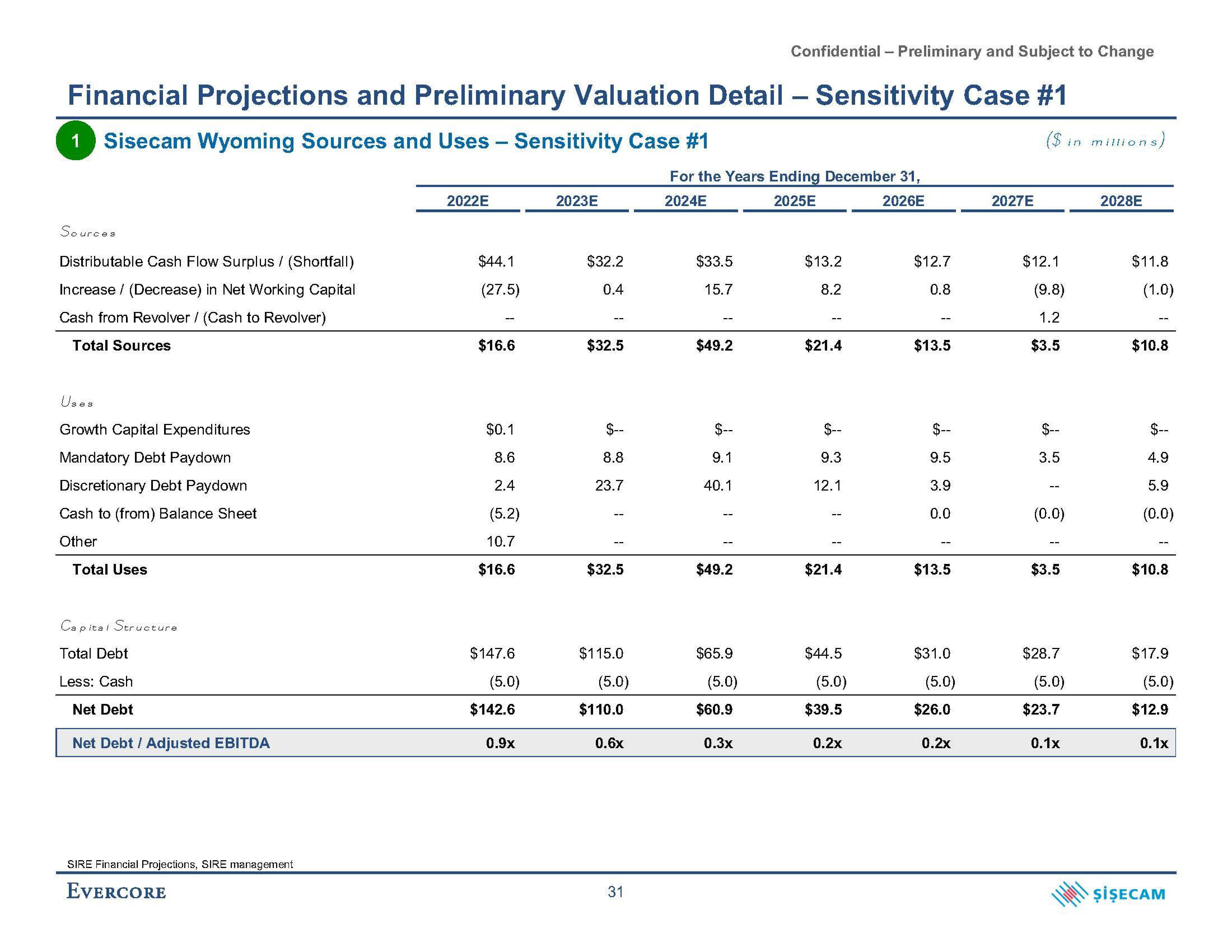

Financial Projections and Preliminary Valuation Detail - Sensitivity Case #1

1 Sisecam Wyoming Sources and Uses - Sensitivity Case #1

Sources

Distributable Cash Flow Surplus / (Shortfall)

Increase / (Decrease) in Net Working Capital

Cash from Revolver / (Cash to Revolver)

Total Sources

Uses

Growth Capital Expenditures

Mandatory Debt Paydown

Discretionary Debt Paydown

Cash to (from) Balance Sheet

Other

Total Uses

Capital Structure

Total Debt

Less: Cash

Net Debt

Net Debt / Adjusted EBITDA

SIRE Financial Projections, SIRE management

EVERCORE

2022E

$44.1

(27.5)

$16.6

$0.1

8.6

2.4

(5.2)

10.7

$16.6

$147.6

(5.0)

$142.6

0.9x

2023E

$32.2

0.4

$32.5

$--

8.8

23.7

$32.5

$115.0

(5.0)

$110.0

0.6x

31

For the Years Ending December 31,

2024E

2025E

2026E

$33.5

15.7

$49.2

$--

9.1

40.1

$49.2

$65.9

(5.0)

$60.9

0.3x

$13.2

8.2

$21.4

$--

9.3

12.1

$21.4

$44.5

(5.0)

$39.5

0.2x

$12.7

0.8

$13.5

$--

9.5

3.9

0.0

$13.5

$31.0

(5.0)

$26.0

0.2x

2027E

$12.1

(9.8)

1.2

$3.5

$--

3.5

(0.0)

$3.5

$28.7

(5.0)

$23.7

0.1x

millions)

in m

2028E

$11.8

(1.0)

$10.8

$--

4.9

5.9

(0.0)

$10.8

$17.9

(5.0)

$12.9

0.1x

ŞİŞECAMView entire presentation