Evercore Investment Banking Pitch Book

Financial Analysis

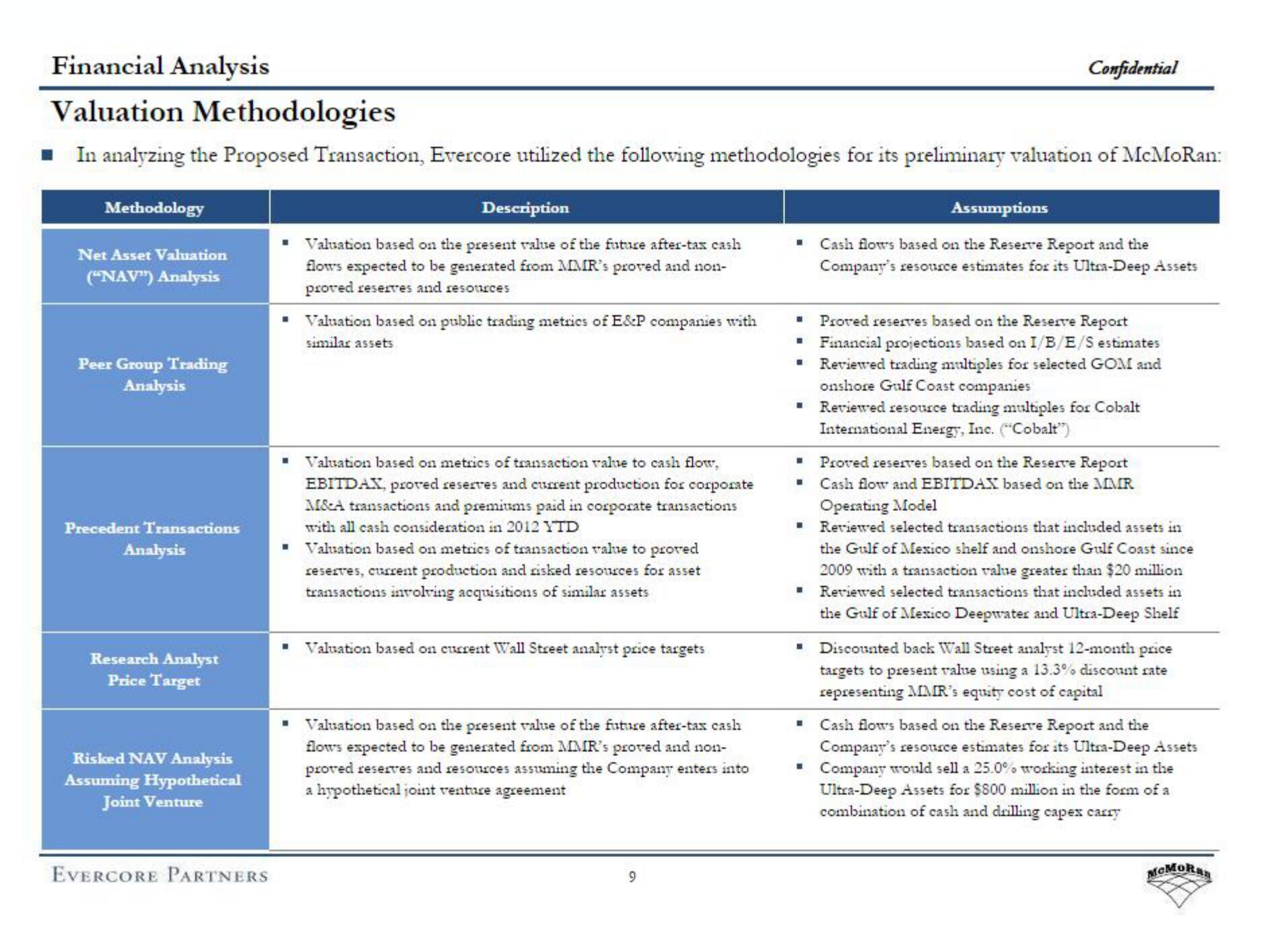

Valuation Methodologies

■ In analyzing the Proposed Transaction, Evercore utilized the following methodologies for its preliminary valuation of McMoRan:

Methodology

Net Asset Valuation

("NAV") Analysis

Peer Group Trading

Analysis

Precedent Transactions

Analysis

Research Analyst

Price Target

Risked NAV Analysis

Assuming Hypothetical

Joint Venture

EVERCORE PARTNERS

Description

Valuation based on the present value of the future after-tax cash

flows expected to be generated from MMR's proved and non-

proved reserves and resources

Valuation based on public trading metrics of E&P companies with

similar assets

Valuation based on metrics of transaction value to cash flow,

EBITDAX, proved reserves and current production for corporate

M&A transactions and premiums paid in corporate transactions

with all cash consideration in 2012 YTD

■ Valuation based on metrics of transaction value to proved

reserves, current production and risked resources for asset

transactions involving acquisitions of similar assets

Valuation based on current Wall Street analyst price targets

Valuation based on the present value of the future after-tax cash

flows expected to be generated from MMR's proved and non-

proved reserves and resources assuming the Company enters into

a hypothetical joint venture agreement

9

I

■

I

I

Confidential

Assumptions

Cash flows based on the Reserve Report and the

Company's resource estimates for its Ultra-Deep Assets

I

Proved reserves based on the Reserve Report

Financial projections based on I/B/E/S estimates

Reviewed trading multiples for selected GOM and

onshore Gulf Coast companies

Proved reserves based on the Reserve Report

I Cash flow and EBITDAX based on the MMR

Operating Model

I Reviewed selected transactions that included assets in

the Gulf of Mexico shelf and onshore Gulf Coast since

2009 with a transaction value greater than $20 million

Reviewed selected transactions that included assets in

the Gulf of Mexico Deepwater and Ultra-Deep Shelf

Reviewed resource trading multiples for Cobalt

International Energy, Inc. ("Cobalt")

m Discounted back Wall Street analyst 12-month price

targets to present value using a 13.3% discount rate

representing MMR's equity cost of capital

Cash flows based on the Reserve Report and the

Company's resource estimates for its Ultra-Deep Assets

I Company would sell a 25.0% working interest in the

Ultra-Deep Assets for $800 million in the form of a

combination of cash and drilling capex carry

MCMORanView entire presentation