SoftBank Results Presentation Deck

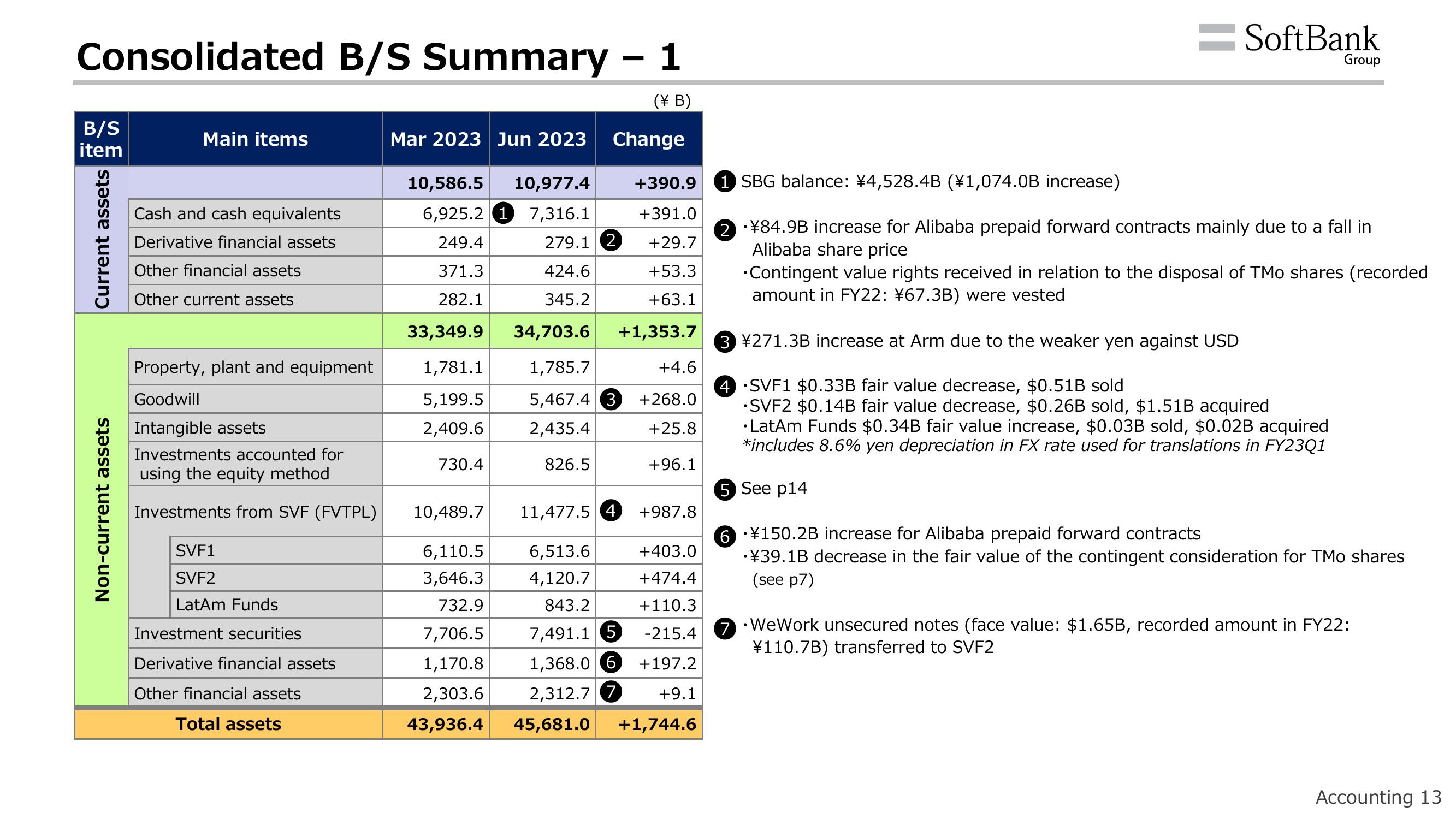

Consolidated B/S Summary - 1

(\ B)

Change

B/S

item

Current assets

Non-current assets

Main items

Cash and cash equivalents

Derivative financial assets

Other financial assets

Other current assets

Property, plant and equipment

Goodwill

Intangible assets

Investments accounted for

using the equity method

Investments from SVF (FVTPL)

SVF1

SVF2

LatAm Funds

Investment securities

Derivative financial assets

Other financial assets

Total assets

Mar 2023 Jun 2023

10,586.5 10,977.4

6,925.2 1

7,316.1

249.4

371.3

282.1

33,349.9

1,781.1

5,199.5

2,409.6

730.4

+390.9 1 SBG balance: ¥4,528.4B (¥1,074.0B increase)

+391.0

279.1 2

+29.7

424.6

+53.3

345.2

+63.1

34,703.6 +1,353.7

1,785.7

5,467.4 3

2,435.4

10,489.7

826.5

+4.6

+268.0

+25.8

+96.1

11,477.5 4 +987.8

6,513.6

4,120.7

6,110.5

3,646.3

732.9

7,706.5

843.2

7,491.1 5

+403.0

+474.4

+110.3

-215.4

+197.2

1,170.8

1,368.0 6

2,303.6

2,312.7 7 +9.1

43,936.4 45,681.0 +1,744.6

= SoftBank

2 ¥84.9B increase for Alibaba prepaid forward contracts mainly due to a fall in

Alibaba share price

5 See p14

Group

•Contingent value rights received in relation to the disposal of TMo shares (recorded

amount in FY22: ¥67.3B) were vested

3 ¥271.3B increase at Arm due to the weaker yen against USD

4

SVF1 $0.33B fair value decrease, $0.51B sold

.SVF2 $0.14B fair value decrease, $0.26B sold, $1.51B acquired

•LatAm Funds $0.34B fair value increase, $0.03B sold, $0.02B acquired

*includes 8.6% yen depreciation in FX rate used for translations in FY23Q1

7

6 ¥150.2B increase for Alibaba prepaid forward contracts

•¥39.1B decrease in the fair value of the contingent consideration for TMo shares

(see p7)

•WeWork unsecured notes (face value: $1.65B, recorded amount in FY22:

¥110.7B) transferred to SVF2

Accounting 13View entire presentation