Melrose Results Presentation Deck

Aerospace: overview

Melrose

£m

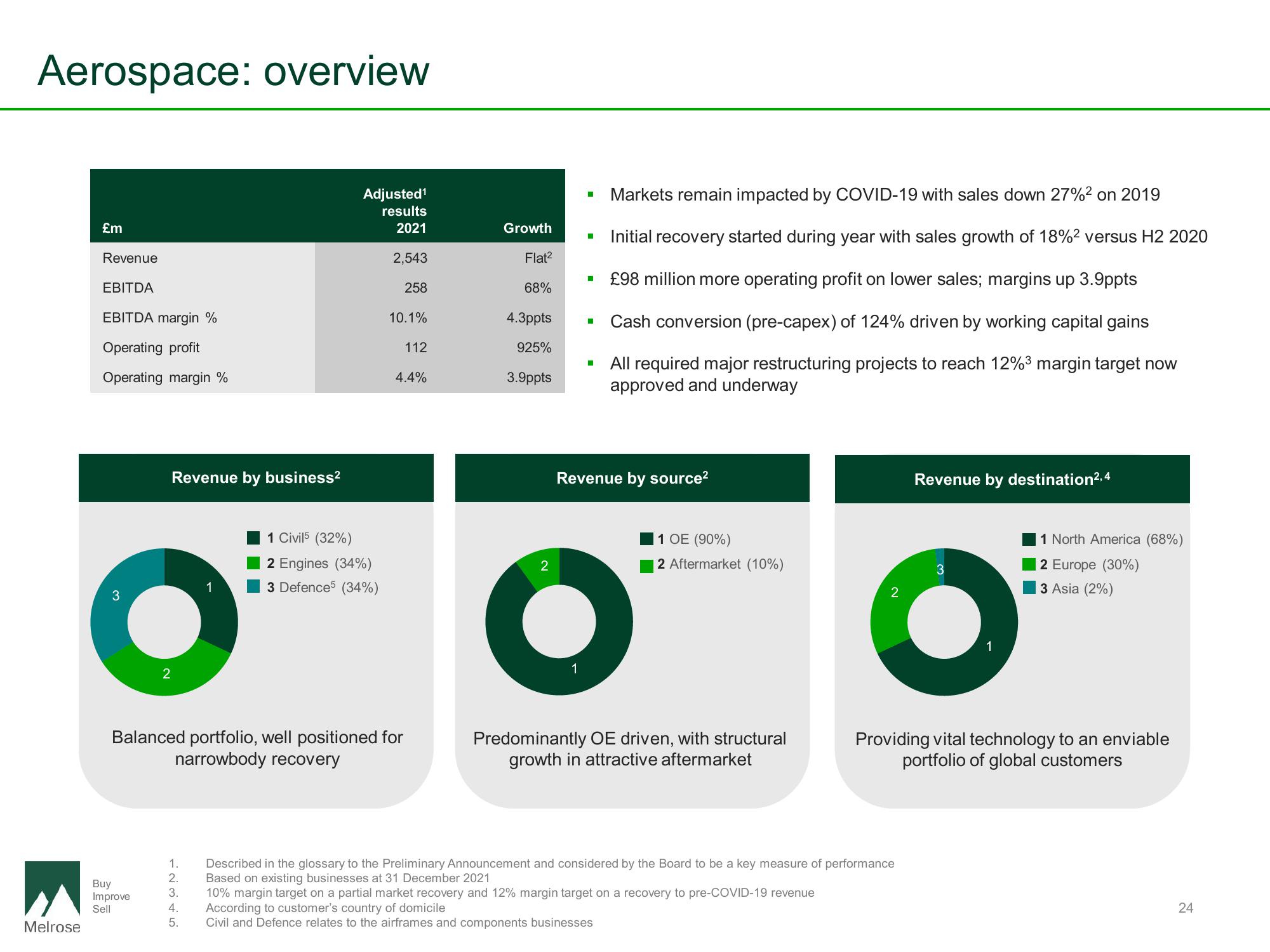

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

3

Revenue by business²

Buy

Improve

Sell

2

12345

1

3.

Adjusted¹

results

2021

2,543

258

Balanced portfolio, well positioned for

narrowbody recovery

5.

1 Civil5 (32%)

2 Engines (34%)

3 Defence5 (34%)

10.1%

112

4.4%

Growth

Flat²

68%

4.3ppts

925%

3.9ppts

I

■

■

Markets remain impacted by COVID-19 with sales down 27% ² on 2019

Initial recovery started during year with sales growth of 18%² versus H2 2020

£98 million more operating profit on lower sales; margins up 3.9ppts

Cash conversion (pre-capex) of 124% driven by working capital gains

All required major restructuring projects to reach 12%³ margin target now

approved and underway

Revenue by source²

2

O

1

1 OE (90%)

|2 Aftermarket (10%)

Predominantly OE driven, with structural

growth in attractive aftermarket

1. Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

2. Based on existing businesses at 31 December 2021

10% margin target on a partial market recovery and 12% margin target on a recovery to pre-COVID-19 revenue

4. According to customer's country of domicile

Civil and Defence relates to the airframes and components businesses

2

Revenue by destination ²,4

3

1 North America (68%)

2 Europe (30%)

3 Asia (2%)

Providing vital technology to an enviable

portfolio of global customers

24View entire presentation