Main Street Capital Investor Day Presentation Deck

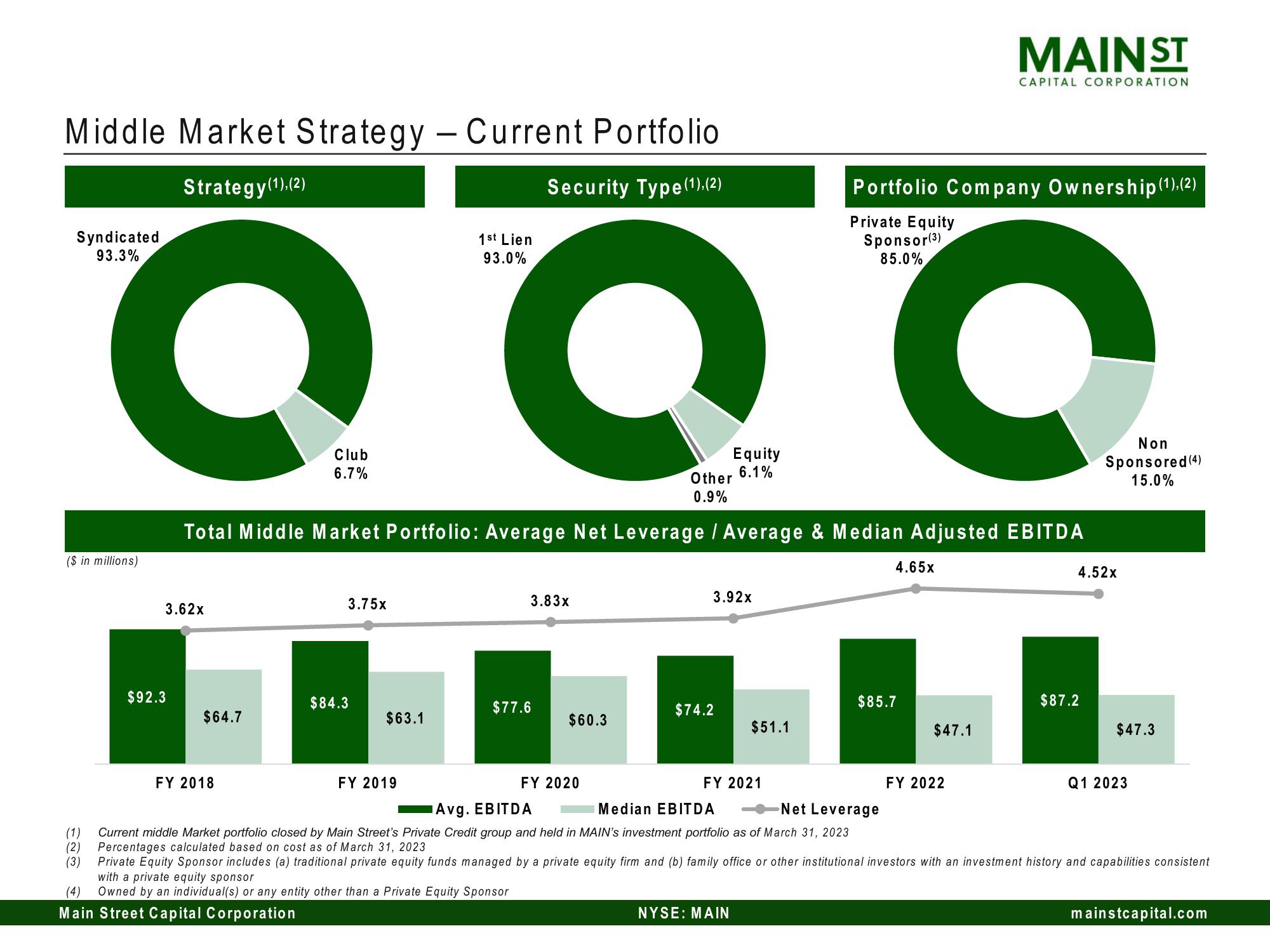

Middle Market Strategy - Current Portfolio

Strategy(1).(2)

Security Type(1).(2)

Syndicated

93.3%

a a

Other

0.9%

Total Middle Market Portfolio: Average Net Leverage / Average & Median Adjusted EBITDA

($ in millions)

3.62x

$92.3

$64.7

FY 2018

Club

6.7%

3.75x

$84.3

$63.1

FY 2019

1st Lien

93.0%

3.83x

$77.6

$60.3

FY 2020

$74.2

Equity

3.92x

6.1%

NYSE: MAIN

$51.1

FY 2021

Portfolio Company Ownership (1), (2)

Private Equity

Sponsor (3)

85.0%

4.65x

$85.7

MAIN ST

$47.1

CAPITAL CORPORATION

FY 2022

Non

Sponsored (4)

15.0%

4.52x

$87.2

$47.3

Q1 2023

Avg. EBITDA

Median EBITDA

Net Leverage

(1) Current middle Market portfolio closed by Main Street's Private Credit group and held in MAIN's investment portfolio as of March 31, 2023

(2) Percentages calculated based on cost as of March 31, 2023

(3) Private Equity Sponsor includes (a) traditional private equity funds managed by a private equity firm and (b) family office or other institutional investors with an investment history and capabilities consistent

with a private equity sponsor

(4) Owned by an individual(s) or any entity other than a Private Equity Sponsor

Main Street Capital Corporation

mainstcapital.comView entire presentation