Apollo Global Management Investor Day Presentation Deck

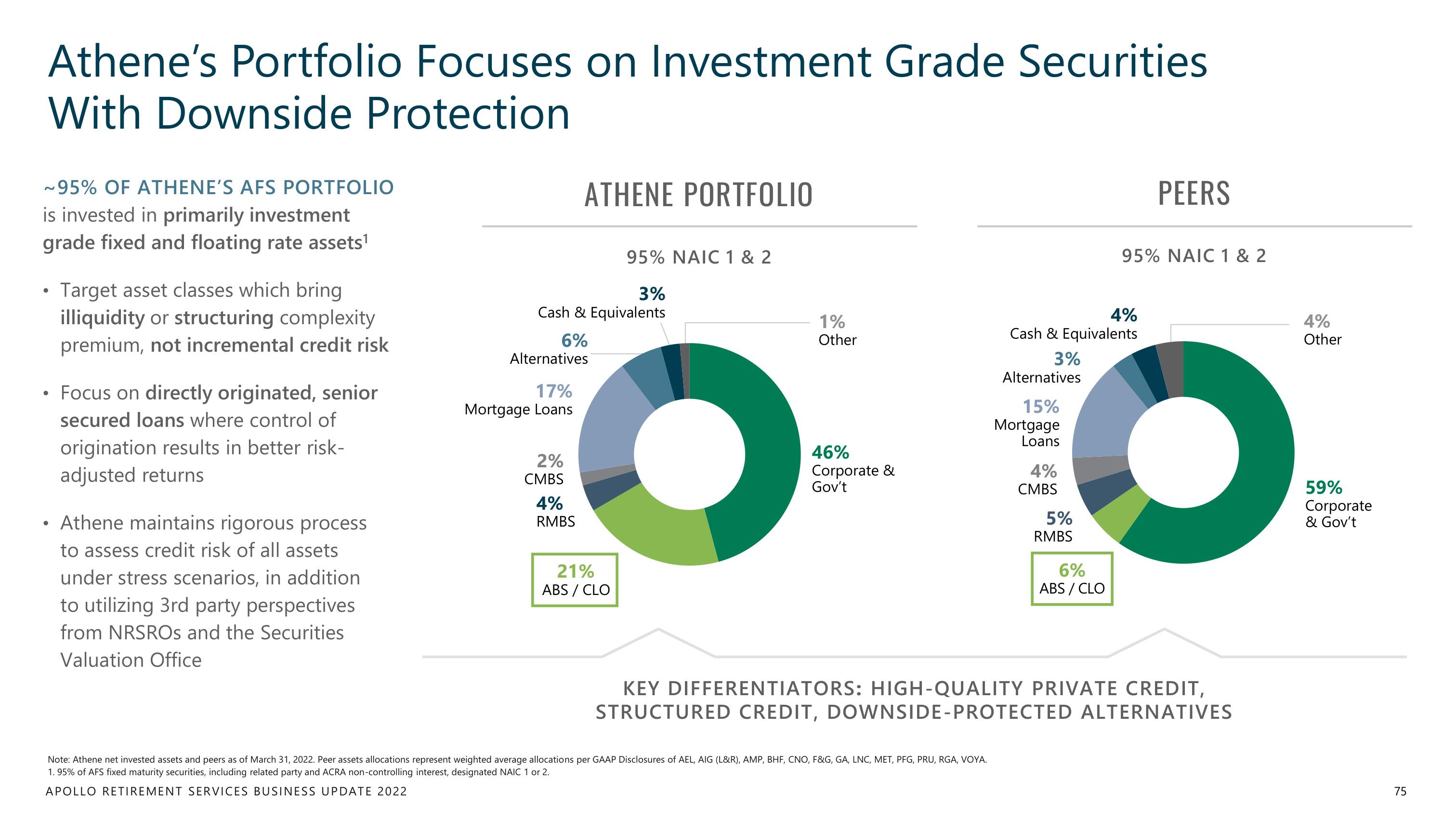

Athene's Portfolio Focuses on Investment Grade Securities

With Downside Protection

~95% OF ATHENE'S AFS PORTFOLIO

is invested in primarily investment

grade fixed and floating rate assets¹

●

●

Target asset classes which bring

illiquidity or structuring complexity

premium, not incremental credit risk

Focus on directly originated, senior

secured loans where control of

origination results in better risk-

adjusted returns

●

• Athene maintains rigorous process

to assess credit risk of all assets

under stress scenarios, in addition

to utilizing 3rd party perspectives

from NRSROs and the Securities

Valuation Office

95% NAIC 1 & 2

3%

Cash & Equivalents

ATHENE PORTFOLIO

6%

Alternatives

17%

Mortgage Loans

2%

CMBS

4%

RMBS

21%

ABS / CLO

1%

Other

46%

Corporate &

Gov't

Note: Athene net invested assets and peers as of March 31, 2022. Peer assets allocations represent weighted average allocations per GAAP Disclosures of AEL, AIG (L&R), AMP, BHF, CNO, F&G, GA, LNC, MET, PFG, PRU, RGA, VOYA.

1.95% of AFS fixed maturity securities, including related party and ACRA non-controlling interest, designated NAIC 1 or 2.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

4%

Cash & Equivalents

3%

Alternatives

15%

Mortgage

Loans

4%

CMBS

5%

RMBS

6%

ABS / CLO

PEERS

95% NAIC 1 & 2

KEY DIFFERENTIATORS: HIGH-QUALITY PRIVATE CREDIT,

STRUCTURED CREDIT, DOWNSIDE-PROTECTED ALTERNATIVES

4%

Other

59%

Corporate

& Gov't

75View entire presentation