Central Pacific Financial Investor Presentation Deck

2 Accelerating & sustainable growth

●

●

●

$ Millions

5,500

5,000

4,500

4,000

3,500

3,000

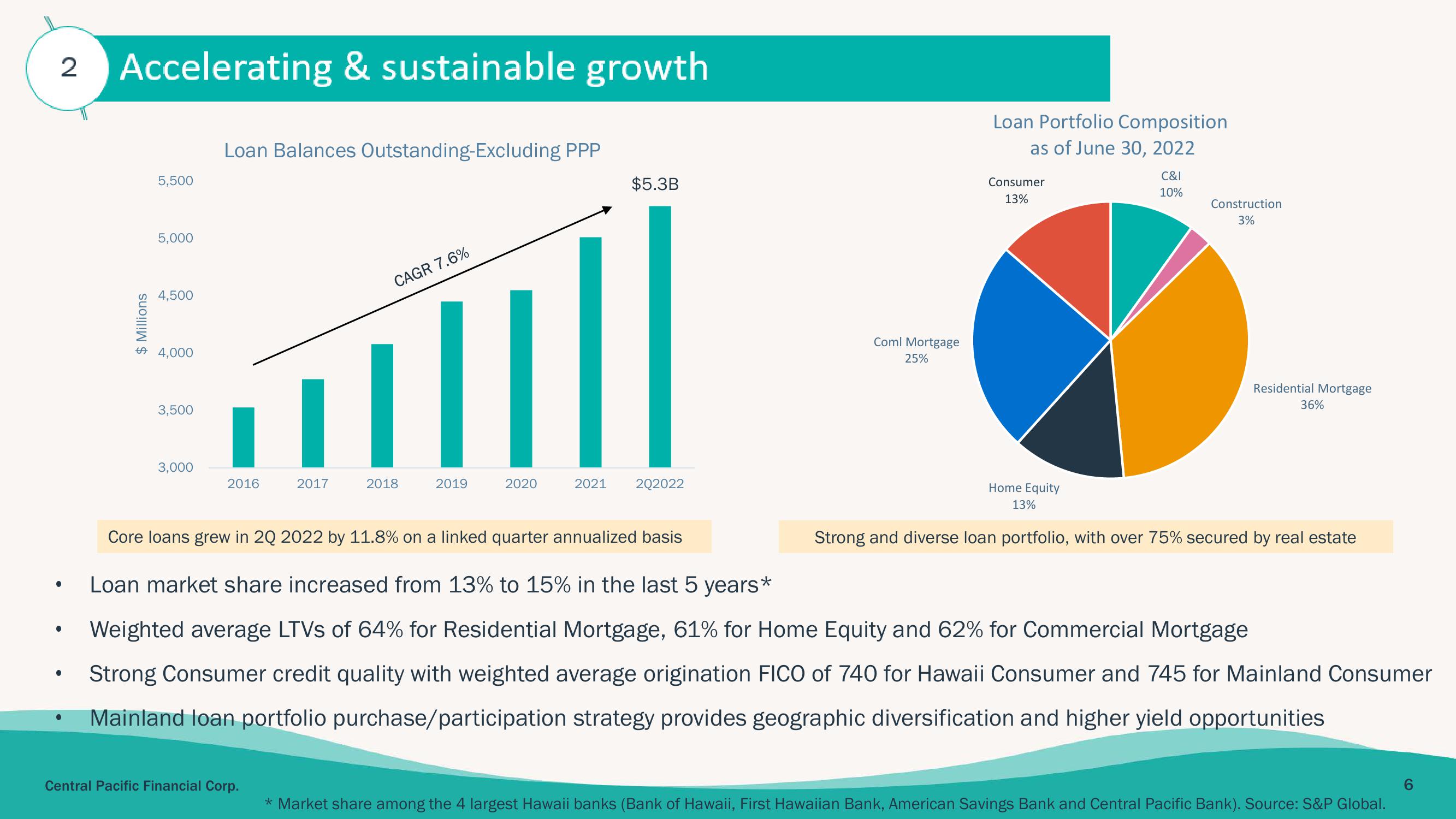

Loan Balances Outstanding-Excluding PPP

2016

2017

Central Pacific Financial Corp.

CAGR 7.6%

2018

11

2019

2020

$5.3B

2021 202022

Coml Mortgage

25%

Loan Portfolio Composition

as of June 30, 2022

Consumer

13%

C&I

10%

Construction

3%

Residential Mortgage

36%

Home Equity

13%

Strong and diverse loan portfolio, with over 75% secured by real estate

Core loans grew in 2Q 2022 by 11.8% on a linked quarter annualized basis

Loan market share increased from 13% to 15% in the last 5 years*

Weighted average LTVS of 64% for Residential Mortgage, 61% for Home Equity and 62% for Commercial Mortgage

Strong Consumer credit quality with weighted average origination FICO of 740 for Hawaii Consumer and 745 for Mainland Consumer

Mainland loan portfolio purchase/participation strategy provides geographic diversification and higher yield opportunities

* Market share among the 4 largest Hawaii banks (Bank of Hawaii, First Hawaiian Bank, American Savings Bank and Central Pacific Bank). Source: S&P Global.

6View entire presentation