flyExclusive SPAC

II. WHO WE ARE

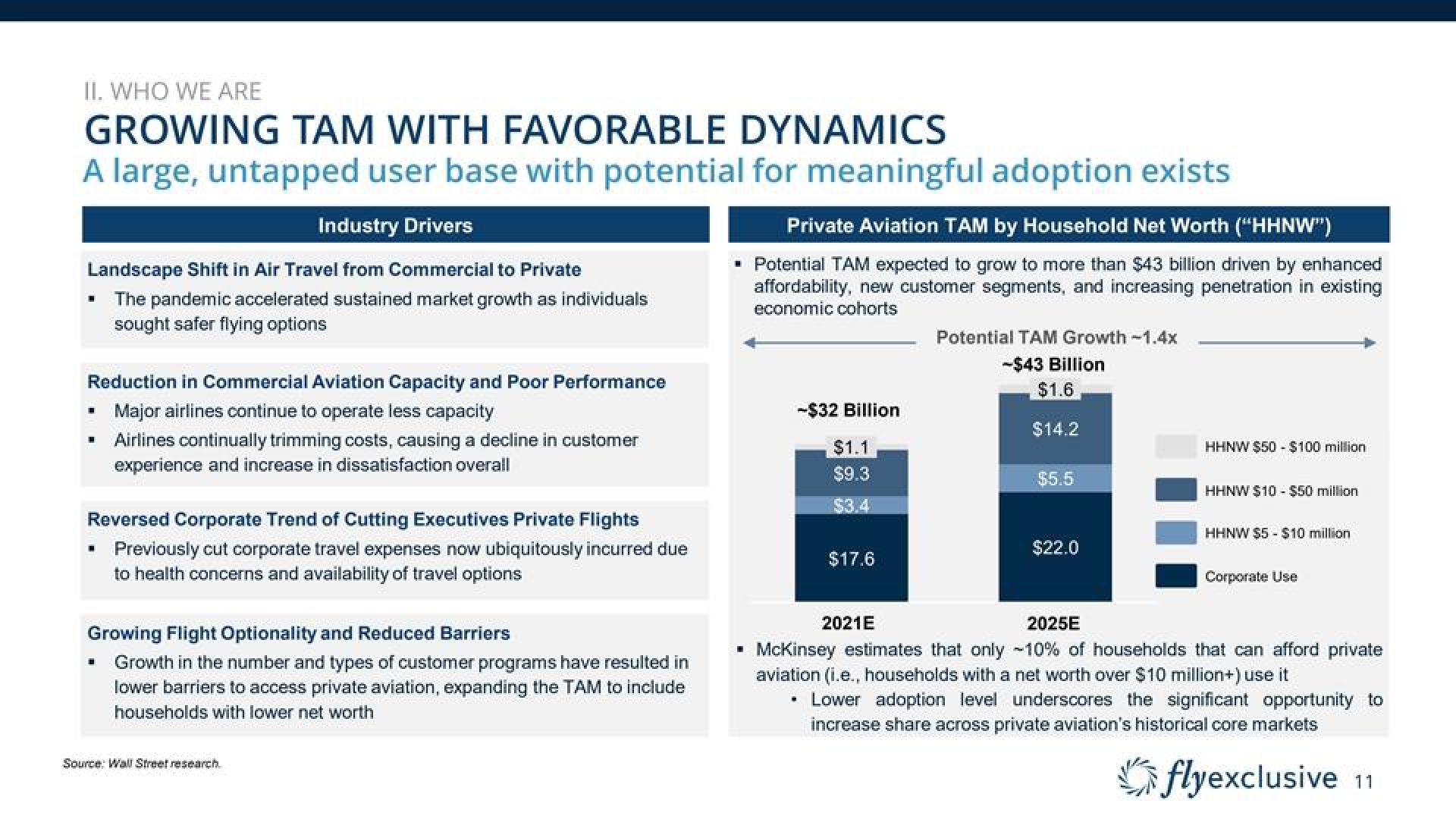

GROWING TAM WITH FAVORABLE DYNAMICS

A large, untapped user base with potential for meaningful adoption exists

Industry Drivers

Landscape Shift in Air Travel from Commercial to Private

The pandemic accelerated sustained market growth as individuals

sought safer flying options

Reduction in Commercial Aviation Capacity and Poor Performance

▪ Major airlines continue to operate less capacity

Airlines continually trimming costs, causing a decline in customer

experience and increase in dissatisfaction overall

Reversed Corporate Trend of Cutting Executives Private Flights

▪ Previously cut corporate travel expenses now ubiquitously incurred due

to health concerns and availability of travel options

Growing Flight Optionality and Reduced Barriers

Growth in the number and types of customer programs have resulted in

lower barriers to access private aviation, expanding the TAM to include

households with lower net worth

■

Source: Wall Street research.

Private Aviation TAM by Household Net Worth (“HHNW”)

▪ Potential TAM expected to grow to more than $43 billion driven by enhanced

affordability, new customer segments, and increasing penetration in existing

economic cohorts

-$32 Billion

$1.1

$9.3

$3.4

$17.6

2021E

Potential TAM Growth -1.4x

-$43 Billion

$1.6

$14.2

$5.5

$22.0

HHNW $50 - $100 million

HHNW $10-$50 million

HHNW $5 - $10 million

Corporate Use

2025E

▪ McKinsey estimates that only 10% of households that can afford private

aviation (i.e., households with a net worth over $10 million+) use it

• Lower adoption level underscores the significant opportunity to

increase share across private aviation's historical core markets

flyexclusive 11View entire presentation