Missfresh IPO Presentation Deck

SE

优鲜

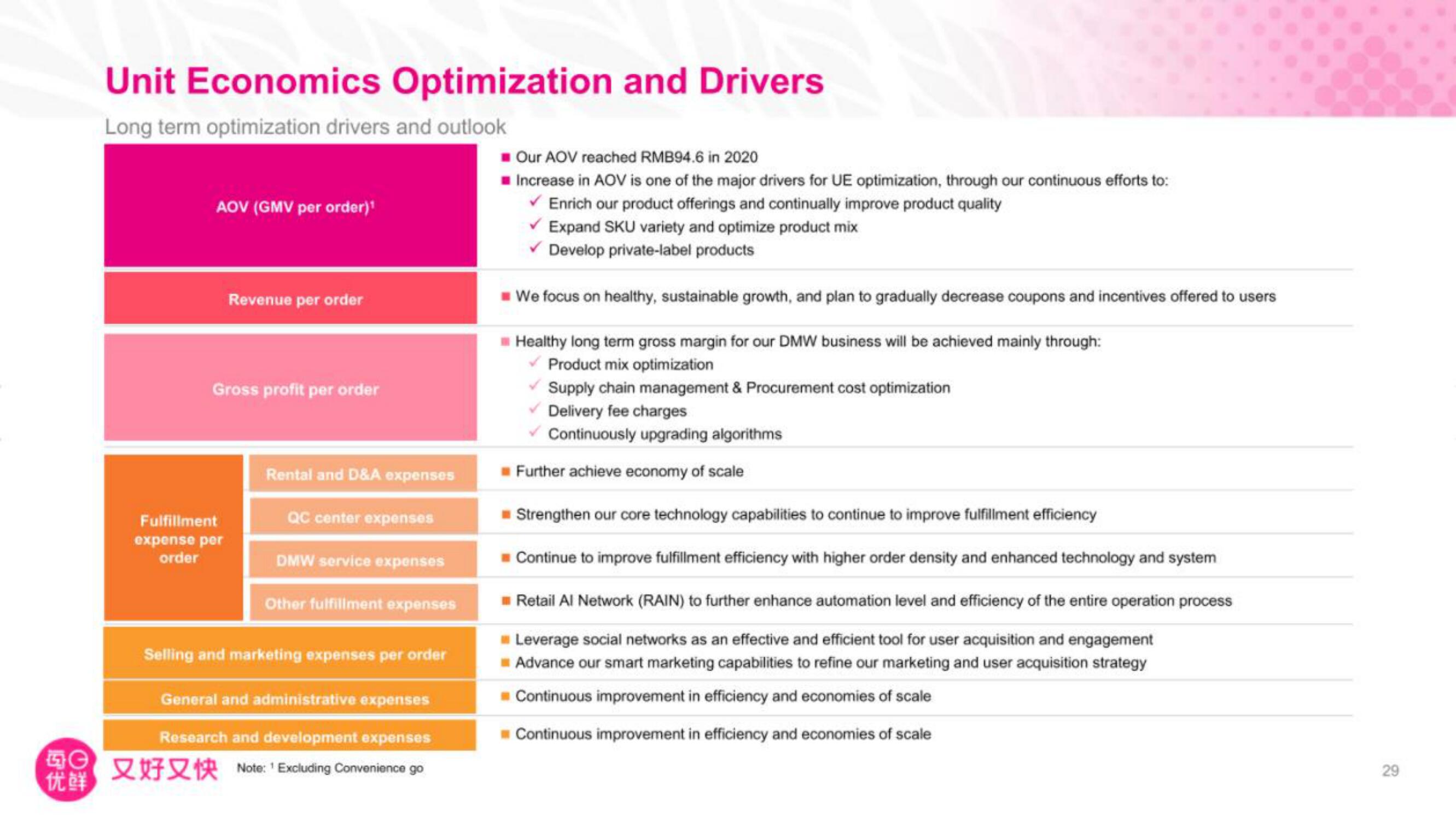

Unit Economics Optimization and Drivers

Long term optimization drivers and outlook

AOV (GMV per order)¹

Revenue per order

Gross profit per order

Fulfillment

expense per

order

Rental and D&A expenses

QC center expenses

DMW service expenses

Other fulfillment expenses

Selling and marketing expenses per order

General and administrative expenses

Research and development expenses

Note: ¹ Excluding Convenience go

■ Our AOV reached RMB94.6 in 2020

■ Increase in AOV is one of the major drivers for UE optimization, through our continuous efforts to:

✓ Enrich our product offerings and continually improve product quality

✓ Expand SKU variety and optimize product mix

Develop private-label products

We focus on healthy, sustainable growth, and plan to gradually decrease coupons and incentives offered to users

Healthy long term gross margin for our DMW business will be achieved mainly through:

Product mix optimization

Supply chain management & Procurement cost optimization

Delivery fee charges

Continuously upgrading algorithms

Further achieve economy of scale

Strengthen our core technology capabilities to continue to improve fulfillment efficiency

Continue to improve fulfillment efficiency with higher order density and enhanced technology and system

Retail Al Network (RAIN) to further enhance automation level and efficiency of the entire operation process

Leverage social networks as an effective and efficient tool for user acquisition and engagement

Advance our smart marketing capabilities to refine our marketing and user acquisition strategy

Continuous improvement in efficiency and economies of scale

Continuous improvement in efficiency and economies of scale

29View entire presentation