Ginkgo Results Presentation Deck

Biotechnology products take significant time to get to market; both

scale and diversity are needed to achieve predictable cash flows

Downstream "Present Value" Will Move with Broader Markets

Equity:

Drop in growth & biotech valuations drives lower marks for

existing equity positions

Effect is felt immediately as equity is a present value

measurement (of expected future value)

Cash Milestones & Royalties:

Milestones and royalties are only paid upon program success /

commercialization and are thus delayed

Higher discount rates similarly drive a lower NPV for these

future expected payments

Ended 2021 with over $1.5 billion in cash

Provides meaningful multi-year runway as we drive towards

profitability

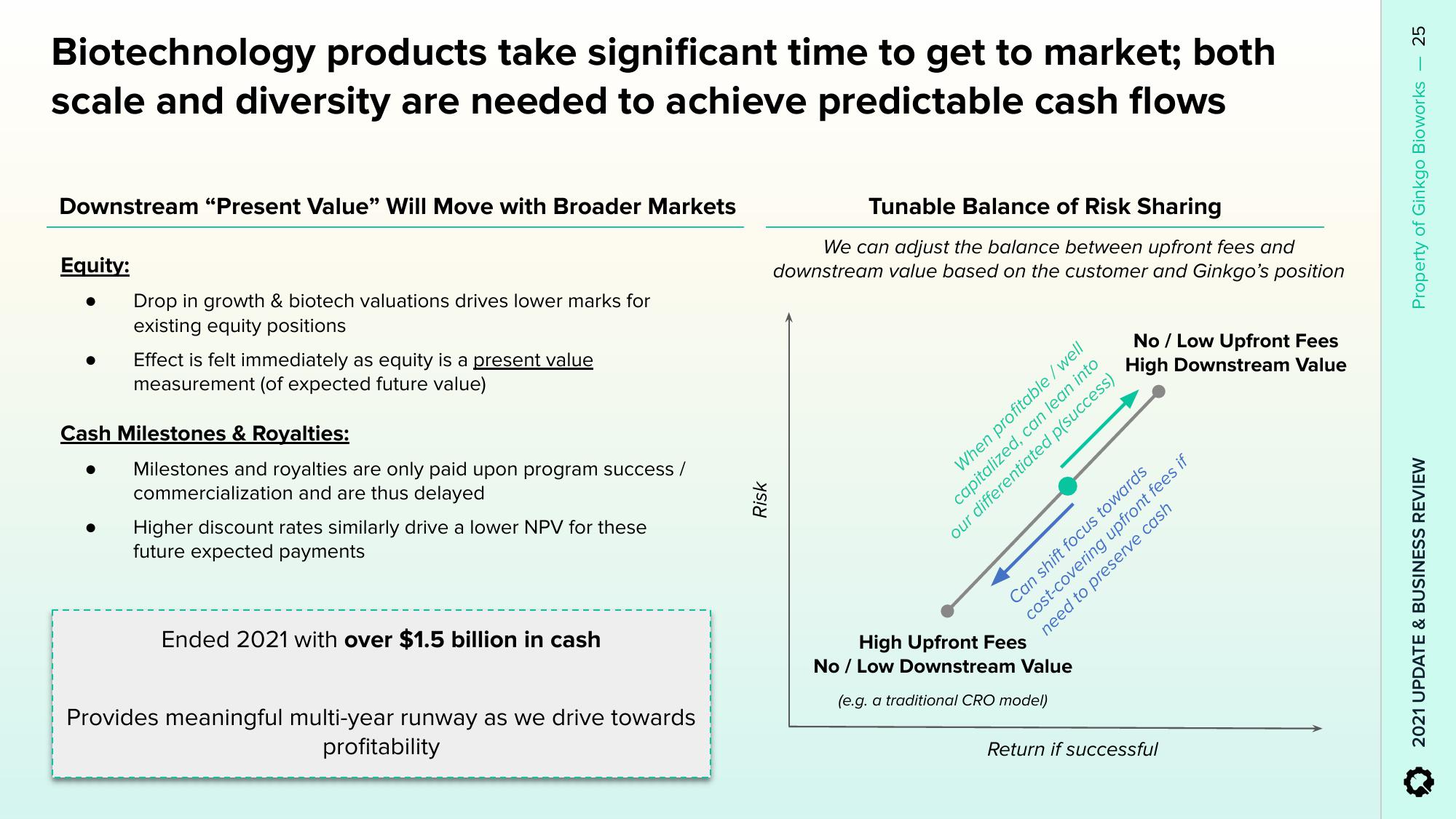

Risk

Tunable Balance of Risk Sharing

We can adjust the balance between upfront fees and

downstream value based on the customer and Ginkgo's position

No / Low Upfront Fees

High Downstream Value

High Upfront Fees

No / Low Downstream Value

(e.g. a traditional CRO model)

When profitable / well

capitalized, can lean into

our differentiated p(success)

Can shift focus towards

need to preserve cash

cost-covering upfront fees if

Return if successful

25

Property of Ginkgo Bioworks

2021 UPDATE & BUSINESS REVIEWView entire presentation