jetBlue Mergers and Acquisitions Presentation Deck

jetBlue

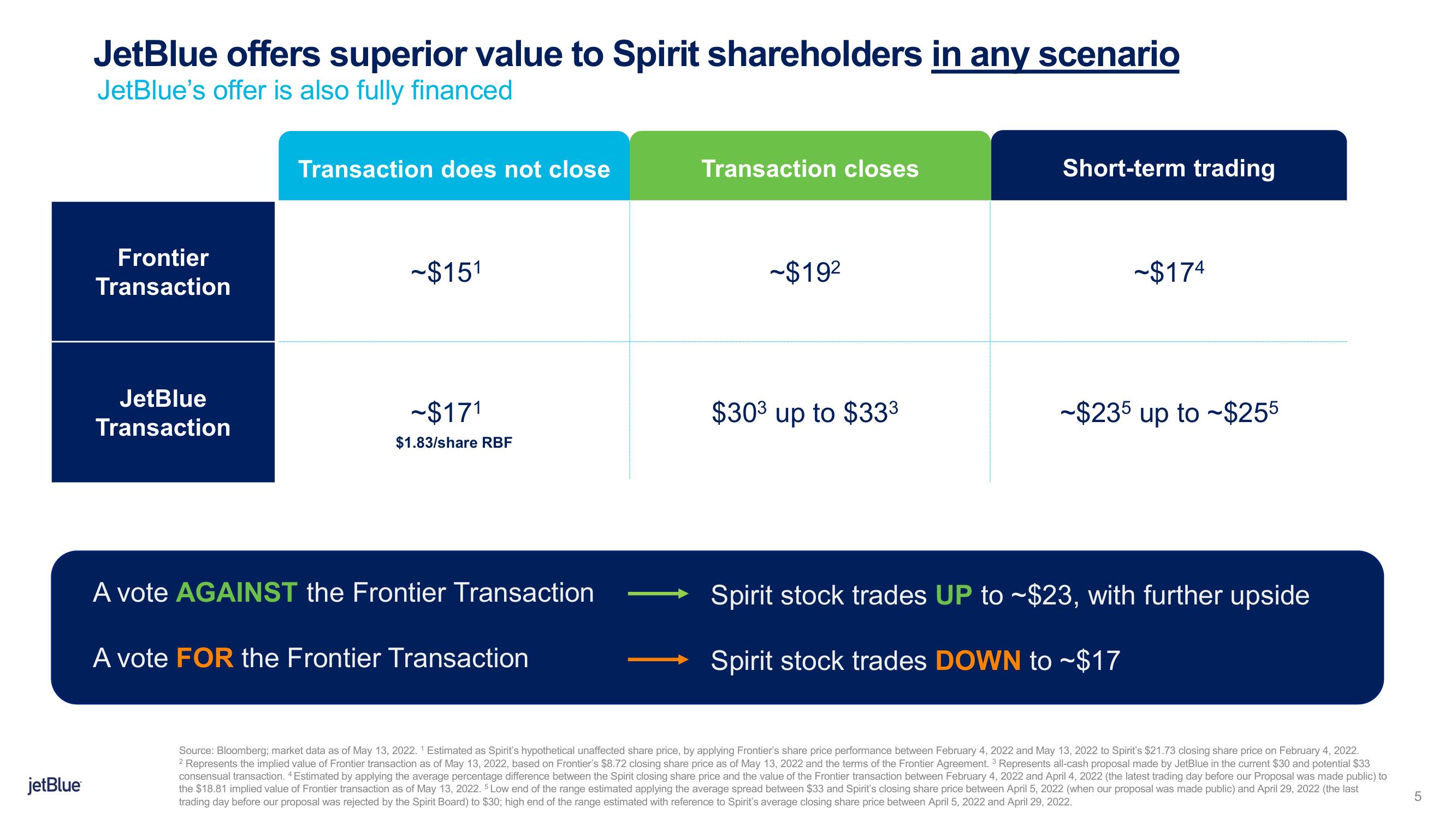

JetBlue offers superior value to Spirit shareholders in any scenario

JetBlue's offer is also fully financed

Frontier

Transaction

JetBlue

Transaction

Transaction does not close

~$151

~$171

$1.83/share RBF

A vote AGAINST the Frontier Transaction

A vote FOR the Frontier Transaction

Transaction closes

~$19²

$303 up to $33³

Short-term trading

~$174

-$235 up to $255

Spirit stock trades UP to ~$23, with further upside

Spirit stock trades DOWN to ~$17

Source: Bloomberg; market data as of May 13, 2022.¹ Estimated as Spirit's hypothetical unaffected share price, by applying Frontier's share price performance between February 4, 2022 and May 13, 2022 to Spirit's $21.73 closing share price on February 4, 2022.

2 Represents the implied value of Frontier transaction as of May 13, 2022, based on Frontier's $8.72 closing share price as of May 13, 2022 and the terms of the Frontier Agreement. ³ Represents all-cash proposal made by JetBlue in the current $30 and potential $33

consensual transaction. 4 Estimated by applying the average percentage difference between the Spirit closing share price and the value of the Frontier transaction between February 4, 2022 and April 4, 2022 (the latest trading day before our Proposal was made public) to

the $18.81 implied value of Frontier transaction as of May 13, 2022. 5 Low end of the range estimated applying the average spread between $33 and Spirit's closing share price between April 5, 2022 (when our proposal was made public) and April 29, 2022 (the last

trading day before our proposal was rejected by the Spirit Board) to $30; high end of the range estimated with reference to Spirit's average closing share price between April 5, 2022 and April 29, 2022.

LO

5View entire presentation