Silicon Valley Bank Results Presentation Deck

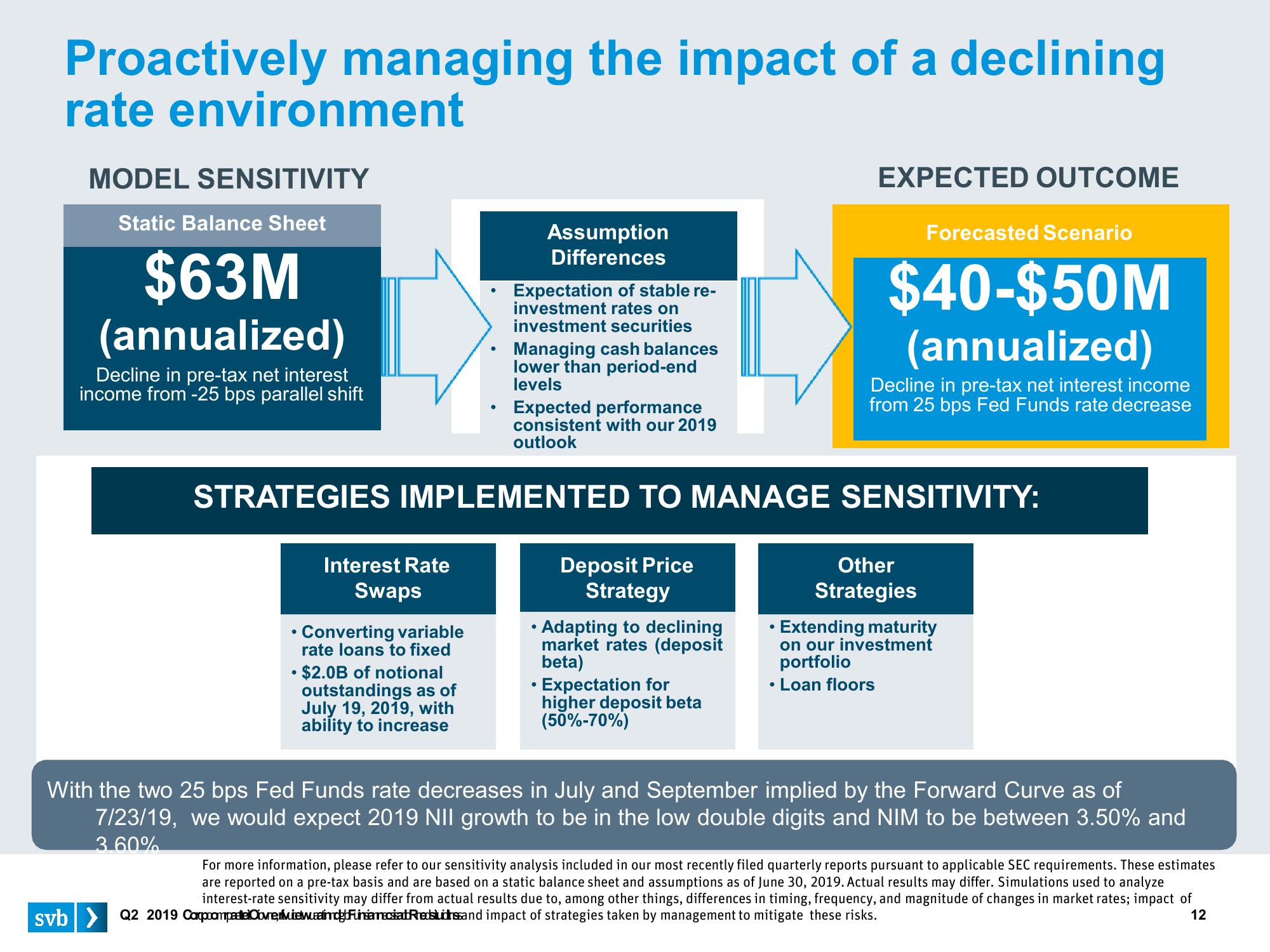

Proactively managing the impact of a declining

rate environment

MODEL SENSITIVITY

Static Balance Sheet

$63M

(annualized)

Decline in pre-tax net interest

income from -25 bps parallel shift

Interest Rate

Swaps

• Converting variable

rate loans to fixed

●

• $2.0B of notional

outstandings as of

July 19, 2019, with

ability to increase

●

Expected performance

consistent with our 2019

outlook

STRATEGIES IMPLEMENTED TO MANAGE SENSITIVITY:

Expectation of stable re-

investment rates on

investment securities

Managing cash balances

lower than period-end

levels

Assumption

Differences

●

●

Deposit Price

Strategy

Adapting to declining

market rates (deposit

beta)

EXPECTED OUTCOME

Expectation for

higher deposit beta

(50%-70%)

Forecasted Scenario

$40-$50M

(annualized)

Decline in pre-tax net interest income

from 25 bps Fed Funds rate decrease

Other

Strategies

Extending maturity

on our investment

portfolio

• Loan floors

With the two 25 bps Fed Funds rate decreases in July and September implied by the Forward Curve as of

7/23/19, we would expect 2019 NII growth to be in the low double digits and NIM to be between 3.50% and

3.60%

For more information, please refer to our sensitivity analysis included in our most recently filed quarterly reports pursuant to applicable SEC requirements. These estimates

are reported on a pre-tax basis and are based on a static balance sheet and assumptions as of June 30, 2019. Actual results may differ. Simulations used to analyze

interest-rate sensitivity may differ from actual results due to, among other things, differences in timing, frequency, and magnitude of changes in market rates; impact of

svb> Q2 2019 Capcomparte Cove, Mielwuzetinde Funsamesisat Rhedslunssand impact of strategies taken by management to mitigate these risks.

12View entire presentation