Sixth Street Lending Partners, Inc. Presentation to State of Connecticut

SIXTH STREET LENDING PARTNERS, INC. (SLX "2.0")

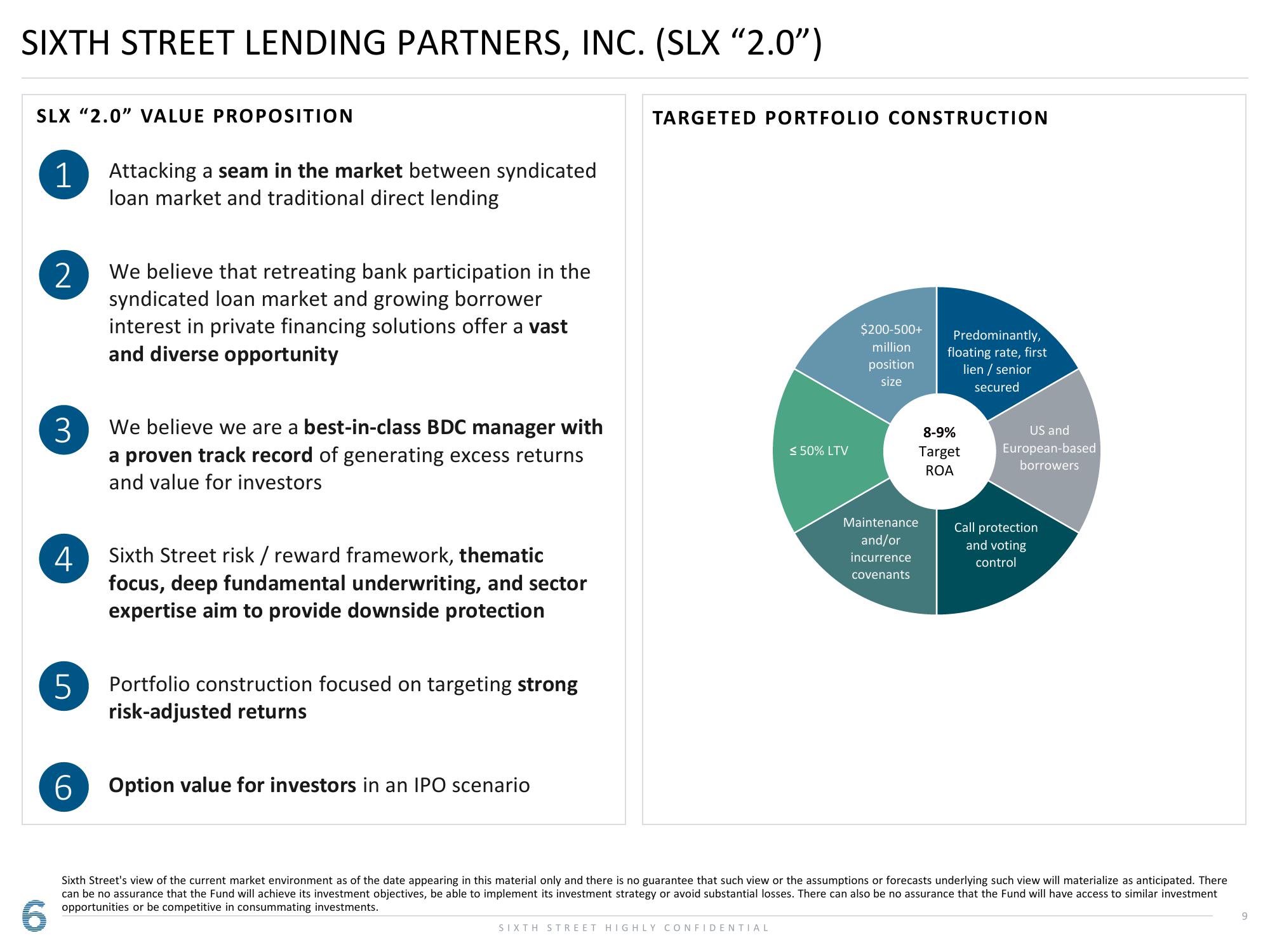

SLX "2.0" VALUE PROPOSITION

1

2

3

4

5

6

Attacking a seam in the market between syndicated

loan market and traditional direct lending

We believe that retreating bank participation in the

syndicated loan market and growing borrower

interest in private financing solutions offer a vast

and diverse opportunity

We believe we are a best-in-class BDC manager with

a proven track record of generating excess returns

and value for investors

Six Street risk / reward framework, thematic

focus, deep fundamental underwriting, and sector

expertise aim to provide downside protection

Portfolio construction focused on targeting strong

risk-adjusted returns

Option value for investors in an IPO scenario

TARGETED PORTFOLIO CONSTRUCTION

≤ 50% LTV

SIXTH STREET HIGHLY CONFIDENTIAL

$200-500+

million

position

size

Predominantly,

floating rate, first

lien / senior

secured

8-9%

Target

ROA

Maintenance

and/or

incurrence

covenants

US and

European-based

borrowers

Call protection

and voting

control

Sixth Street's view of the current market environment as of the date appearing in this material only and there is no guarantee that such view or the assumptions or forecasts underlying such view will materialize as anticipated. There

can be no assurance that the Fund will achieve its investment objectives, be able to implement its investment strategy or avoid substantial losses. There can also be no assurance that the Fund will have access to similar investment

opportunities or be competitive in consummating investments.

9View entire presentation