First Watch IPO Presentation Deck

6

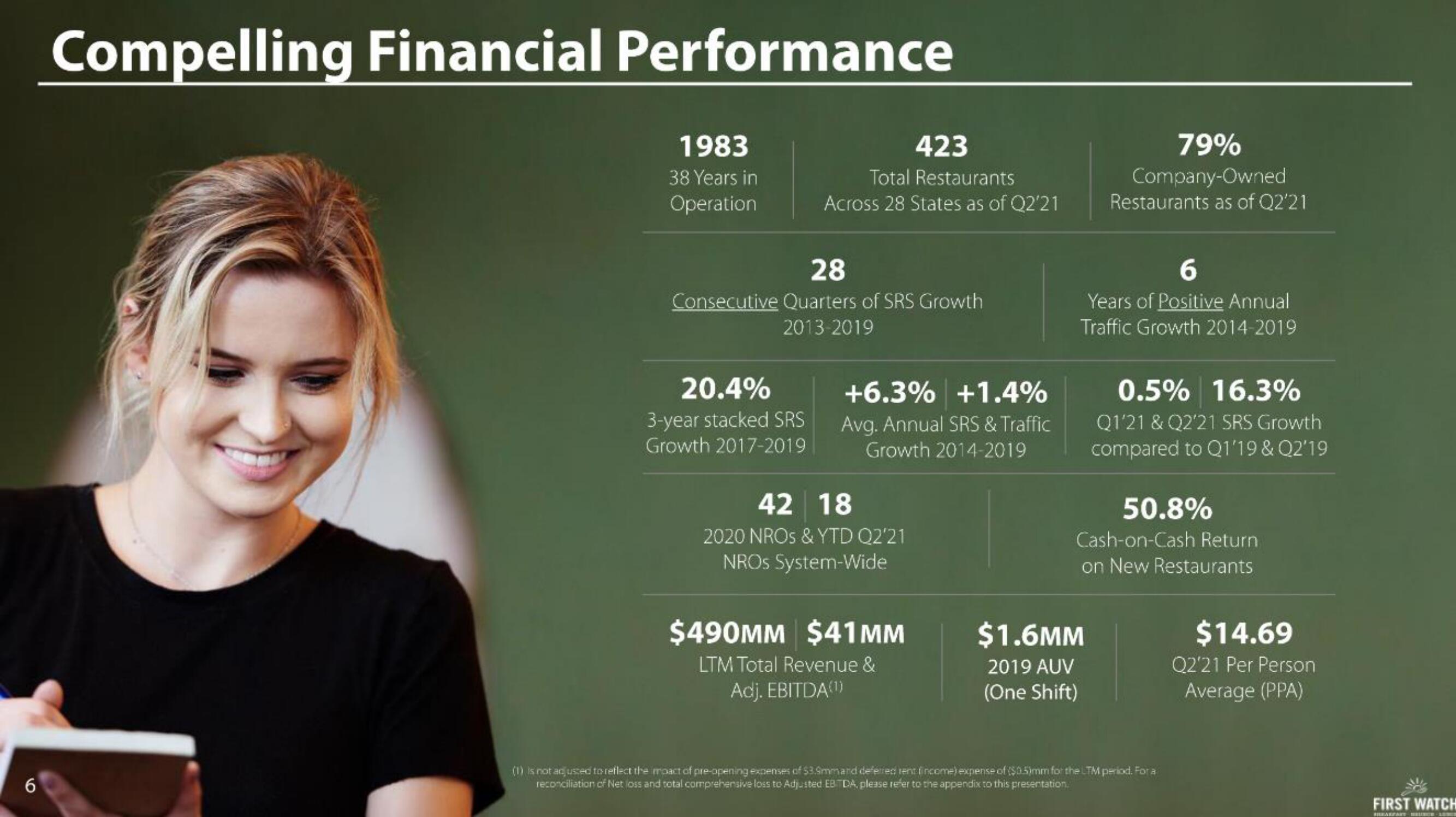

Compelling Financial Performance

1983

38 Years in

Operation

423

Total Restaurants

Across 28 States as of Q2'21

28

Consecutive Quarters of SRS Growth

2013-2019

20.4%

3-year stacked SRS

Growth 2017-2019

+6.3% +1.4%

Avg. Annual SRS & Traffic

Growth 2014-2019

42 18

2020 NROS & YTD Q2'21

NROS System-Wide

$490MM $41MM

LTM Total Revenue &

Adj. EBITDA(1)

79%

Company-Owned

Restaurants as of Q2'21

6

Years of Positive Annual

Traffic Growth 2014-2019

$1.6MM

2019 AUV

(One Shift)

0.5% 16.3%

Q1'21 & Q2'21 SRS Growth

compared to Q1'19 & Q2'19

50.8%

Cash-on-Cash Return

on New Restaurants

(1) is not adjusted to reflect the moact of pre-opening expenses of $3.9mmard deferred rent (income) expense of ($0.5)mm for the LTM period. For a

reconciliation of Net loss and total comprehensive loss to Adjusted EBITDA, please refer to the appendix to this presentation.

$14.69

Q2'21 Per Person

Average (PPA)

FIRST WATCH

BREAKFART BELINE - LONENView entire presentation