Kering Investor Presentation Deck

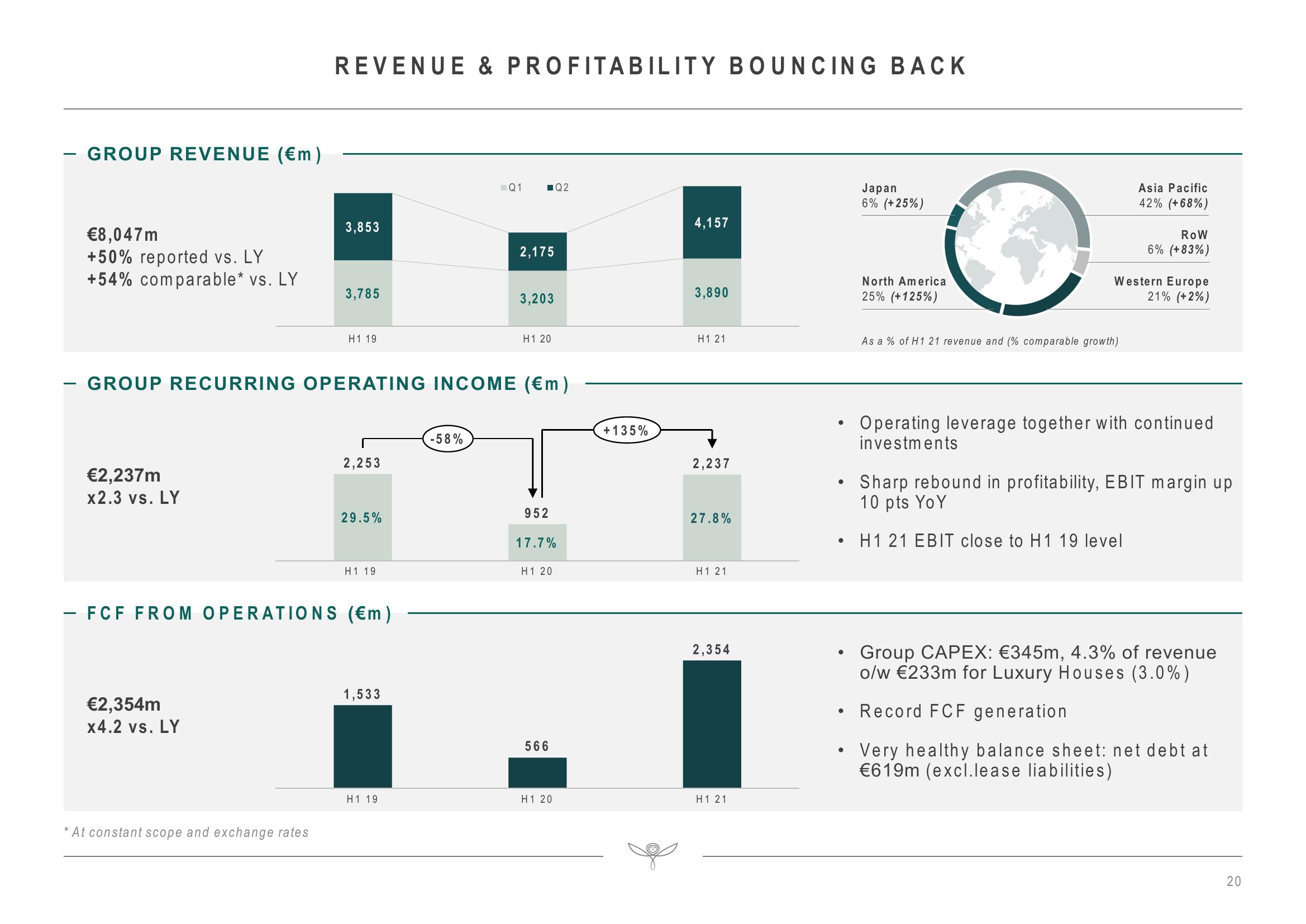

GROUP REVENUE (€m)

€8,047m

+50% reported vs. LY

+54% comparable* vs. LY

€2,237m

x2.3 vs. LY

REVENUE & PROFITABILITY BOUNCING BACK

€2,354m

x4.2 vs. LY

3,853

* At constant scope and exchange rates

3,785

H119

GROUP RECURRING OPERATING INCOME (€m)

2,253

29.5%

- FCF FROM OPERATIONS (€m)

H119

1,533

H 1 19

Q1 ■Q2

-58%

2,175

3,203

H1 20

952

17.7%

H1 20

566

H120

+ 135%

4,157

3,890

H121

2,237

27.8%

H121

2,354

H121

●

●

●

●

●

●

Japan

6% (+25%)

North America

25% (+125%)

Asia Pacific

42% (+68%)

As a % of H1 21 revenue and (% comparable growth)

ROW

6% (+83%)

Western Europe

21% (+2%)

Operating leverage together with continued

investments

Sharp rebound in profitability, EBIT margin up

10 pts YoY

H1 21 EBIT close to H1 19 level

Group CAPEX: €345m, 4.3% of revenue

o/w €233m for Luxury Houses (3.0%)

Record FCF generation

Very healthy balance sheet: net debt at

€619m (excl.lease liabilities)

20View entire presentation