Accelerating Value Creation for Shareholders

Further reinforcement of competitive advantages

Business for corporate clients

New type unsecured loans

to SMEs

Origination of "Business Select Loan"

Investment banking business

Profits related to loan syndication

(Billions of yen)

1,500

1,000

(Billions of yen)

40

Profit (left scale)

Origination

Term-end balance

-Ж

- Origination (right scale)

30

500

733.7

455.3

0

FY02 result

FY03 result

FY04 plan

220

10

0

FY02 result

FY03 result

SMFG

700

500

300

FY04 plan

Peer comparison (Origination of new type unsecured loans to SMEs)

(Billions of yen)

800

733.7

(FY03)

Profits through collaboration with Daiwa Securities SMBC*

(Billions of yen)

600

400

200

SMBC: Business Select Loan

Tokyo-Mitsubishi: Yukatsuryoku

Mizuho: Mizuho Advance Partner

UFJ: UFJ Business Loan

180

200

100

40

ㅎ 상영 중 엉

20

30

0

0

FY01 result

FY02 result

FY03 result

SMBC

Tokyo-Mitsubishi

Mizuho

UFJ

(Note) Peer companies' figure: the Nikkan Kogyo Shimbun dated Apr. 30, 04.

*SMBC's managerial accounting basis (Sum of the profits of SMBC and Daiwa SMBC)

4

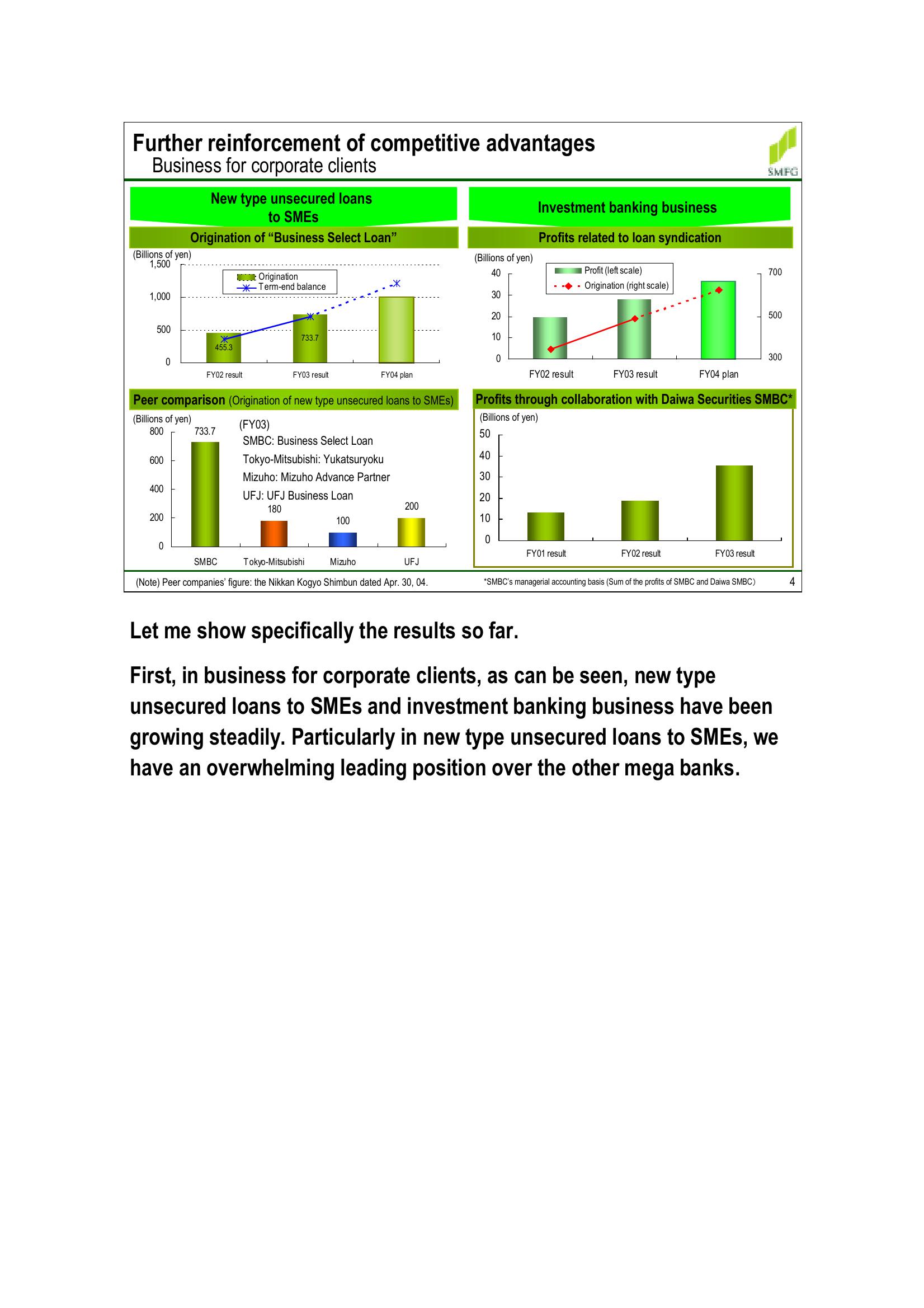

Let me show specifically the results so far.

First, in business for corporate clients, as can be seen, new type

unsecured loans to SMEs and investment banking business have been

growing steadily. Particularly in new type unsecured loans to SMEs, we

have an overwhelming leading position over the other mega banks.View entire presentation