OppFi SPAC Presentation Deck

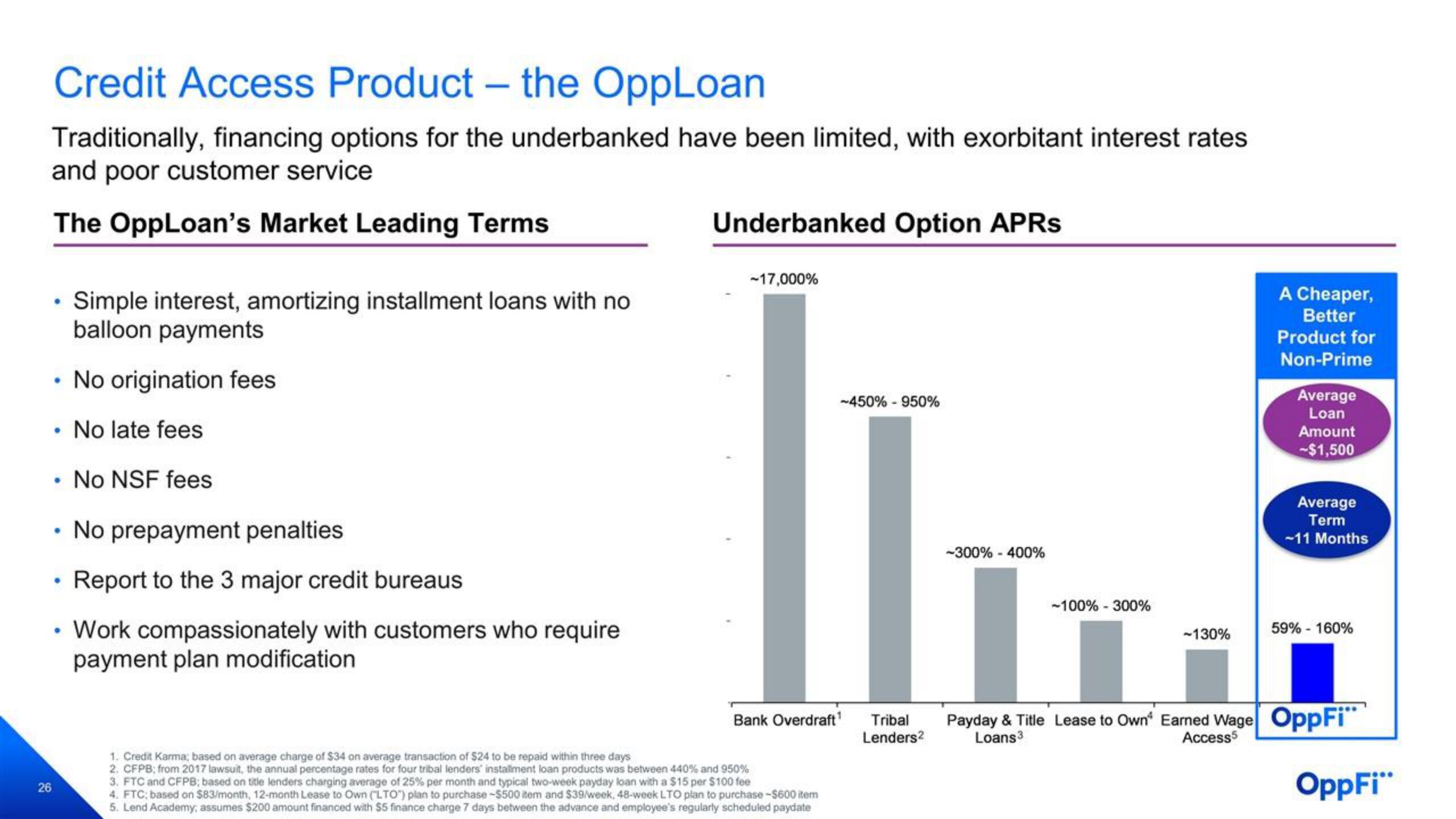

Credit Access Product - the OppLoan

Traditionally, financing options for the underbanked have been limited, with exorbitant interest rates

and poor customer service

The OppLoan's Market Leading Terms

• No origination fees

No late fees

• No NSF fees

• No prepayment penalties

Report to the 3 major credit bureaus

• Work compassionately with customers who require

payment plan modification

26

Simple interest, amortizing installment loans with no

balloon payments

●

Underbanked Option APRs

-17,000%

1. Credit Karma; based on average charge of $34 on average transaction of $24 to be repaid within three days

2. CFPB; from 2017 lawsuit, the annual percentage rates for four tribal lenders installment loan products was between 440 % and 950%

Bank Overdraft¹

-450% - 950%

3. FTC and CFPB; based on title lenders charging average of 25% per month and typical two-week payday loan with a $15 per $100 fee

4. FTC: based on $83/month, 12-month Lease to Own (LTO) plan to purchase -$500 item and $39/week, 48-week LTO plan to purchase-$600 item

5. Lend Academy, assumes $200 amount financed with $5 finance charge 7 days between the advance and employee's regularly scheduled paydate

Tribal

Lenders²

-300% - 400%

-100% -300%

-130%

A Cheaper,

Better

Product for

Non-Prime

Average

Loan

Amount

-$1,500

Average

Term

-11 Months

59% - 160%

Payday & Title Lease to Own Earned Wage OppFi

Loans 3

Access5

OppFi"View entire presentation