Ashtead Group Results Presentation Deck

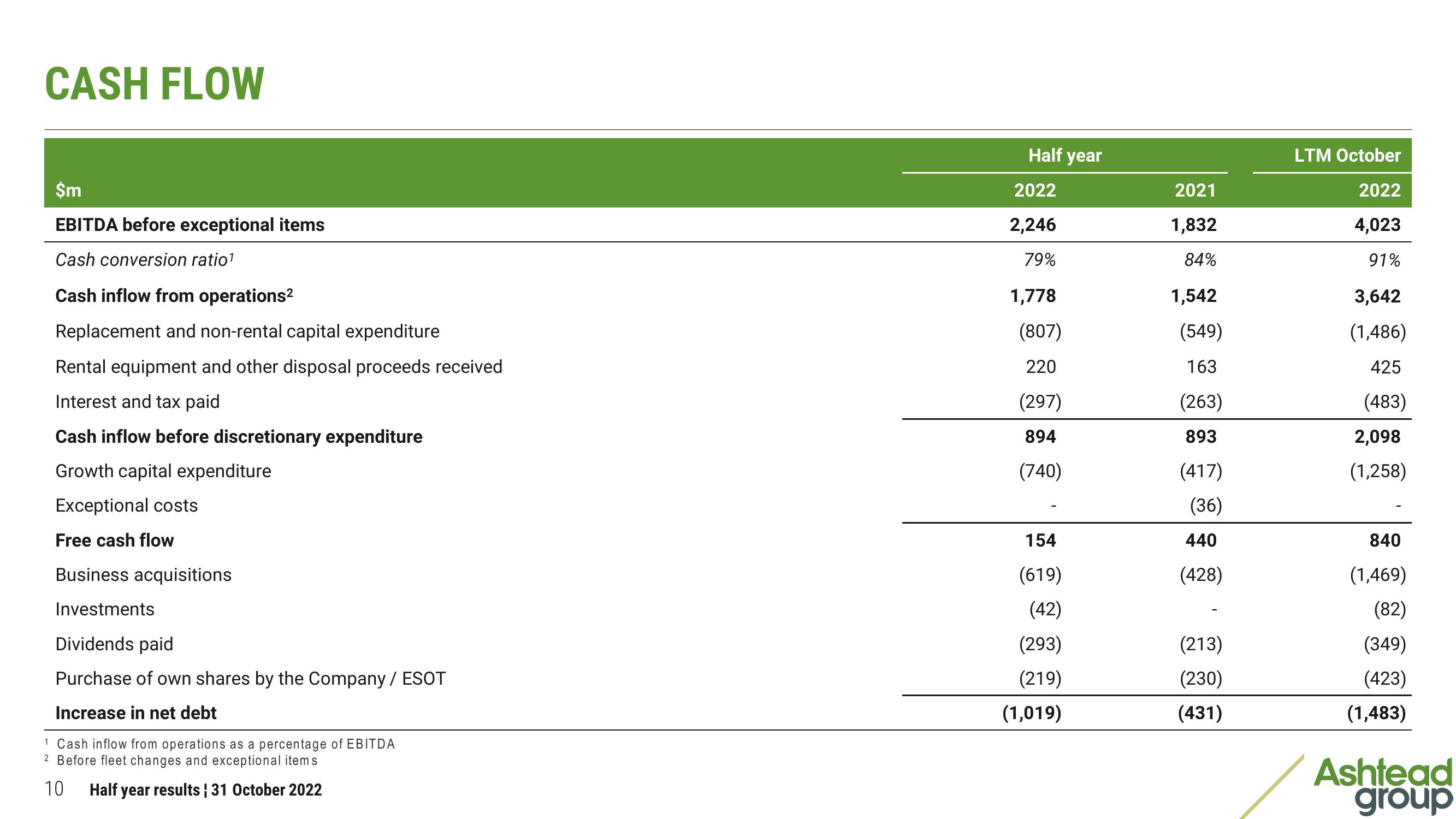

CASH FLOW

$m

EBITDA before exceptional items

Cash conversion ratio¹

Cash inflow from operations²

Replacement and non-rental capital expenditure

Rental equipment and other disposal proceeds received

Interest and tax paid

Cash inflow before discretionary expenditure

Growth capital expenditure

Exceptional costs

Free cash flow

Business acquisitions

Investments

Dividends paid

Purchase of own shares by the Company / ESOT

Increase in net debt

1 Cash inflow from operations as a percentage of EBITDA

2 Before fleet changes and exceptional items

10

Half year results ¦ 31 October 2022

Half year

2022

2,246

79%

1,778

(807)

220

(297)

894

(740)

154

(619)

(42)

(293)

(219)

(1,019)

2021

1,832

84%

1,542

(549)

163

(263)

893

(417)

(36)

440

(428)

(213)

(230)

(431)

LTM October

2022

4,023

91%

3,642

(1,486)

425

(483)

2,098

(1,258)

840

(1,469)

(82)

(349)

(423)

(1,483)

Ashtead

groupView entire presentation