Investor Presentation

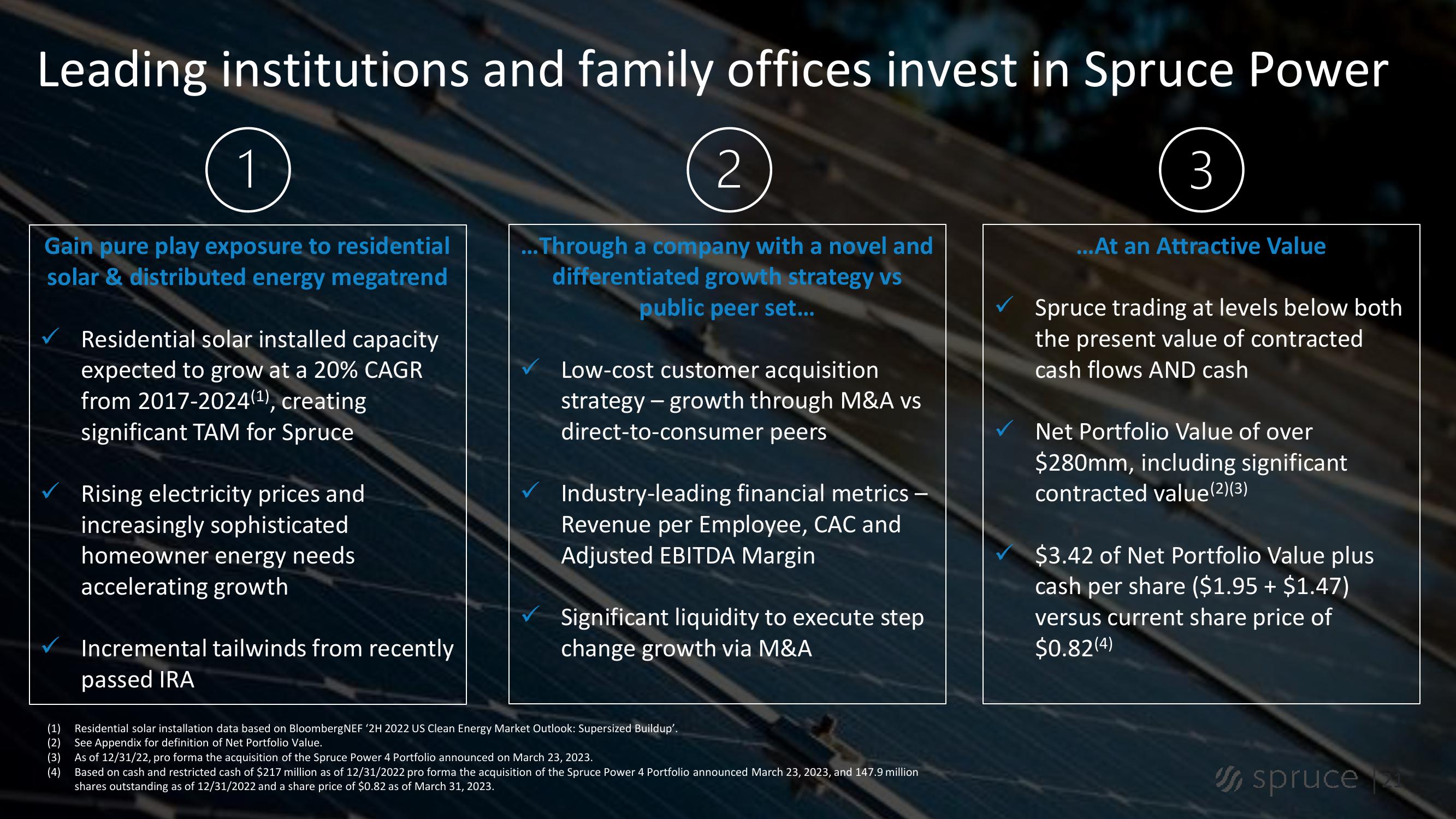

Leading institutions and family offices invest in Spruce Power

1

Gain pure play exposure to residential

solar & distributed energy megatrend

Residential solar installed capacity

expected to grow at a 20% CAGR

from 2017-2024(1), creating

significant TAM for Spruce

Rising electricity prices and

increasingly sophisticated

homeowner energy needs

accelerating growth

Incremental tailwinds from recently

2

...Through a company with a novel and

differentiated growth strategy vs

public peer set...

Low-cost customer acquisition

strategy - growth through M&A vs

direct-to-consumer peers

Industry-leading financial metrics

Revenue per Employee, CAC and

Adjusted EBITDA Margin

Significant liquidity to execute step

change growth via M&A

3

...At an Attractive Value

Spruce trading at levels below both

the present value of contracted

cash flows AND cash

Net Portfolio Value of over

$280mm, including significant

contracted value(2)(3)

$3.42 of Net Portfolio Value plus

cash per share ($1.95 + $1.47)

versus current share price of

$0.82(4)

passed IRA

(1)

Residential solar installation data based on BloombergNEF '2H 2022 US Clean Energy Market Outlook: Supersized Buildup'.

(2) See Appendix for definition of Net Portfolio Value.

1234

(3)

(4)

As of 12/31/22, pro forma the acquisition of the Spruce Power 4 Portfolio announced on March 23, 2023.

Based on cash and restricted cash of $217 million as of 12/31/2022 pro forma the acquisition of the Spruce Power 4 Portfolio announced March 23, 2023, and 147.9 million

shares outstanding as of 12/31/2022 and a share price of $0.82 as of March 31, 2023.

spruceView entire presentation