Sonos Results Presentation Deck

Strong Revenue Growth While Investing in the Future

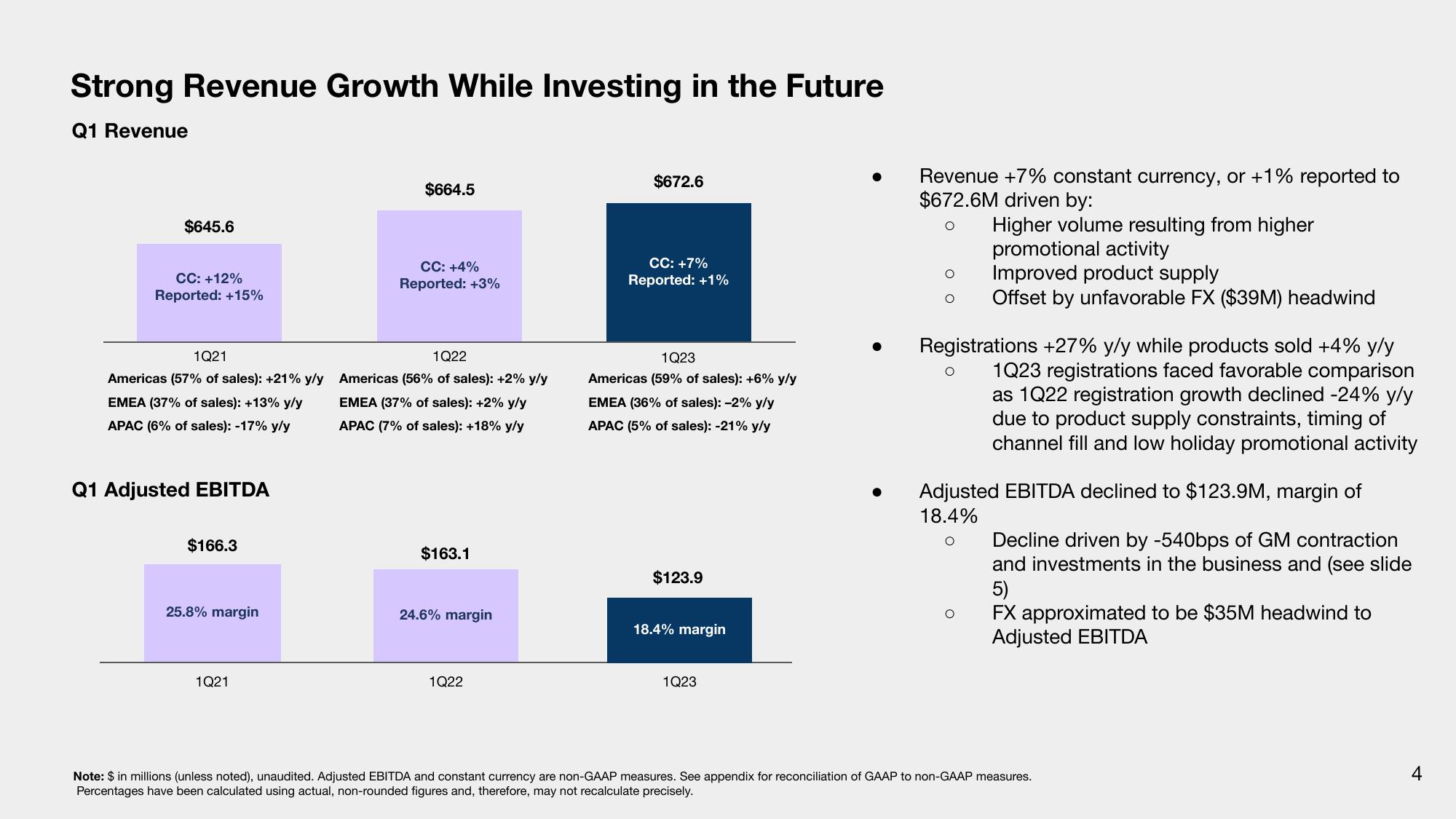

Q1 Revenue

$645.6

CC: +12%

Reported: +15%

1Q21

Americas (57% of sales): +21% y/y

EMEA (37% of sales): +13% y/y

APAC (6% of sales): -17% y/y

Q1 Adjusted EBITDA

$166.3

25.8% margin

1Q21

$664.5

CC: +4%

Reported: +3%

1Q22

Americas (56% of sales): +2% y/y

EMEA (37% of sales): +2% y/y

APAC (7% of sales): +18% y/y

$163.1

24.6% margin

1Q22

$672.6

CC: +7%

Reported: +1%

1Q23

Americas (59% of sales): +6% y/y

EMEA (36% of sales): -2% y/y

APAC (5% of sales): -21% y/y

$123.9

18.4% margin

1Q23

Revenue +7% constant currency, or +1% reported to

$672.6M driven by:

O

Higher volume resulting from higher

Registrations +27% y/y while products sold +4% y/y

1Q23 registrations faced favorable comparison

as 1Q22 registration growth declined -24% y/y

due to product supply constraints, timing of

channel fill and low holiday promotional activity

O

promotional activity

Improved product supply

Offset by unfavorable FX ($39M) headwind

Adjusted EBITDA declined to $123.9M, margin of

18.4%

O

O

Decline driven by -540bps of GM contraction

and investments in the business and (see slide

5)

FX approximated to be $35M headwind to

Adjusted

Note: $ in millions (unless noted), unaudited. Adjusted EBITDA and constant currency are non-GAAP measures. See appendix for reconciliation of GAAP to non-GAAP measures.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

4View entire presentation