Vroom Results Presentation Deck

reconciliation of non-gaap financial measures (cont'd)

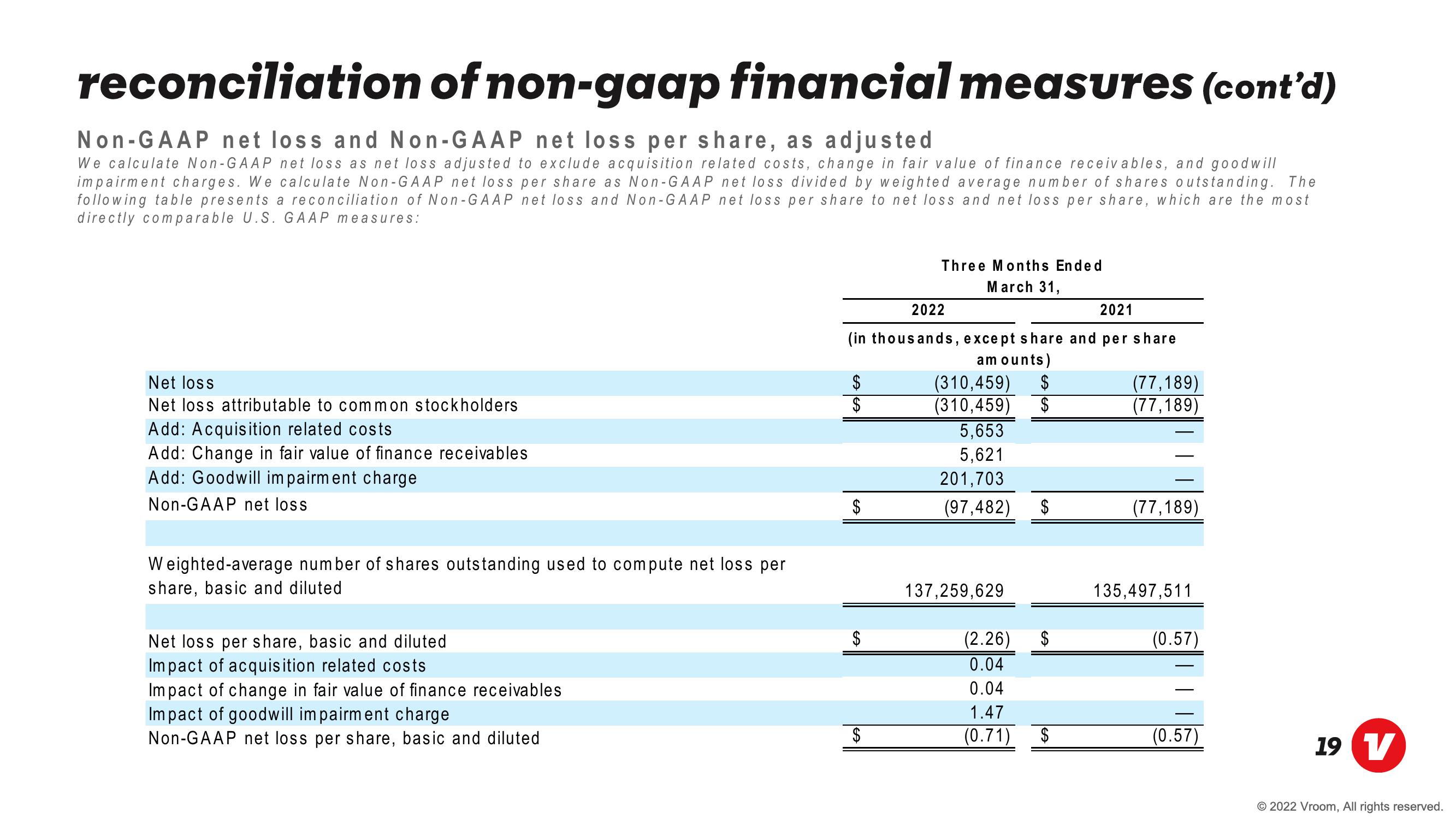

Non-GAAP net loss and Non-GAAP net loss per share, as adjusted

We calculate Non-GAAP net loss as net loss adjusted to exclude acquisition related costs, change in fair value of finance receivables, and goodwill

impairment charges. We calculate Non-GAAP net loss per share as Non-GAAP net loss divided by weighted average number of shares outstanding. The

following table presents a reconciliation of Non-GAAP net loss and Non-GAAP net loss per share to net loss and net loss per share, which are the most

directly comparable U.S. GAAP measures:

Net loss

Net loss attributable to common stockholders

Add: Acquisition related costs

Add: Change in fair value of finance receivables

Add: Goodwill impairment charge

Non-GAAP net loss

Weighted-average number of shares outstanding used to compute net loss per

share, basic and diluted

Net loss per share, basic and diluted

Impact of acquisition related costs

Impact of change in fair value of finance receivables

Impact of goodwill impairment charge

Non-GAAP net loss per share, basic and diluted

2022

2021

(in thousands, except share and per share

amounts)

(310,459) $

(310,459)

5,653

5,621

201,703

(97,482)

LA LA

$

$

$

$

GA

Three Months Ended

March 31,

$

137,259,629

(2.26) $

0.04

0.04

1.47

(0.71)

$

(77,189)

(77,189)

(77,189)

135,497,511

(0.57)

(0.57)

19 V

© 2022 Vroom, All rights reserved.View entire presentation