AgroFresh SPAC Presentation Deck

AgroFresh Q1 2015 Financial

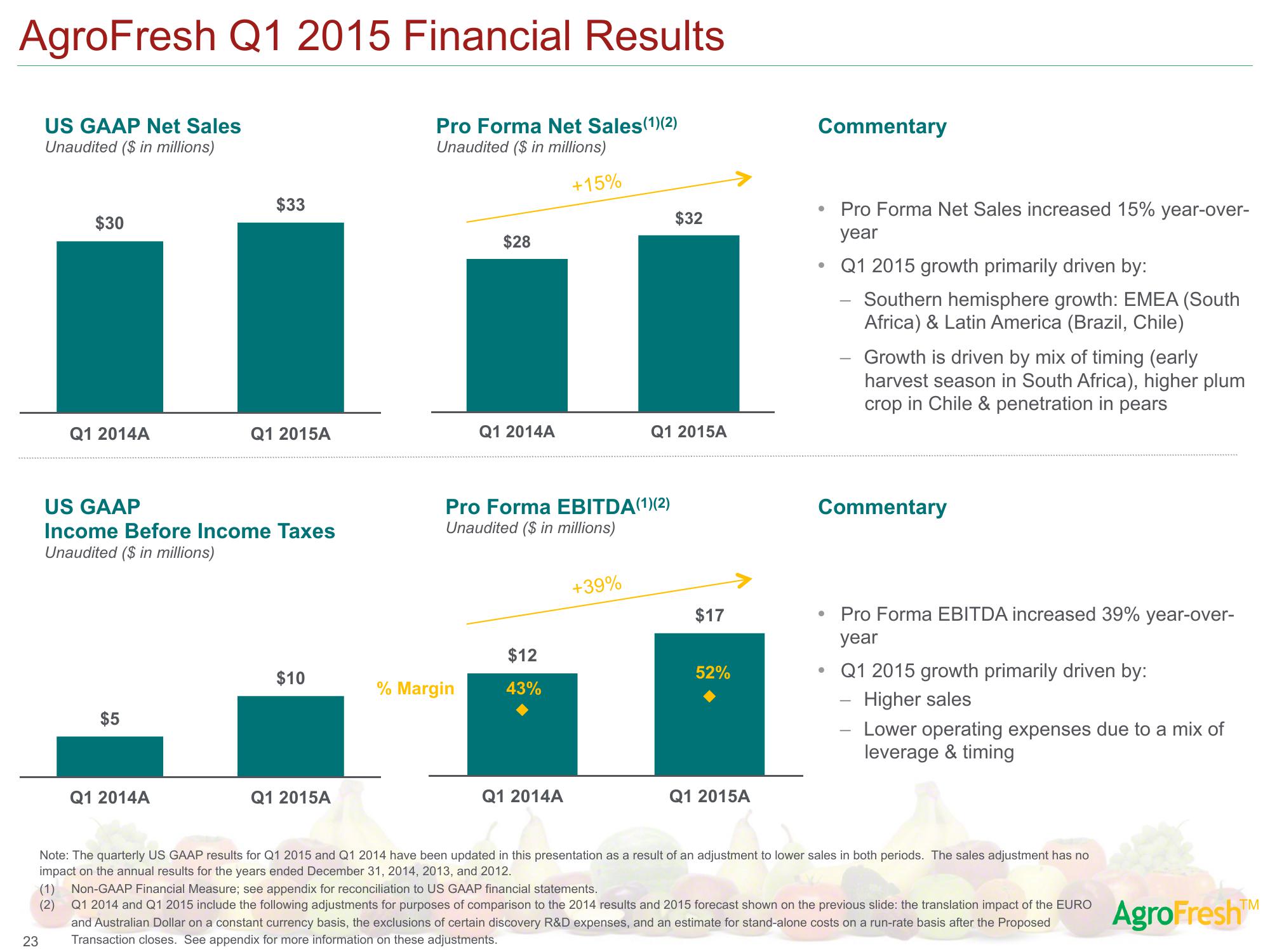

US GAAP Net Sales

Unaudited ($ in millions)

$30

Q1 2014A

$5

$33

US GAAP

Income Before Income Taxes

Unaudited ($ in millions)

Q1 2014A

Q1 2015A

$10

Financial Results

Q1 2015A

Pro Forma Net Sales(1)(2)

Unaudited ($ in millions)

+15%

$28

% Margin

Q1 2014A

Pro Forma EBITDA(1)(2)

Unaudited ($ in millions)

$12

43%

Q1 2014A

+39%

$32

Q1 2015A

$17

52%

Q1 2015A

Commentary

●

●

Pro Forma Net Sales increased 15% year-over-

year

●

Q1 2015 growth primarily driven by:

Southern hemisphere growth: EMEA (South

Africa) & Latin America (Brazil, Chile)

Commentary

Growth is driven by mix of timing (early

harvest season in South Africa), higher plum

crop in Chile & penetration in pears

Pro Forma EBITDA increased 39% year-over-

year

Q1 2015 growth primarily driven by:

Higher sales

Lower operating expenses due to a mix of

leverage & timing

Note: The quarterly US GAAP results for Q1 2015 and Q1 2014 have been updated in this presentation as a result of an adjustment to lower sales in both periods. The sales adjustment has no

impact on the annual results for the years ended December 31, 2014, 2013, and 2012.

(1) Non-GAAP Financial Measure; see appendix for reconciliation to US GAAP financial statements.

(2)

Q1 2014 and Q1 2015 include the following adjustments for purposes of comparison to the 2014 results and 2015 forecast shown on the previous slide: the translation impact of the EURO

and Australian Dollar on a constant currency basis, the exclusions of certain discovery R&D expenses, and an estimate for stand-alone costs on a run-rate basis after the Proposed

23 Transaction closes. See appendix for more information on these adjustments.

AgroFresh™View entire presentation