Tradeweb Results Presentation Deck

13

Capital Management & FY Guidance

■

■

■

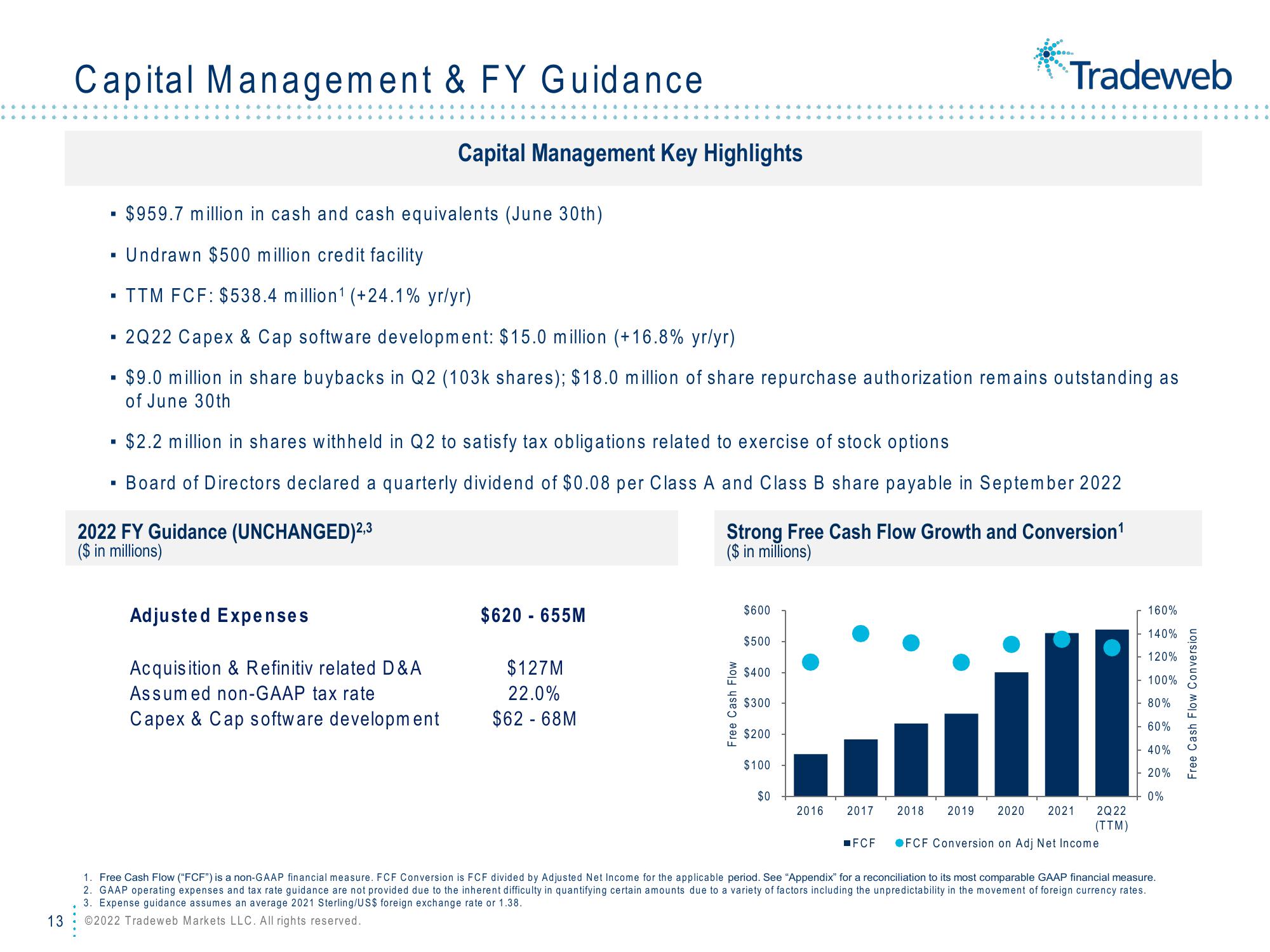

$959.7 million in cash and cash equivalents (June 30th)

Undrawn $500 million credit facility

TTM FCF: $538.4 million¹ (+24.1% yr/yr)

Capital Management Key Highlights

▪ 2Q22 Capex & Cap software development: $15.0 million (+16.8% yr/yr)

$9.0 million in share buybacks in Q2 (103k shares); $18.0 million of share repurchase authorization remains outstanding as

of June 30th

2022 FY Guidance (UNCHANGED)2,3

($ in millions)

▪ $2.2 million in shares withheld in Q2 to satisfy tax obligations related to exercise of stock options

Board of Directors declared a quarterly dividend of $0.08 per Class A and Class B share payable in September 2022

Adjusted Expenses

Acquisition & Refinitiv related D&A

Assumed non-GAAP tax rate

Capex & Cap software development

$620 - 655M

$127M

22.0%

$62 - 68M

Strong Free Cash Flow Growth and Conversion¹

($ in millions)

Free Cash Flow

$600

$500

$400

$300

$200

$100

Tradeweb

$0

2016 2017

FCF

2018 2019 2020 2021 2Q22

(TTM)

FCF Conversion on Adj Net Income

160%

140%

120%

100%

- 80%

60%

40%

-20%

0%

1. Free Cash Flow ("FCF") is a non-GAAP financial measure. FCF Conversion is FCF divided by Adjusted Net Income for the applicable period. See "Appendix" for a reconciliation to its most comparable GAAP financial measure.

2. GAAP operating expenses and tax rate guidance are not provided due to the inherent difficulty in quantifying certain amounts due to a variety of factors including the unpredictability in the movement of foreign currency rates.

3. Expense guidance assumes an average 2021 Sterling/US$ foreign exchange rate or 1.38.

©2022 Tradeweb Markets LLC. All rights reserved.

Free Cash Flow ConversionView entire presentation