UBS Results Presentation Deck

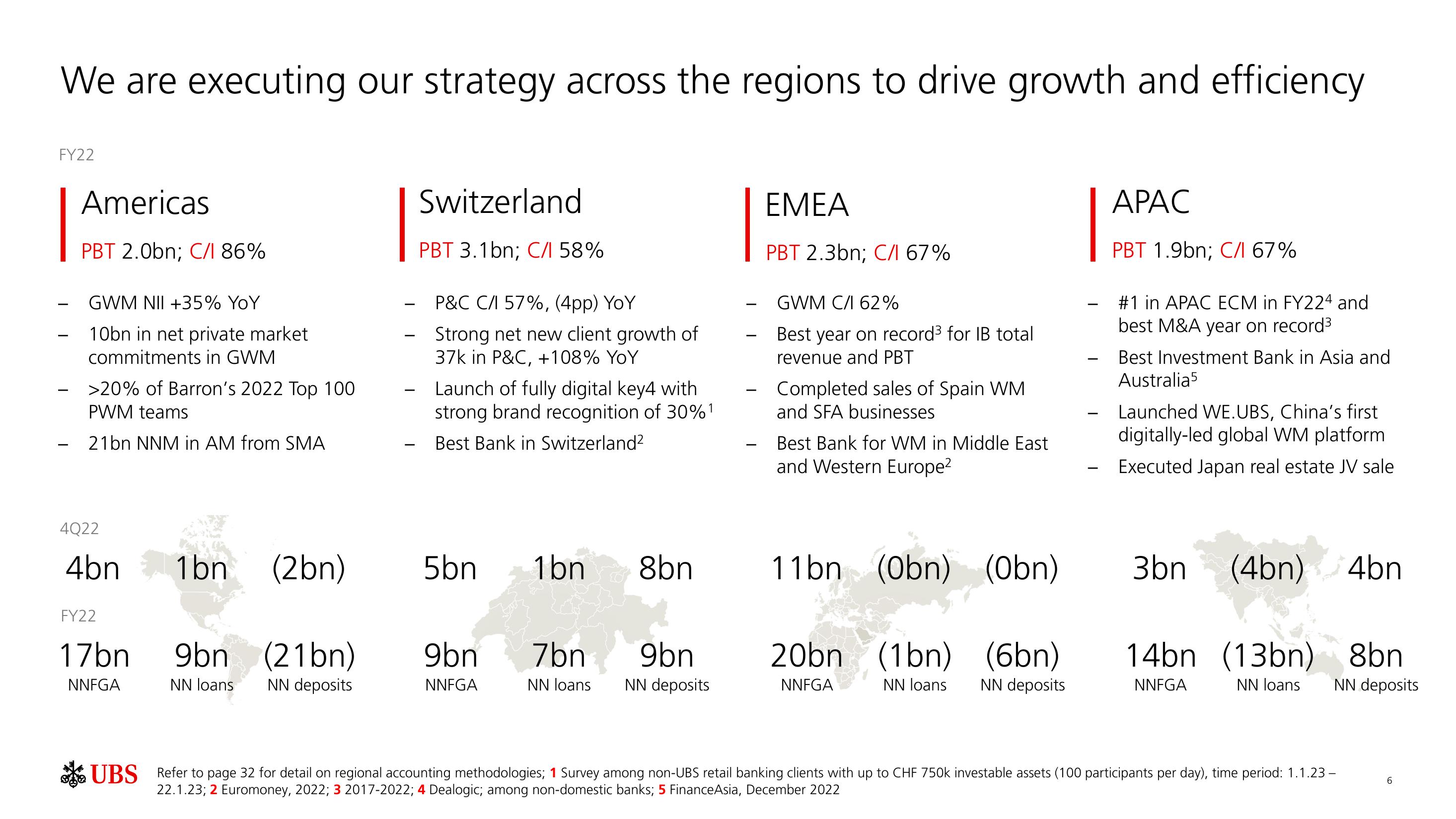

We are executing our strategy across the regions to drive growth and efficiency

FY22

Americas

PBT 2.0bn; C/1 86%

GWM NII +35% YoY

10bn in net private market

commitments in GWM

>20% of Barron's 2022 Top 100

PWM teams

21bn NNM in AM from SMA

4Q22

4bn

1bn

(2bn)

FY22

17bn 9bn (21bn)

NNFGA

NN loans

NN deposits

Switzerland

PBT 3.1bn; C/1 58%

P&C C/1 57%, (4pp) YOY

Strong net new client growth of

37k in P&C, +108% YoY

Launch of fully digital key4 with

strong brand recognition of 30%¹

Best Bank in Switzerland²

5bn 1bn 8bn

9bn

NNFGA

7bn 9bn

NN loans NN deposits

EMEA

PBT 2.3bn; C/I 67%

GWM C/I 62%

Best year on record³ for IB total

revenue and PBT

Completed sales of Spain WM

and SFA businesses

Best Bank for WM in Middle East

and Western Europe²

11bn (Obn)

20bn (1bn)

NNFGA

NN loans

(Obn)

(6bn)

NN deposits

-

-

APAC

PBT 1.9bn; C/1 67%

#1 in APAC ECM in FY224 and

best M&A year on record³

Best Investment Bank in Asia and

Australia5

Launched WE.UBS, China's first

digitally-led global WM platform

Executed Japan real estate JV sale

3bn (4bn) 4bn

14bn (13bn) 8bn

NNFGA

NN loans

NN deposits

UBS Refer to page 32 for detail on regional accounting methodologies; 1 Survey among non-UBS retail banking clients with up to CHF 750k investable assets (100 participants per day), time period: 1.1.23-

22.1.23; 2 Euromoney, 2022; 3 2017-2022; 4 Dealogic; among non-domestic banks; 5 FinanceAsia, December 2022

6View entire presentation