Silicon Valley Bank Results Presentation Deck

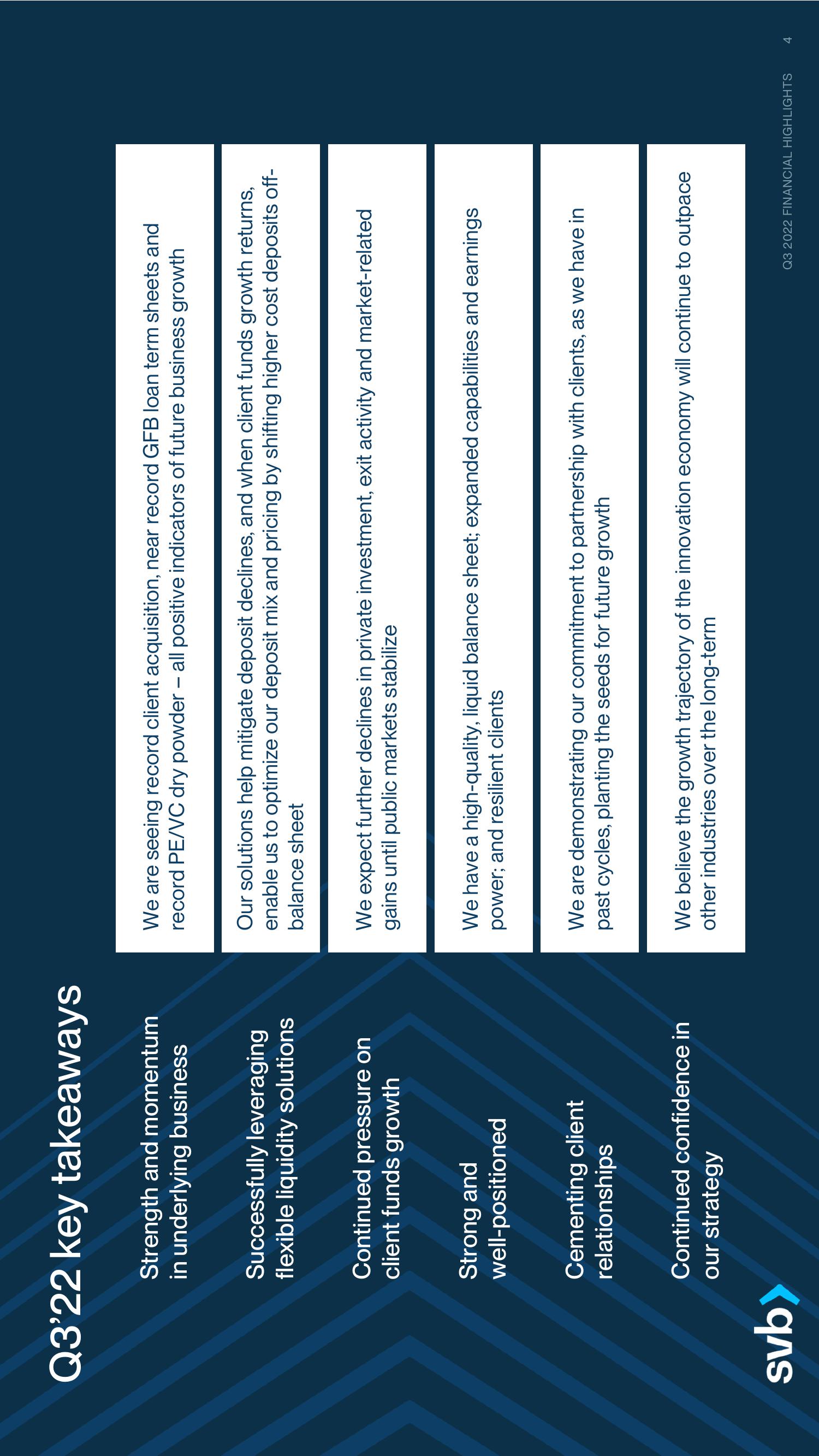

Q3'22 key takeaways

Strength and momentum

in underlying business

svb>

Successfully leveraging

flexible liquidity solutions

Continued pressure on

client funds growth

Strong and

well-positioned

Cementing client

relationships

Continued confidence in

our strategy

We are seeing record client acquisition, near record GFB loan term sheets and

record PE/VC dry powder - all positive indicators of future business growth

Our solutions help mitigate deposit declines, and when client funds growth returns,

enable us to optimize our deposit mix and pricing by shifting higher cost deposits off-

balance sheet

We expect further declines in private investment, exit activity and market-related

gains until public markets stabilize

We have a high-quality, liquid balance sheet; expanded capabilities and earnings

power; and resilient clients

We are demonstrating our commitment to partnership with clients, as we have in

past cycles, planting the seeds for future growth

We believe the growth trajectory of the innovation economy will continue to outpace

other industries over the long-term

Q3 2022 FINANCIAL HIGHLIGHTS

4View entire presentation