Bed Bath & Beyond Results Presentation Deck

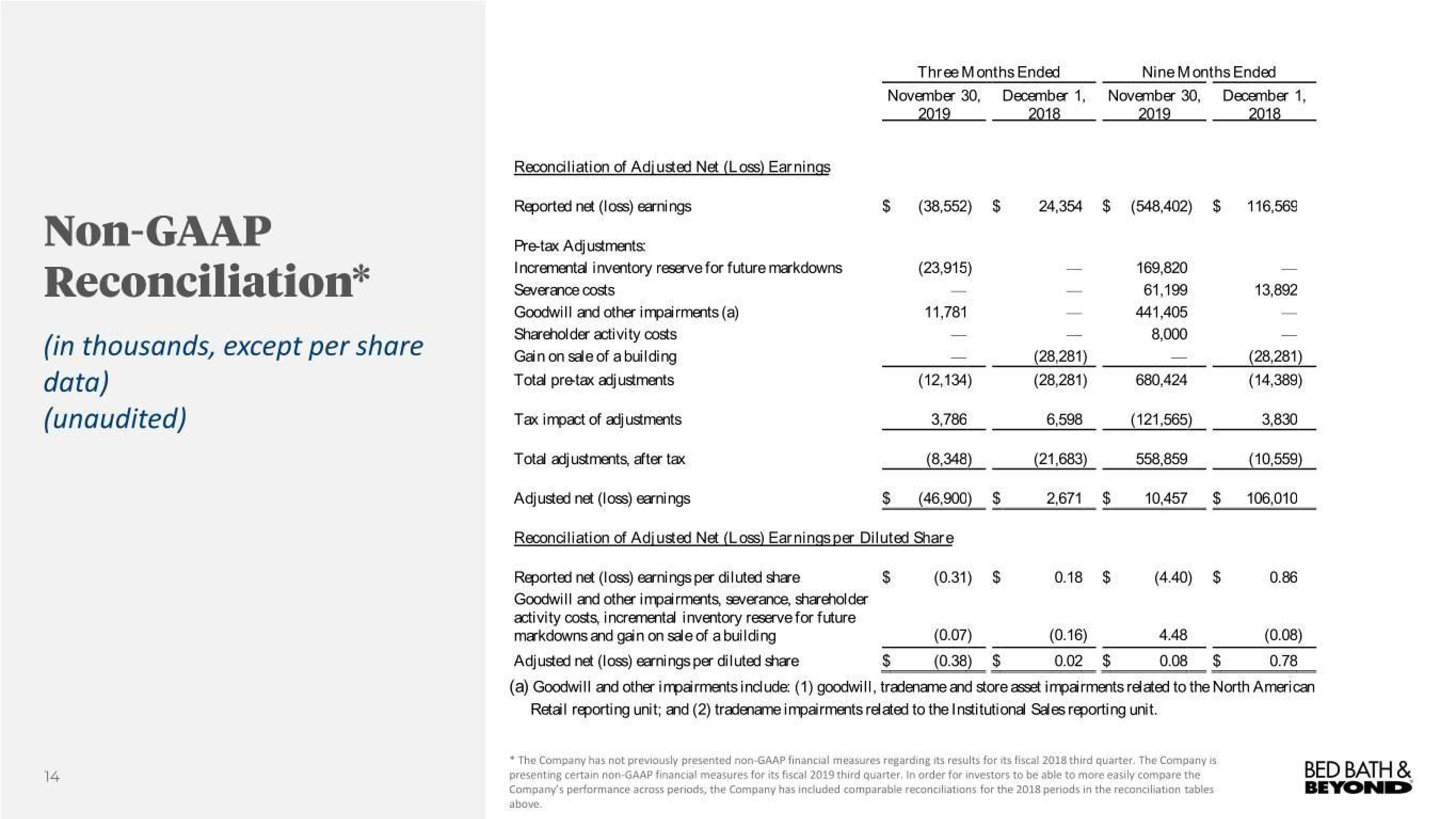

Non-GAAP

Reconciliation*

(in thousands, except per share

data)

(unaudited)

14

Reconciliation of Adjusted Net (Loss) Earnings

Three Months Ended

November 30, December 1,

2019

2018

$

$

$

Reported net (loss) earnings

Pre-tax Adjustments:

Incremental inventory reserve for future markdowns

Severance costs

Goodwill and other impairments (a)

Shareholder activity costs

Gain on sale of a building

Total pre-tax adjustments

Tax impact of adjustments

Total adjustments, after tax

Adjusted net (loss) earnings

Reconciliation of Adjusted Net (Loss) Earnings per Diluted Share

Reported net (loss) earnings per diluted share.

Goodwill and other impairments, severance, shareholder

activity costs, incremental inventory reserve for future

markdowns and gain on sale of a building

(0.07)

(0.38) $

4.48

0.08 $

$

$

Adjusted net (loss) earnings per diluted share

(a) Goodwill and other impairments include: (1) goodwill, tradename and store asset impairments related to the North American

Retail reporting unit; and (2) tradename impairments related to the Institutional Sales reporting unit.

(38,552) $

(23,915)

11,781

(12,134)

3,786

(8,348)

(46,900) $

(0.31) $

24,354 $ (548,402) $

(28,281)

(28,281)

Nine Months Ended

November 30, December 1,

2019

2018

6,598

(21,683)

2,671 $

0.18 $

(0.16)

0.02

169,820

61,199

441,405

8,000

680,424

(121,565)

558,859

10,457

$

(4.40) $

The Company has not previously presented non-GAAP financial measures regarding its results for its fiscal 2018 third quarter. The Company is

presenting certain non-GAAP financial measures for its fiscal 2019 third quarter, In order for investors to be able to more easily compare the

Company's performance across periods, the Company has included comparable reconciliations for the 2018 periods in the reconciliation tables

above.

116,569

13,892

(28,281)

(14,389)

3,830

(10,559)

106,010

0.86

(0.08)

0.78

BED BATH &

BEYONDView entire presentation