Ford Results 3Q23 Earnings

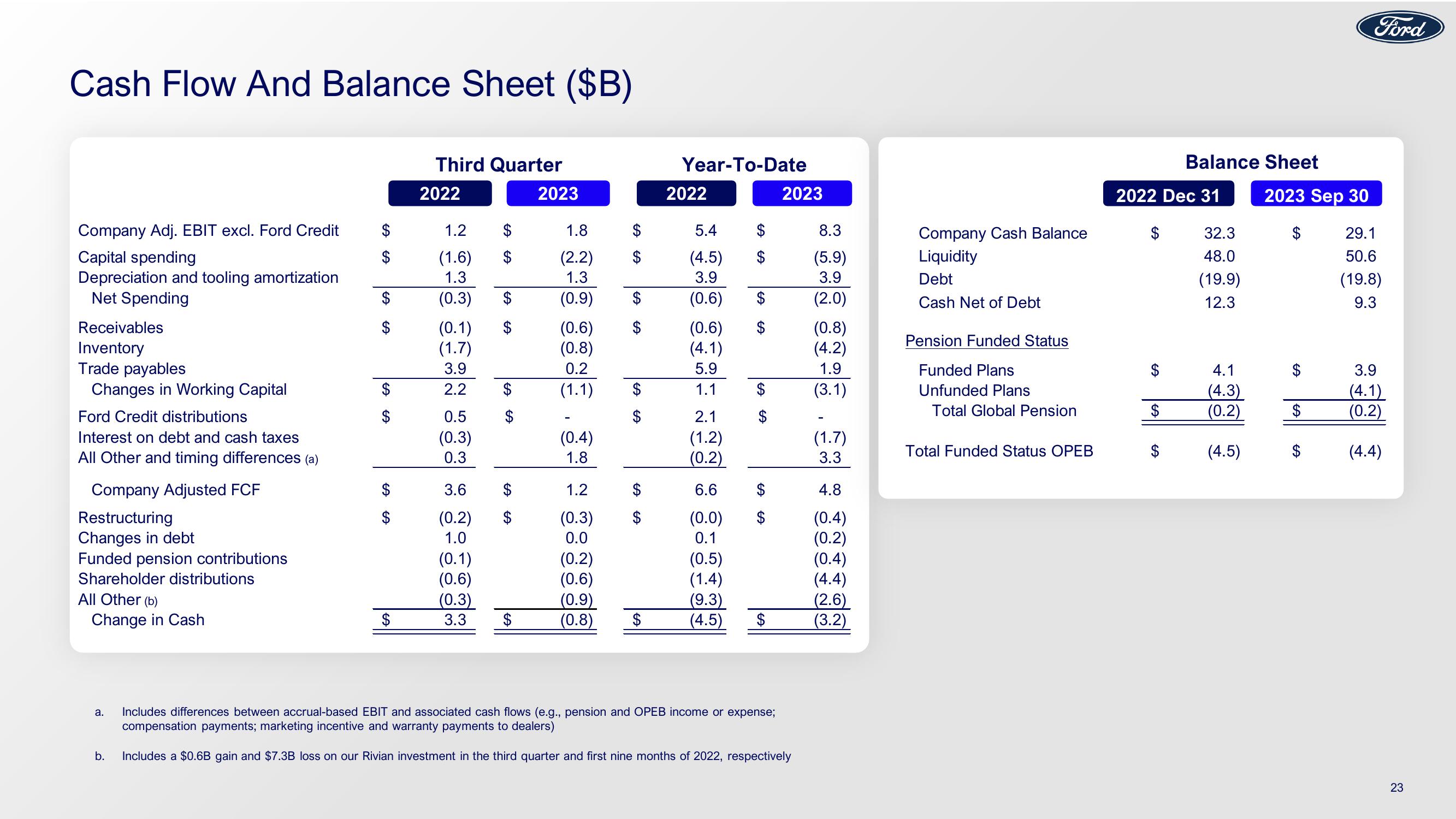

Cash Flow And Balance Sheet ($B)

Company Adj. EBIT excl. Ford Credit

Capital spending

Depreciation and tooling amortization

Net Spending

Receivables

Inventory

Trade payables

Changes in Working Capital

Ford Credit distributions

Interest on debt and cash taxes

All Other and timing differences (a)

Company Adjusted FCF

Restructuring

Changes in debt

Funded pension contributions

Shareholder distributions

All Other (b)

Change in Cash

$

a.

LA

$

Third Quarter

2022

1.2

(1.6)

1.3

(0.3)

(0.1)

(1.7)

3.9

2.2

0.5

(0.3)

0.3

3.6

(0.2)

1.0

$

A

SA

(0.1)

(0.6)

(0.3)

3.3 $

2023

1.8

(2.2)

1.3

(0.9)

(0.6)

(0.8)

0.2

(1.1)

(0.4)

1.8

1.2

(0.3)

0.0

(0.2)

(0.6)

(0.9)

(0.8)

SA

A LA

A A

$

Year-To-Date

2022

5.4

(4.5)

3.9

(0.6)

(0.6)

(4.1)

5.9

1.1

$

(0.5)

(1.4)

(9.3)

(4.5)

$

$

$

GAGA

2.1

(1.2)

(0.2)

6.6

(0.0) $

0.1

$

GALA

$

2023

Includes differences between accrual-based EBIT and associated cash flows (e.g., pension and OPEB income or expense;

compensation payments; marketing incentive and warranty payments to dealers)

b. Includes a $0.6B gain and $7.3B loss on our Rivian investment in the third quarter and first nine months of 2022, respectively

8.3

(5.9)

3.9

(2.0)

(0.8)

(4.2)

1.9

(3.1)

(1.7)

3.3

4.8

(0.4)

(0.2)

(0.4)

(4.4)

(2.6)

(3.2)

Company Cash Balance

Liquidity

Debt

Cash Net of Debt

Pension Funded Status

Funded Plans

Unfunded Plans

Total Global Pension

Total Funded Status OPEB

2022 Dec 31

$

$

$

Balance Sheet

SA

32.3

48.0

(19.9)

12.3

4.1

(4.3)

(0.2)

(4.5)

2023 Sep 30

$

$

$

$

Ford

29.1

50.6

(19.8)

9.3

3.9

(4.1)

(0.2)

(4.4)

23View entire presentation