WeWork Investor Presentation Deck

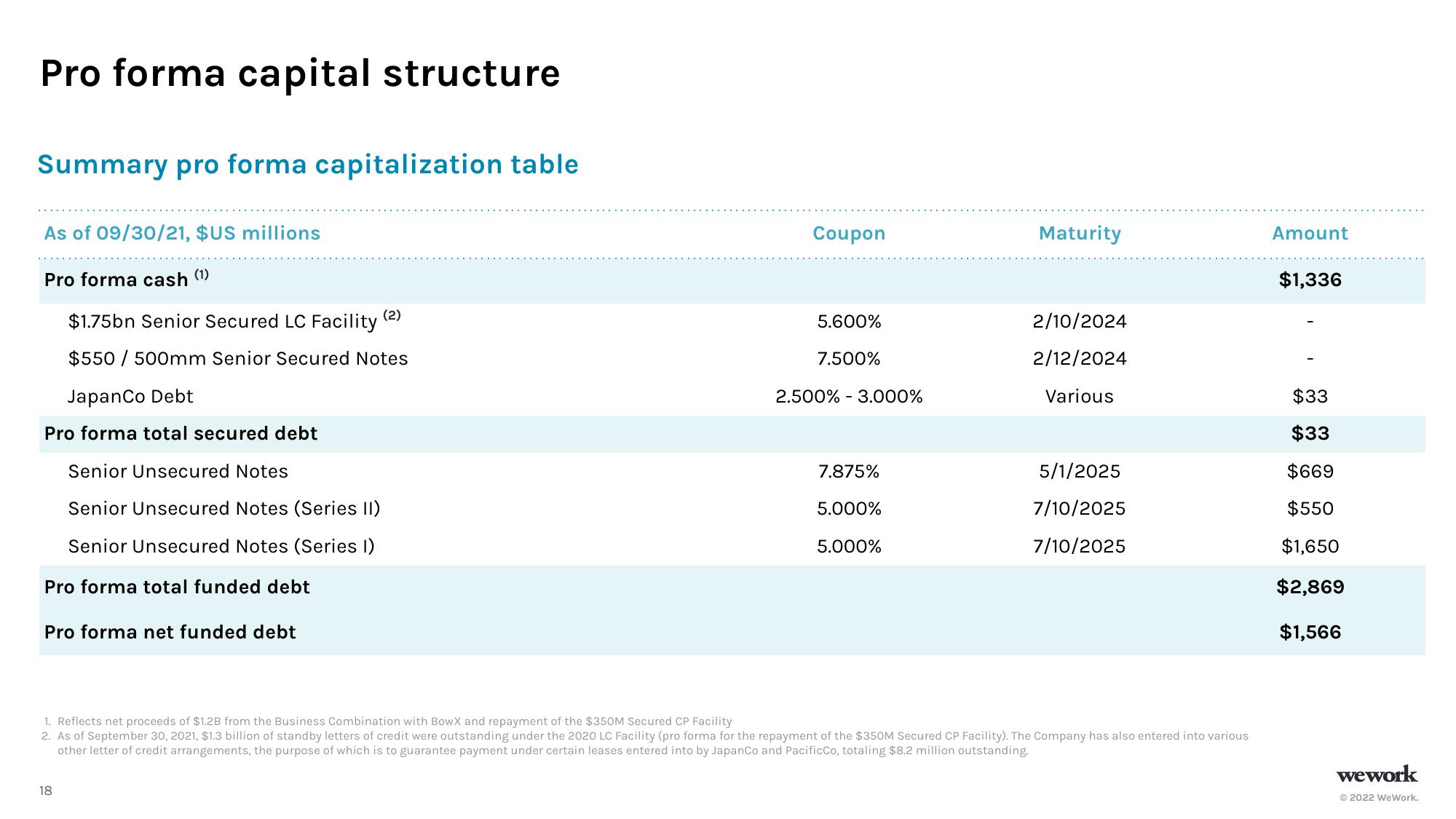

Pro forma capital structure

Summary pro forma capitalization table

As of 09/30/21, $US millions

Pro forma cash (1)

$1.75bn Senior Secured LC Facility

$550 / 500mm Senior Secured Notes

JapanCo Debt

Pro forma total secured debt

Senior Unsecured Notes

Senior Unsecured Notes (Series II)

Senior Unsecured Notes (Series 1)

Pro forma total funded debt

Pro forma net funded debt

(2)

18

Coupon

5.600%

7.500%

2.500% - 3.000%

7.875%

5.000%

5.000%

Maturity

2/10/2024

2/12/2024

Various

5/1/2025

7/10/2025

7/10/2025

1. Reflects net proceeds of $1.2B from the Business Combination with BowX and repayment of the $350M Secured CP Facility

2. As of September 30, 2021, $1.3 billion of standby letters of credit were outstanding under the 2020 LC Facility (pro forma for the repayment of the $350M Secured CP Facility). The Company has also entered into various

other letter of credit arrangements, the purpose of which is to guarantee payment under certain leases entered into by JapanCo and PacificCo, totaling $8.2 million outstanding.

Amount

$1,336

$33

$33

$669

$550

$1,650

$2,869

$1,566

wework

Ⓒ2022 WeWork.View entire presentation