GMS Results Presentation Deck

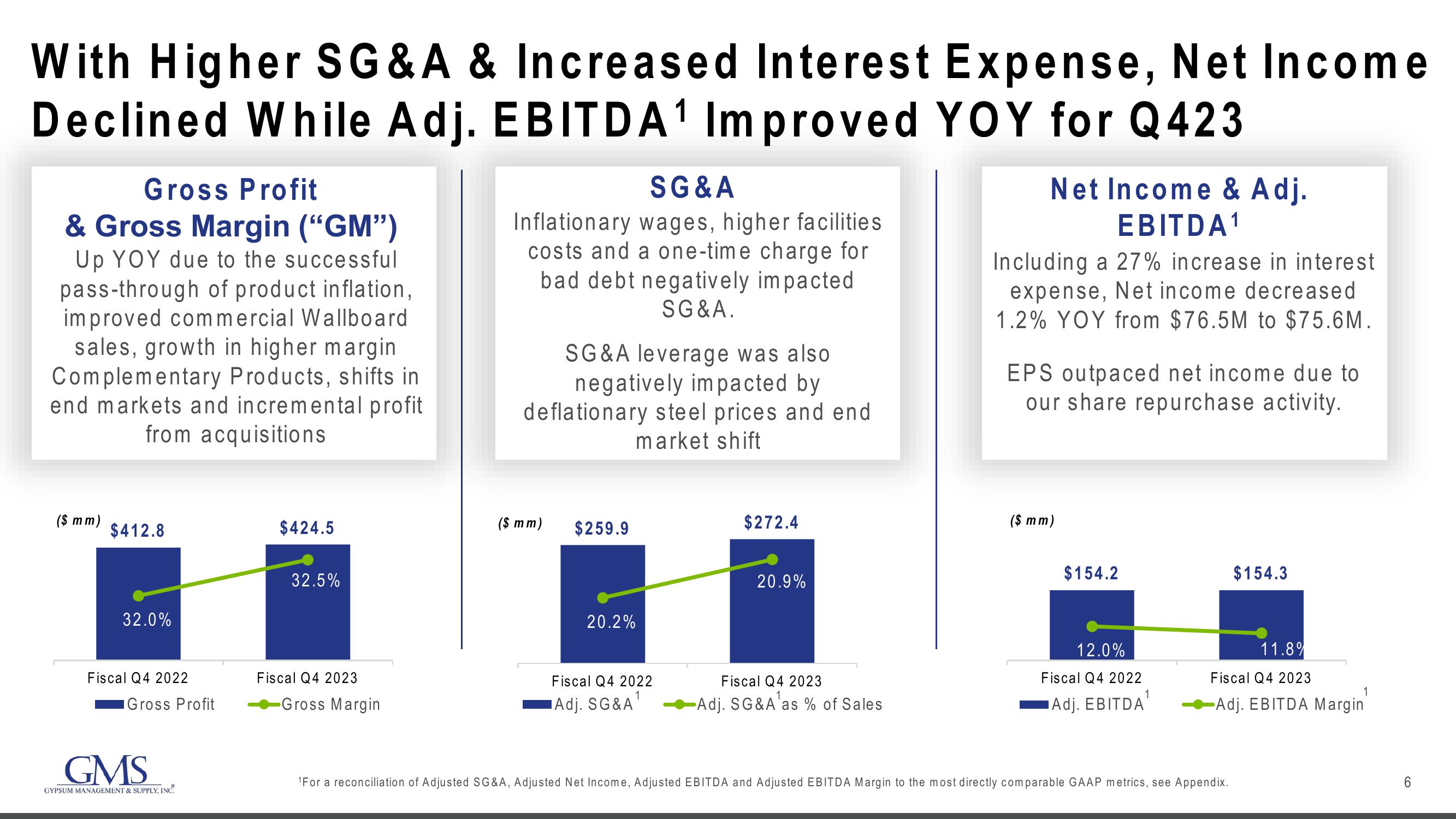

With Higher SG&A & Increased Interest Expense, Net Income

Declined While Adj. EBITDA¹ Improved YOY for Q423

Gross Profit

& Gross Margin ("GM")

Up YOY due to the successful

pass-through of product inflation,

improved commercial Wallboard

sales, growth in higher margin

Complementary Products, shifts in

end markets and incremental profit

from acquisitions

($ mm)

$412.8

32.0%

Fiscal Q4 2022

Gross Profit

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

$424.5

32.5%

Fiscal Q4 2023

Gross Margin

SG&A

Inflationary wages, higher facilities

costs and a one-time charge for

bad debt negatively impacted

SG&A.

SG&A leverage was also

negatively impacted by

deflationary steel prices and end

market shift

($ mm)

$259.9

20.2%

Fiscal Q4 2022

Adj. SG&A

$272.4

20.9%

Fiscal Q4 2023

-Adj. SG&A as % of Sales

Net Income & Adj.

EBITDA¹

Including a 27% increase in interest

expense, Net income decreased

1.2% YOY from $76.5M to $75.6M.

EPS outpaced net income due to

our share repurchase activity.

($ mm)

$154.2

12.0%

Fiscal Q4 2022

Adj. EBITDA

1

$154.3

11.8%

Fiscal Q4 2023

1

-Adj. EBITDA Margin

¹For a reconciliation of Adjusted SG&A, Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA Margin to the most directly comparable GAAP metrics, see Appendix.

6View entire presentation