Liberty Global Results Presentation Deck

(1)

(2)

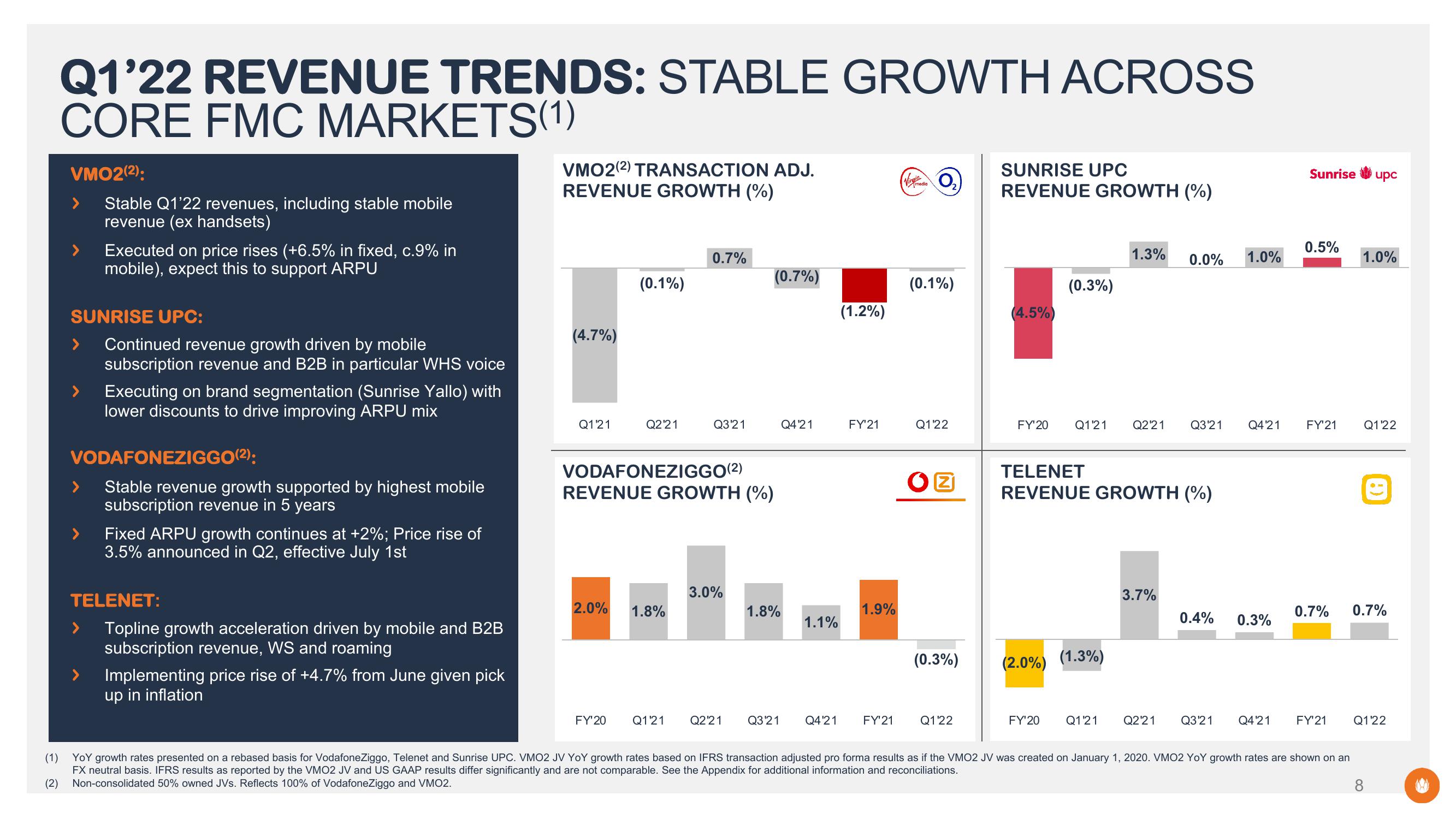

Q1'22 REVENUE TRENDS: STABLE GROWTH ACROSS

CORE FMC MARKETS(1)

VMO2(2):

Stable Q1'22 revenues, including stable mobile

revenue (ex handsets)

Executed on price rises (+6.5% in fixed, c.9% in

mobile), expect this to support ARPU

SUNRISE UPC:

Continued revenue growth driven by mobile

subscription revenue and B2B in particular WHS voice

Executing on brand segmentation (Sunrise Yallo) with

lower discounts to drive improving ARPU mix

VODAFONEZIGGO(²):

Stable revenue growth supported by highest mobile

subscription revenue in 5 years

Fixed ARPU growth continues at +2%; Price rise of

3.5% announced in Q2, effective July 1st

TELENET:

Topline growth acceleration driven by mobile and B2B

subscription revenue, WS and roaming

Implementing price rise of +4.7% from June given pick

up in inflation

VMO2(2) TRANSACTION ADJ.

REVENUE GROWTH (%)

(4.7%)

Q1'21

(0.1%)

2.0%

Q2'21

0.7%

VODAFONEZIGGO (²)

REVENUE GROWTH (%)

1.8%

Q3'21

3.0%

FY'20 Q1'21 Q2¹21

(0.7%)

1.8%

Q4'21

1.1%

Q3'21 Q4'21

(1.2%)

FY'21

1.9%

FY'21

Virgit O₂

media

(0.1%)

Q1'22

OZ

(0.3%)

Q1'22

SUNRISE UPC

REVENUE GROWTH (%)

(4.5%)

(0.3%)

(2.0%)

1.3%

TELENET

REVENUE GROWTH (%)

(1.3%)

0.0% 1.0%

FY'20 Q1'21 Q2'21 Q3'21 Q4'21 FY'21 Q1'22

3.7%

Sunrise upc

0.4% 0.3%

0.5%

1.0%

0.7% 0.7%

FY'20 Q1'21 Q2'21 Q3'21 Q4'21 FY'21

Q1'22

YOY growth rates presented on a rebased basis for VodafoneZiggo, Telenet and Sunrise UPC. VMO2 JV YOY growth rates based on IFRS transaction adjusted pro forma results as if the VMO2 JV was created on January 1, 2020. VMO2 YOY growth rates are shown on an

FX neutral basis. IFRS results as reported by the VMO2 JV and US GAAP results differ significantly and are not comparable. See the Appendix for additional information and reconciliations.

Non-consolidated 50% owned JVs. Reflects 100% of VodafoneZiggo and VMO2.

8View entire presentation