Q2 Quarter 2023

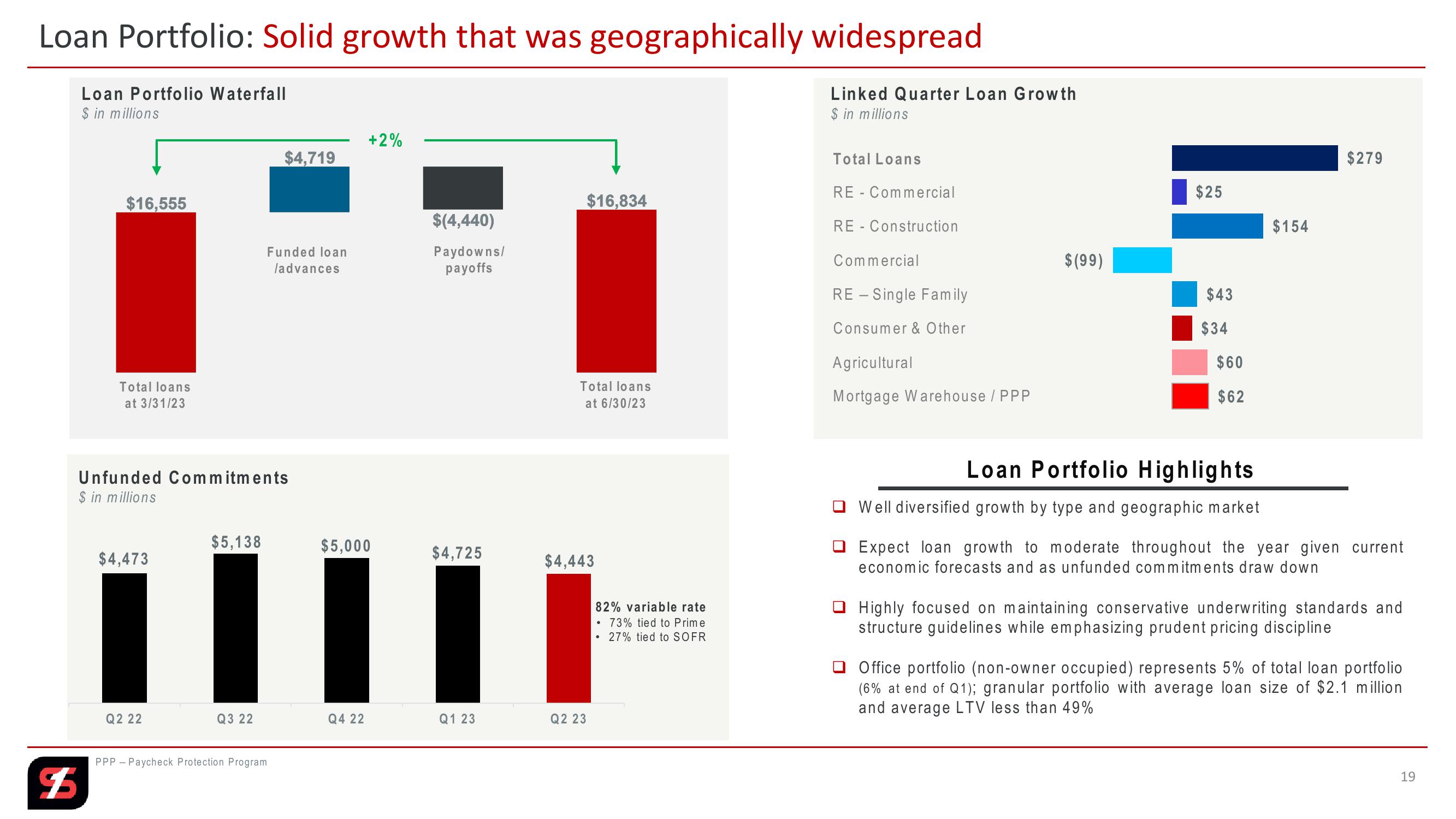

Loan Portfolio: Solid growth that was geographically widespread

Loan Portfolio Waterfall

$ in millions

+2%

$4,719

$16,555

$16,834

$(4,440)

Funded loan

/advances

Paydowns/

payoffs

Linked Quarter Loan Growth

$ in millions

Total Loans

RE Commercial

RE Construction

Commercial

Total loans

at 3/31/23

Unfunded Commitments

$ in millions

RE Single Family

Consumer & Other

Agricultural

Total loans

at 6/30/23

Mortgage Warehouse / PPP

$5,138

$5,000

$4,473

$4,725

$4,443

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

$

PPP Paycheck Protection Program

82% variable rate

.73% tied to Prime

.

27% tied to SOFR

$25

$154

$(99)

$43

$34

$60

$62

$279

Loan Portfolio Highlights

Well diversified growth by type and geographic market

Expect loan growth to moderate throughout the year given current

economic forecasts and as unfunded commitments draw down

Highly focused on maintaining conservative underwriting standards and

structure guidelines while emphasizing prudent pricing discipline

Office portfolio (non-owner occupied) represents 5% of total loan portfolio

(6% at end of Q1); granular portfolio with average loan size of $2.1 million

and average LTV less than 49%

19View entire presentation