Evotec ESG Presentation Deck

evotec

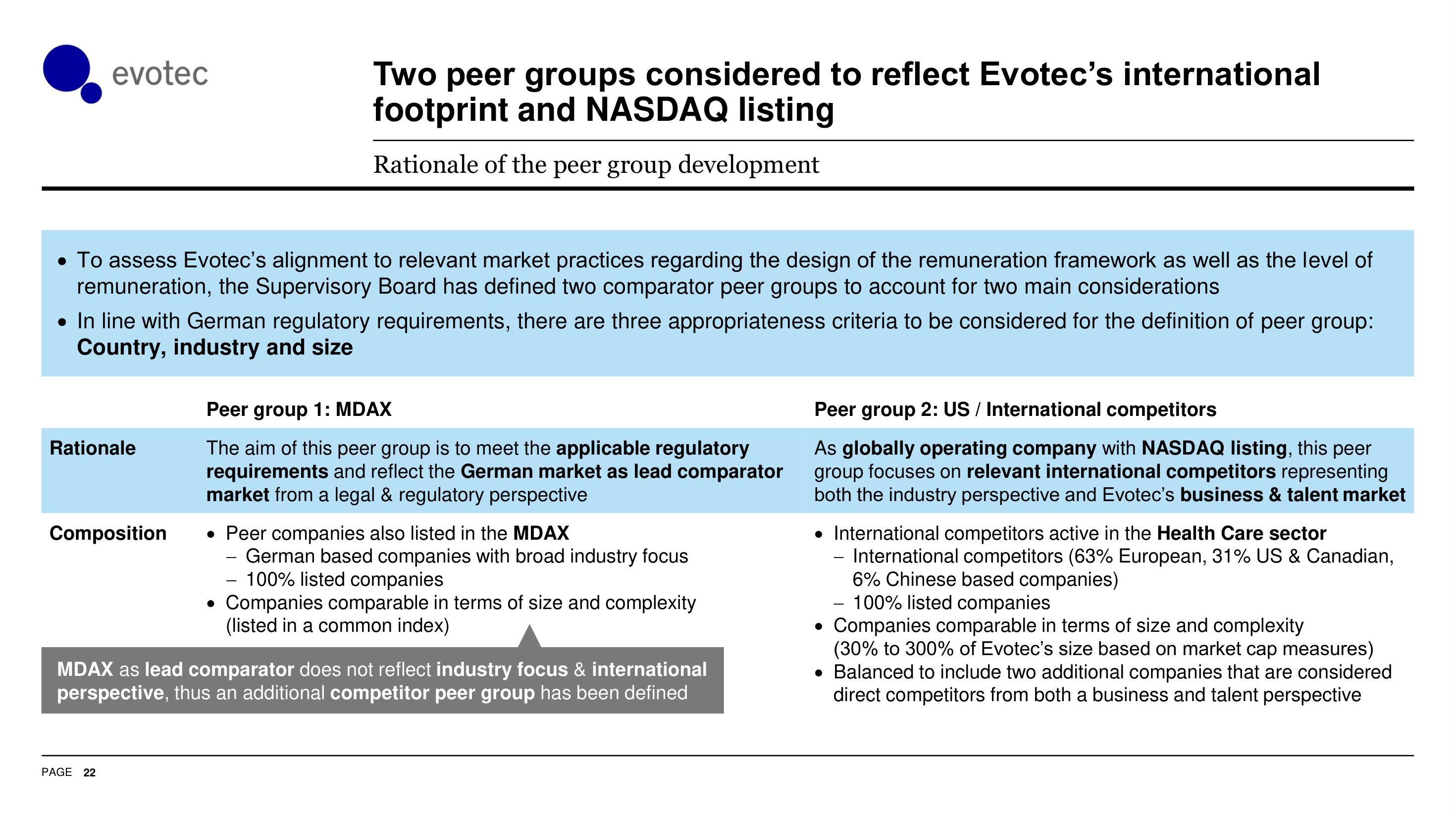

• To assess Evotec's alignment to relevant market practices regarding the design of the remuneration framework as well as the level of

remuneration, the Supervisory Board has defined two comparator peer groups to account for two main considerations

• In line with German regulatory requirements, there are three appropriateness criteria to be considered for the definition of peer group:

Country, industry and size

Rationale

Two peer groups considered to reflect Evotec's international

footprint and NASDAQ listing

Rationale of the peer group development

Composition

PAGE 22

Peer group 1: MDAX

The aim of this peer group is to meet the applicable regulatory

requirements and reflect the German market as lead comparator

market from a legal & regulatory perspective

• Peer companies also listed in the MDAX

- German based companies with broad industry focus

100% listed companies

• Companies comparable in terms of size and complexity

(listed in a common index)

MDAX as lead comparator does not reflect industry focus & international

perspective, thus an additional competitor peer group has been defined

Peer group 2: US / International competitors

As globally operating company with NASDAQ listing, this peer

group focuses on relevant international competitors representing

both the industry perspective and Evotec's business & talent market

• International competitors active in the Health Care sector

- International competitors (63% European, 31% US & Canadian,

6% Chinese based companies)

- 100% listed companies

• Companies comparable in terms of size and complexity

(30% to 300% of Evotec's size based on market cap measures)

• Balanced to include two additional companies that are considered

direct competitors from both a business and talent perspectiveView entire presentation