Active and Passive Investing

Be More Patient

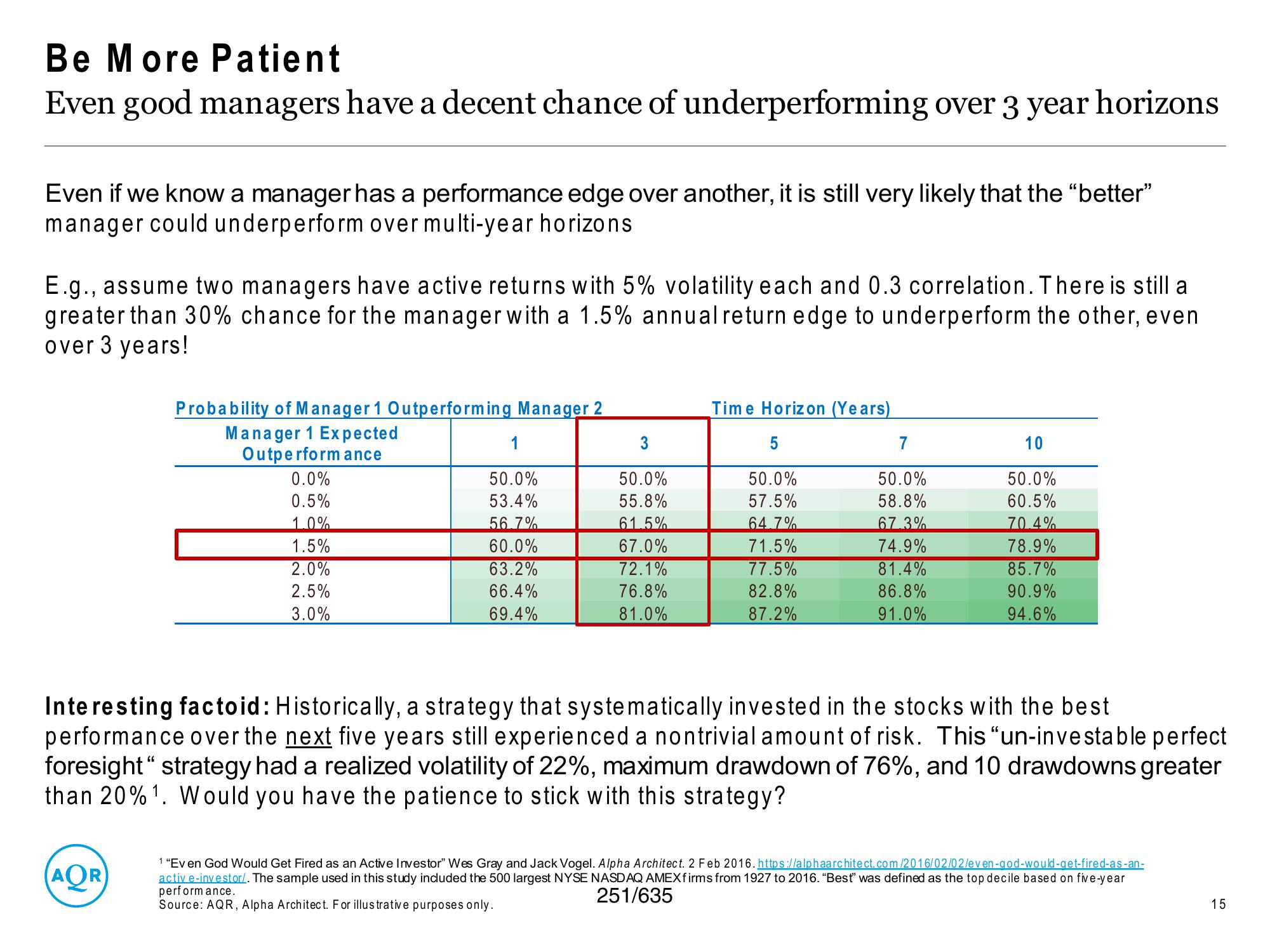

Even good managers have a decent chance of underperforming over 3 year horizons

Even if we know a manager has a performance edge over another, it is still very likely that the "better"

manager could underperform over multi-year horizons

E.g., assume two managers have active returns with 5% volatility each and 0.3 correlation. There is still a

greater than 30% chance for the manager with a 1.5% annual return edge to underperform the other, even

over 3 years!

Probability of Manager 1 Outperforming Manager 2

Manager 1 Expected

Outperformance

0.0%

0.5%

1.0%

(AOR

1.5%

2.0%

2.5%

3.0%

1

50.0%

53.4%

56.7%

60.0%

63.2%

66.4%

69.4%

3

50.0%

55.8%

61.5%

67.0%

72.1%

76.8%

81.0%

Time Horizon (Years)

5

50.0%

57.5%

64.7%

71.5%

77.5%

82.8%

87.2%

7

50.0%

58.8%

67.3%

74.9%

81.4%

86.8%

91.0%

10

50.0%

60.5%

70.4%

78.9%

85.7%

90.9%

94.6%

Interesting factoid: Historically, a strategy that systematically invested in the stocks with the best

performance over the next five years still experienced a nontrivial amount of risk. This "un-investable perfect

foresight" strategy had a realized volatility of 22%, maximum drawdown of 76%, and 10 drawdowns greater

than 20% ¹. Would you have the patience to stick with this strategy?

1 "Ev en God Would Get Fired as an Active Investor" Wes Gray and Jack Vogel. Alpha Architect. 2 Feb 2016. https://alphaarchitect.com/2016/02/02/even-god-would-get-fired-as-an-

activ e-investor/. The sample used in this study included the 500 largest NYSE NASDAQ AMEXfirms from 1927 to 2016. "Best" was defined as the top decile based on five-year

performance.

251/635

Source: AQR, Alpha Architect. For illustrative purposes only.

15View entire presentation