Silicon Valley Bank Results Presentation Deck

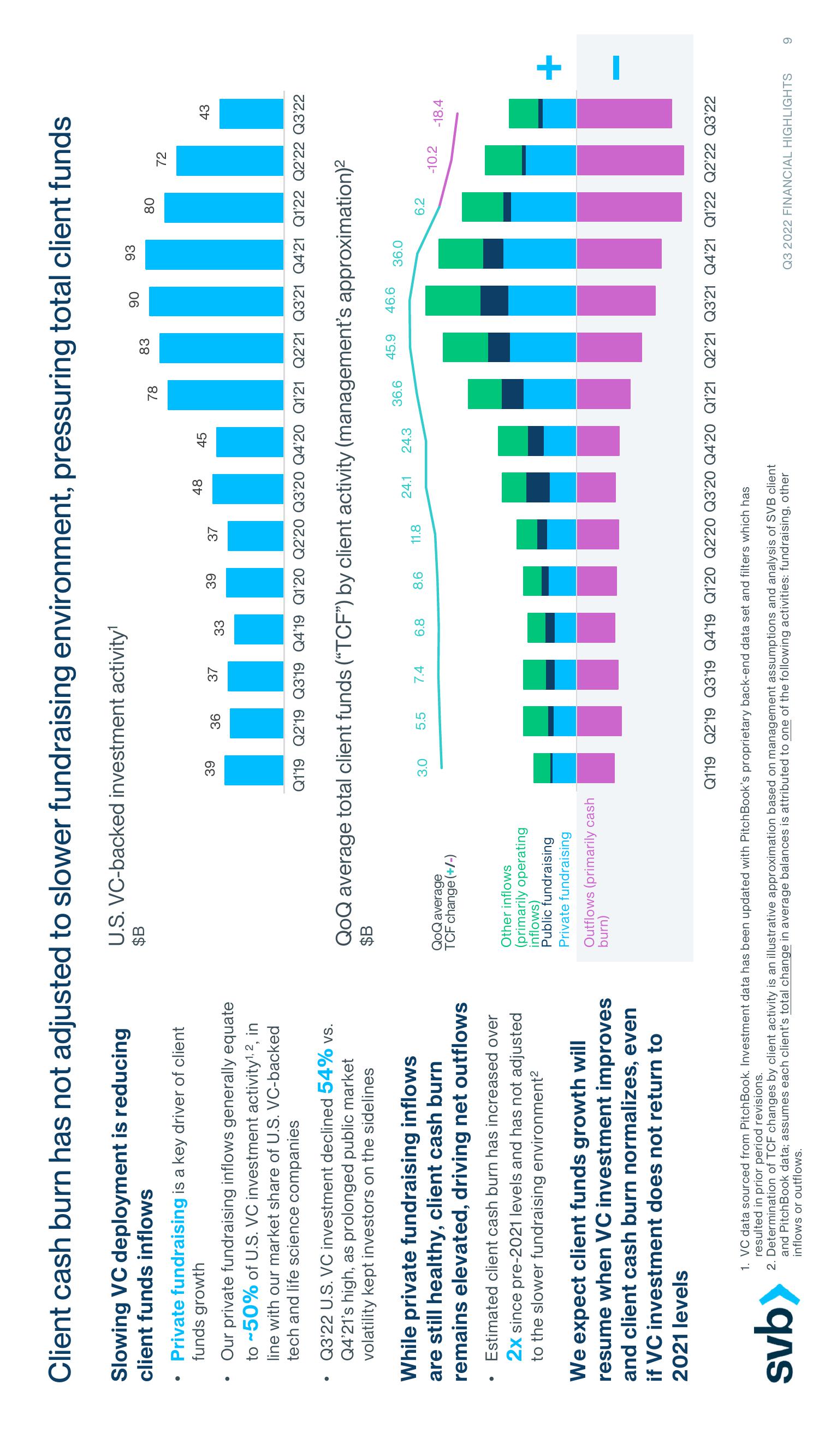

Client cash burn has not adjusted to slower fundraising environment, pressuring total client funds

U.S. VC-backed investment activity¹

$B

Slowing VC deployment is reducing

client funds inflows

●

Private fundraising is a key driver of client

funds growth

●

Our private fundraising inflows generally equate

to ~50% of U.S. VC investment activity¹, 2, in

line with our market share of U.S. VC-backed

tech and life science companies

Q3'22 U.S. VC investment declined 54% vs.

Q4'21's high, as prolonged public market

volatility kept investors on the sidelines

While private fundraising inflows

are still healthy, client cash burn

remains elevated, driving net outflows

Estimated client cash burn has increased over

2x since pre-2021 levels and has not adjusted

to the slower fundraising environment²

We expect client funds growth will

resume when VC investment improves

and client cash burn normalizes, even

if VC investment does not return to

2021 levels

svb>

QoQ average

TCF change (+/-)

39

Other inflows

(primarily operating

inflows)

Public fundraising

Private fundraising

Outflows (primarily cash

burn)

36

3.0

37

5.5

33

7.4

39

6.8

37

8.6

48

QoQ average total client funds ("TCF") by client activity (management's approximation)²

$B

11.8

45

Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22

78

24.1 24.3

1. VC data sourced from Pitch Book. Investment data has been updated with PitchBook's proprietary back-end data set and filters which has

resulted in prior period revisions.

2. Determination of TCF changes by client activity is an illustrative approximation based on management assumptions and analysis of SVB client

and PitchBook data; assumes each client's total change in average balances is attributed to one of the following activities: fundraising, other

inflows or outflows.

83

90

36.6

93

45.9 46.6

80

36.0

72

6.2

43

-10.2

-18.4

Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22

+

Q3 2022 FINANCIAL HIGHLIGHTS 9View entire presentation