LionTree Investment Banking Pitch Book

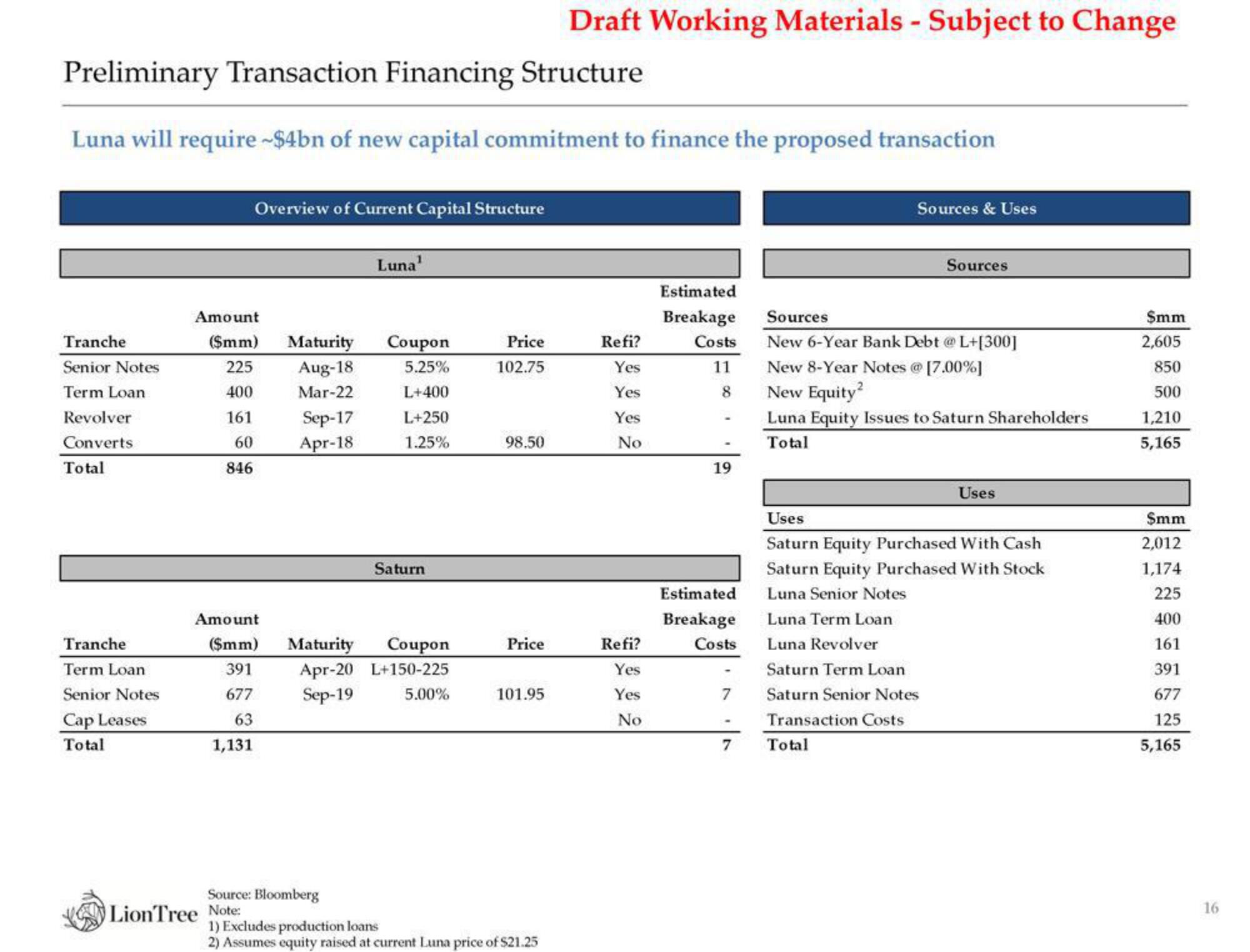

Preliminary Transaction Financing Structure

Luna will require -$4bn of new capital commitment to finance the proposed transaction

Tranche

Senior Notes

Term Loan

Revolver

Converts

Total

Tranche

Term Loan

Senior Notes

Cap Leases

Total

Overview of Current Capital Structure

Amount

($mm) Maturity Coupon

225

Aug-18

5.25%

400

Mar-22

L+400

161

L+250

60

1.25%

846

Sep-17

Apr-18

LionTree Note:

Luna¹

Source: Bloomberg

Amount

($mm) Maturity Coupon

Apr-20 L+150-225

391

677

Sep-19

5.00%

63

1,131

Saturn

Price

102.75

98.50

Price

101.95

Draft Working Materials - Subject to change

1) Excludes production loans

2) Assumes equity raised at current Luna price of $21.25

Refi?

Yes

Yes

Yes

No

Refi?

Yes

Yes

No

19

Estimated

Breakage

Costs

Sources & Uses

Estimated

Breakage

Sources

Costs New 6-Year Bank Debt @ L+[300]

11

New 8-Year Notes @[7.00%]

8

New Equity²

Luna Equity Issues to Saturn Shareholders

Total

-

Sources

Luna Term Loan

Luna Revolver

Saturn Term Loan

7 Saturn Senior Notes

Transaction Costs

7 Total

11

Uses

Uses

Saturn Equity Purchased With Cash

Saturn Equity Purchased With Stock

Luna Senior Notes

$mm

2,605

850

500

1,210

5,165

$mm

2,012

1,174

225

400

161

391

677

125

5,165

16View entire presentation