SmileDirectClub Investor Presentation Deck

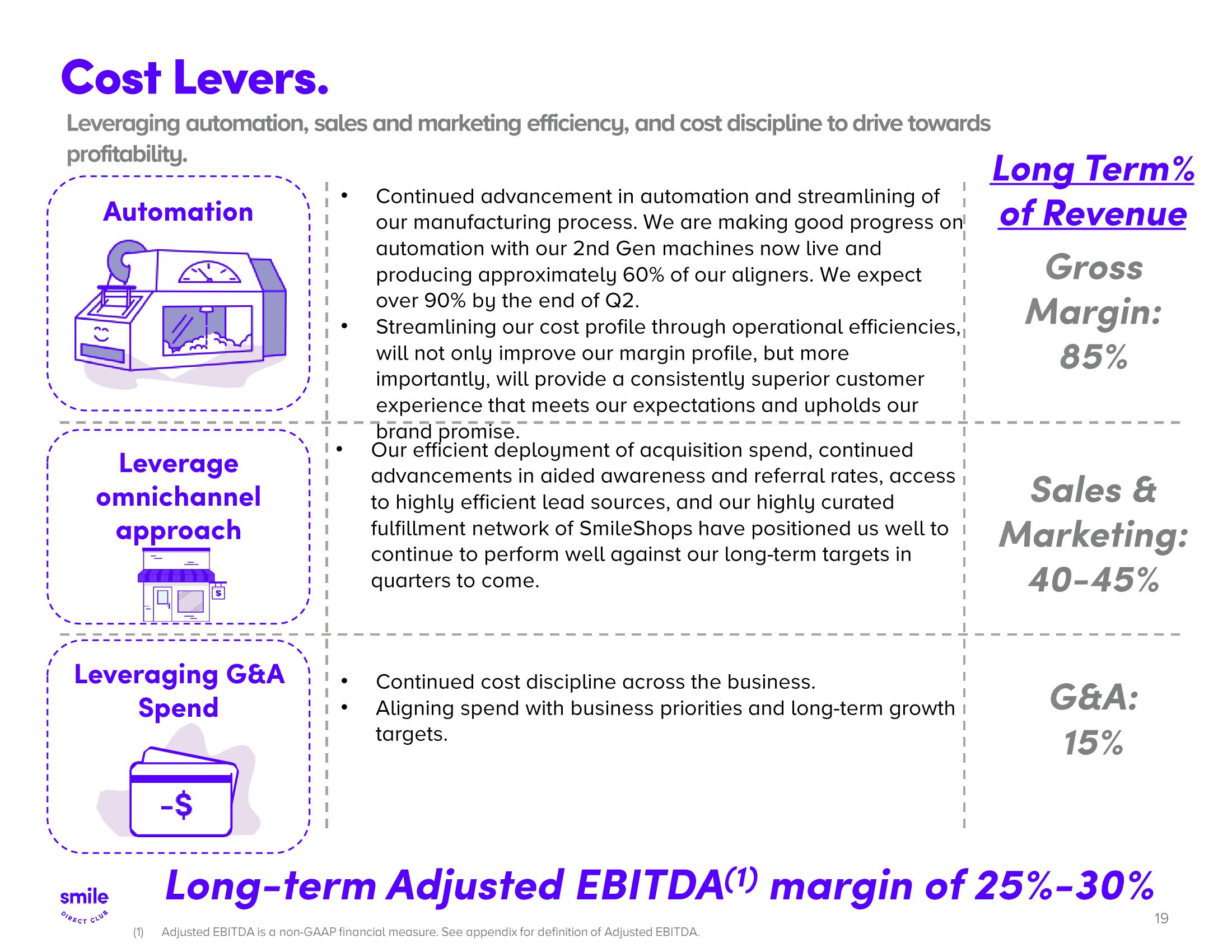

Cost Levers.

Leveraging automation, sales and marketing efficiency, and cost discipline to drive towards

profitability.

Automation

Leverage

omnichannel

approach

Leveraging G&A

Spend

smile

DIRECT CLUB

-$

Continued advancement in automation and streamlining of

our manufacturing process. We are making good progress on

automation with our 2nd Gen machines now live and

producing approximately 60% of our aligners. We expect

over 90% by the end of Q2.

Streamlining our cost profile through operational efficiencies,

will not only improve our margin profile, but more

importantly, will provide a consistently superior customer

experience that meets our expectations and upholds our

brand promise.

Our efficient deployment of acquisition spend, continued

advancements in aided awareness and referral rates, access

to highly efficient lead sources, and our highly curated

fulfillment network of SmileShops have positioned us well to

continue to perform well against our long-term targets in

quarters to come.

Continued cost discipline across the business.

Aligning spend with business priorities and long-term growth

targets.

Long Term%

of Revenue

Gross

Margin:

85%

Sales &

Marketing:

40-45%

G&A:

15%

Long-term Adjusted EBITDA(1) margin of 25%-30%

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA.

19View entire presentation