Pathward Financial Results Presentation Deck

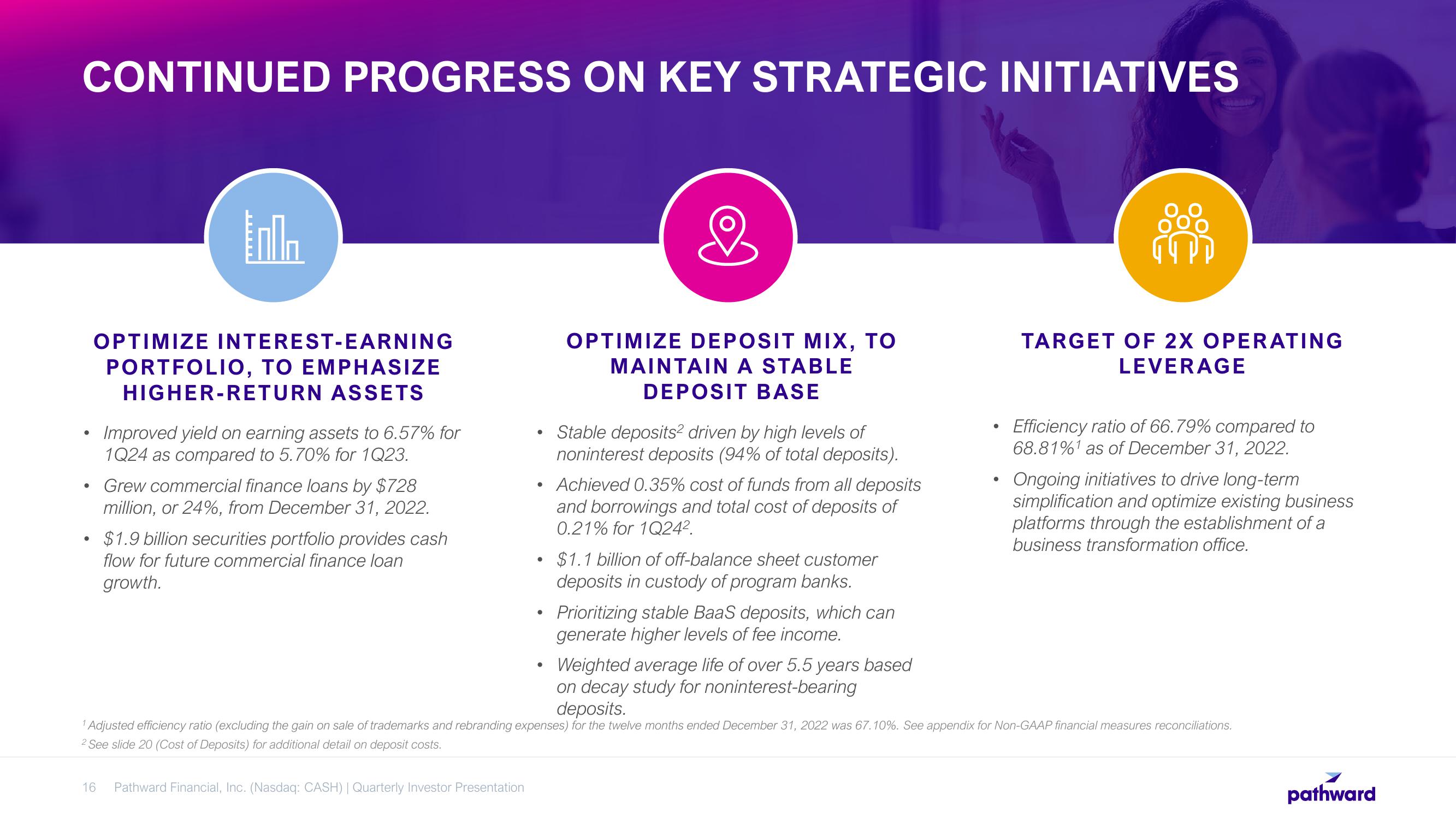

CONTINUED PROGRESS ON KEY STRATEGIC INITIATIVES

●

●

●

Inh

OPTIMIZE INTEREST-EARNING

PORTFOLIO, TO EMPHASIZE

HIGHER-RETURN ASSETS

Improved yield on earning assets to 6.57% for

1Q24 as compared to 5.70% for 1Q23.

Grew commercial finance loans by $728

million, or 24%, from December 31, 2022.

$1.9 billion securities portfolio provides cash

flow for future commercial finance loan

growth.

●

16 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

●

●

●

&

OPTIMIZE DEPOSIT MIX, TO

MAINTAIN A STABLE

DEPOSIT BASE

●

Stable deposits2 driven by high levels of

noninterest deposits (94% of total deposits).

Achieved 0.35% cost of funds from all deposits

and borrowings and total cost of deposits of

0.21% for 1Q24².

$1.1 billion of off-balance sheet customer

deposits in custody of program banks.

Prioritizing stable BaaS deposits, which can

generate higher levels of fee income.

809

TARGET OF 2X OPERATING

LEVERAGE

Efficiency ratio of 66.79% compared to

68.81%¹ as of December 31, 2022.

Weighted average life of over 5.5 years based

on decay study for noninterest-bearing

deposits.

1 Adjusted efficiency ratio (excluding the gain on sale of trademarks and rebranding expenses) for the twelve months ended December 31, 2022 was 67.10%. See appendix for Non-GAAP financial measures reconciliations.

2 See slide 20 (Cost of Deposits) for additional detail on deposit costs.

Ongoing initiatives to drive long-term

simplification and optimize existing business

platforms through the establishment of a

business transformation office.

pathwardView entire presentation