Tudor, Pickering, Holt & Co Investment Banking

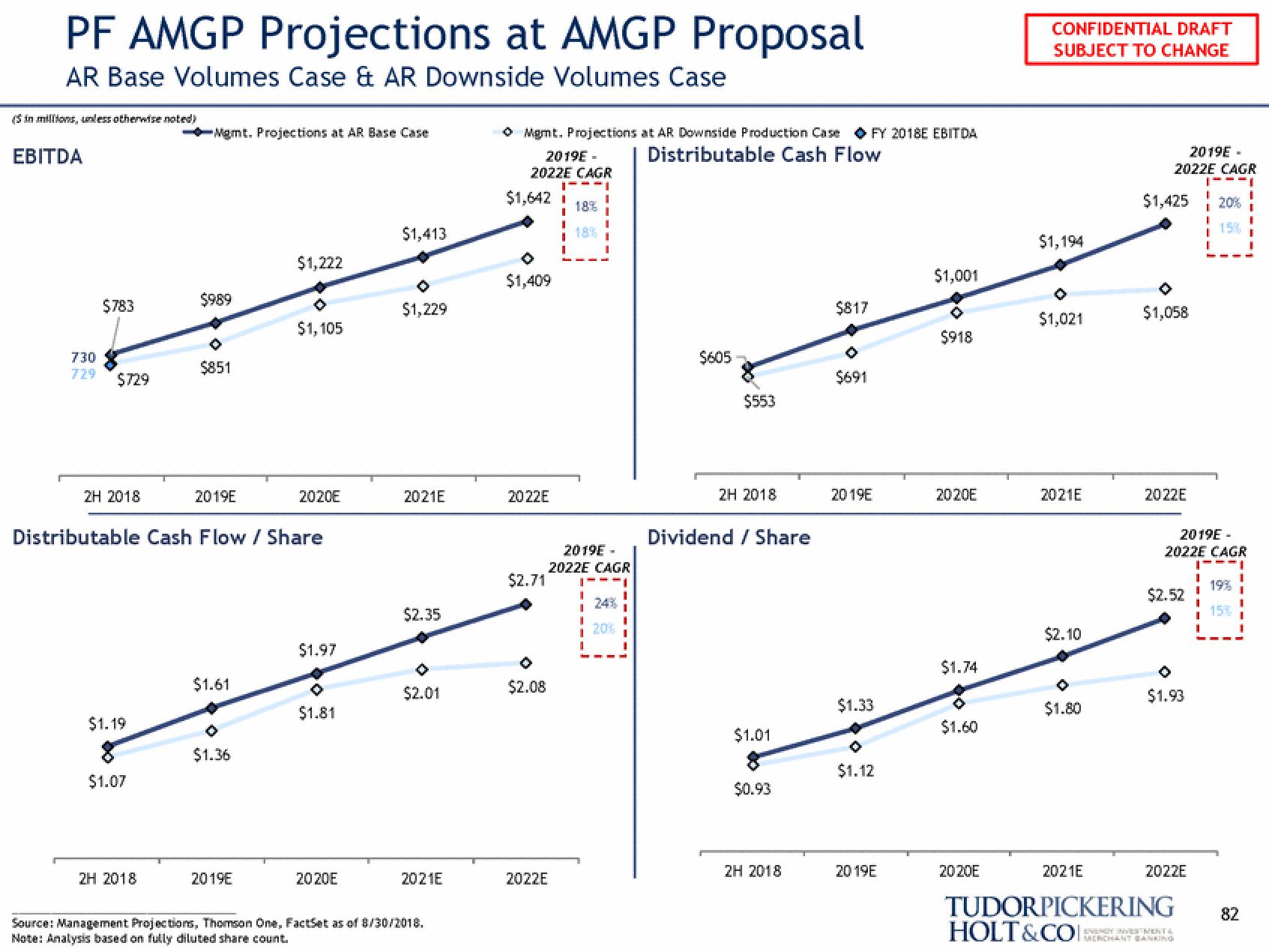

PF AMGP Projections at AMGP Proposal

AR Base Volumes Case & AR Downside Volumes Case

(in millions, unless otherwise noted)

EBITDA

$783

730

729 $729

2H 2018

$1.19

$1.07

Mgmt. Projections at AR Base Case

2H 2018

$989

$851

2019E

Distributable Cash Flow / Share

$1.61

0

$1.36

$1,222

2019E

$1,105

2020E

$1.97

$1.81

2020E

$1,413

$1,229

2021E

$2.35

$2.01

2021E

Source: Management Projections, Thomson One, FactSet as of 8/30/2018.

Note: Analysis based on fully diluted share count.

ⒸMgmt. Projections at AR Downside Production Case FY 2018E EBITDA

Distributable Cash Flow

2019E-

2022E CAGR

1---1

$1,642 i 18%

18%

$1,409

2022E

$2.71

O

$2.08

2022E

I

I

2019E-

2022E CAGR

24%

20%

$605

$553

2H 2018

Dividend / Share

$1.01

$0.93

2H 2018

$817

$691

2019E

$1.33

$1.12

2019E

$1,001

$918

2020E

$1.74

$1.60

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2020E

$1,194

$1,021

2021E

$2.10

O

$1.80

2019E-

2022E CAGR

$1,425 20%

15%

$1,058

2022E

2019E-

2022E CAGR

|---|

19%

15%

$2.52

$1.93

1

2022E

1

I

2021E

TUDORPICKERING 82

HOLT&COCHANT BANKING

1View entire presentation