FaZe SPAC Presentation Deck

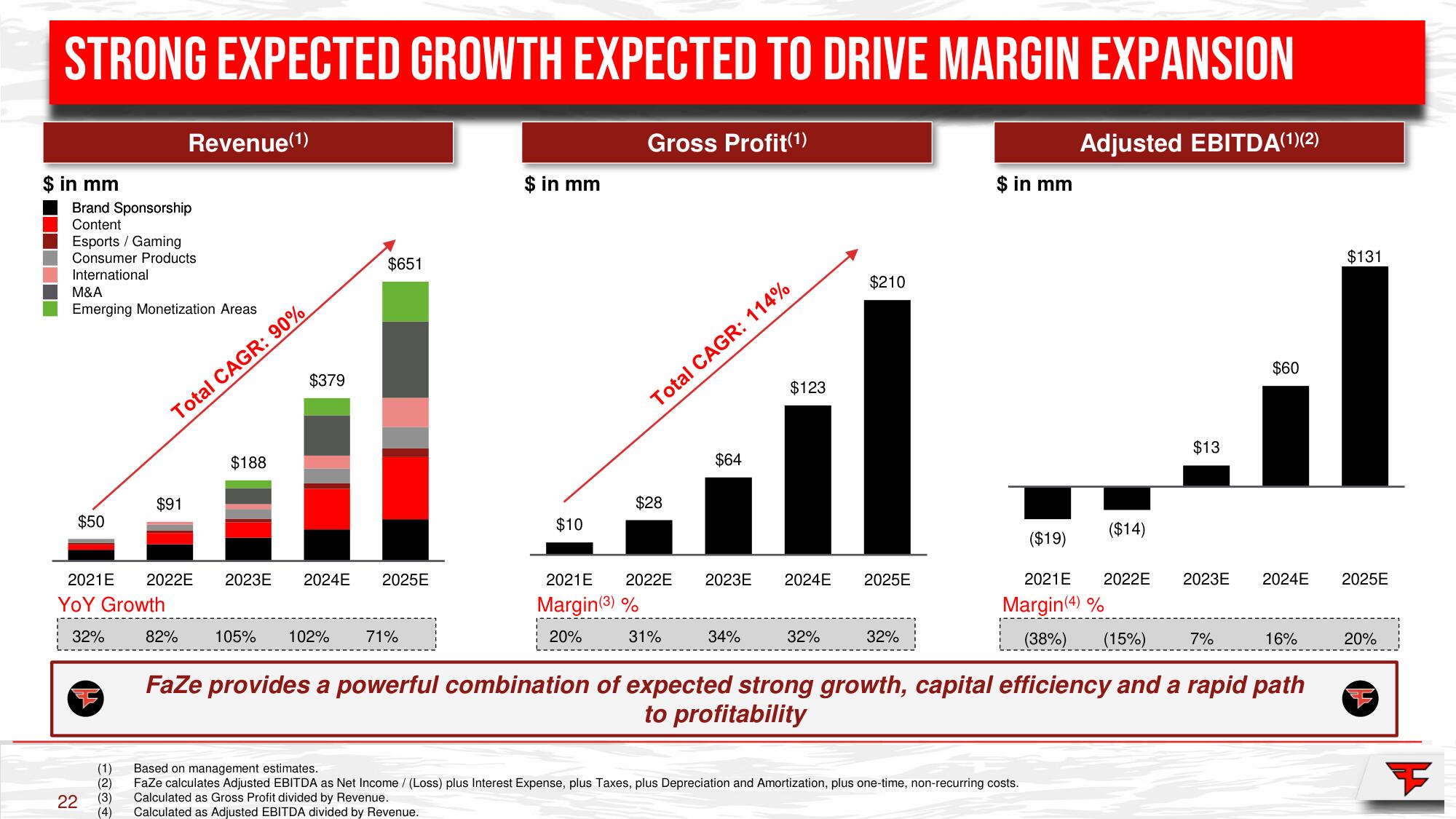

STRONG EXPECTED GROWTH EXPECTED TO DRIVE MARGIN EXPANSION

$ in mm

Brand Sponsorship

Content

Esports Gaming

Consumer Products

International

M&A

Emerging Monetization Areas

$50

32%

22

Revenue (1)

EN

$91

Total CAGR: 90%

2021E 2022E 2023E 2024E 2025E

YOY Growth

2%

$188

$379

105%

$651

2%

71%

$ in mm

$10

Gross Profit(1)

Total CAGR: 114%

$28

$64

$123

2021E 2022E 2023E 2024E

Margin(3) %

20%

319

34%

$210

2025E

32%

$ in mm

Adjusted EBITDA(1)(2)

($14)

($19)

2021E 2022E

Margin(4) %

(38%) (15%)

Based on management estimates.

FaZe calculates Adjusted EBITDA as Net Income / (Loss) plus Interest Expense, plus Taxes, plus Depreciation and Amortization, plus one-time, non-recurring costs.

(3) Calculated as Gross Profit divided by Revenue.

(4) Calculated as Adjusted EBITDA divided by Revenue.

$13

2023E

7%

$60

2024E 2025E

16%

FaZe provides a powerful combination of expected strong growth, capital efficiency and a rapid path

to profitability

$131

20%View entire presentation