LSE Investor Presentation Deck

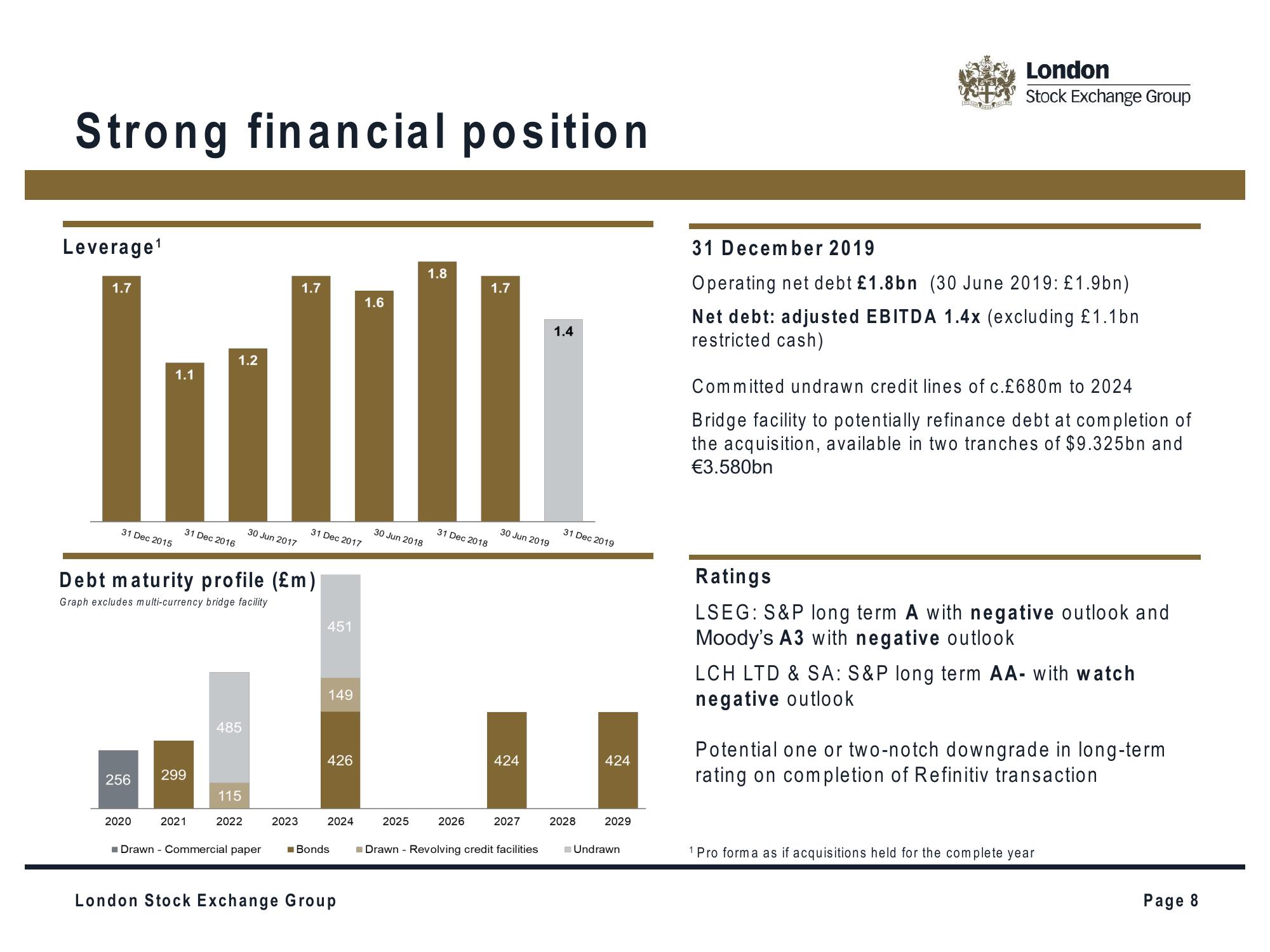

Strong financial position

Leverage ¹

1.7

1.2

1.1

In

31 Dec 2015

256

31 Dec 2016

2020

Debt maturity profile (£m)

Graph excludes multi-currency bridge facility

299

2021

485

115

30 Jun 2017

2022

■ Drawn - Commercial paper

1.7

2023

31 Dec 2017

451

149

426

2024

Bonds

London Stock Exchange Group

1.6

30 Jun 2018

2025

1.8

31 Dec 2018

2026

1.7

30 Jun 2019

424

2027

Drawn - Revolving credit facilities

1.4

31 Dec 2019

2028

424

2029

Undrawn

London

Stock Exchange Group

31 December 2019

Operating net debt £1.8bn (30 June 2019: £1.9bn)

Net debt: adjusted EBITDA 1.4x (excluding £1.1bn

restricted cash)

Committed undrawn credit lines of c.£680m to 2024

Bridge facility to potentially refinance debt at completion of

the acquisition, available in two tranches of $9.325bn and

€3.580bn

Ratings

LSEG: S&P long term A with negative outlook and

Moody's A3 with negative outlook

LCH LTD & SA: S&P long term AA- with watch

negative outlook

Potential one or two-notch downgrade in long-term

rating on completion of Refinitiv transaction

1 Pro forma as if acquisitions held for the complete year

Page 8View entire presentation