LionTree Investment Banking Pitch Book

Overview of Luna Proposal

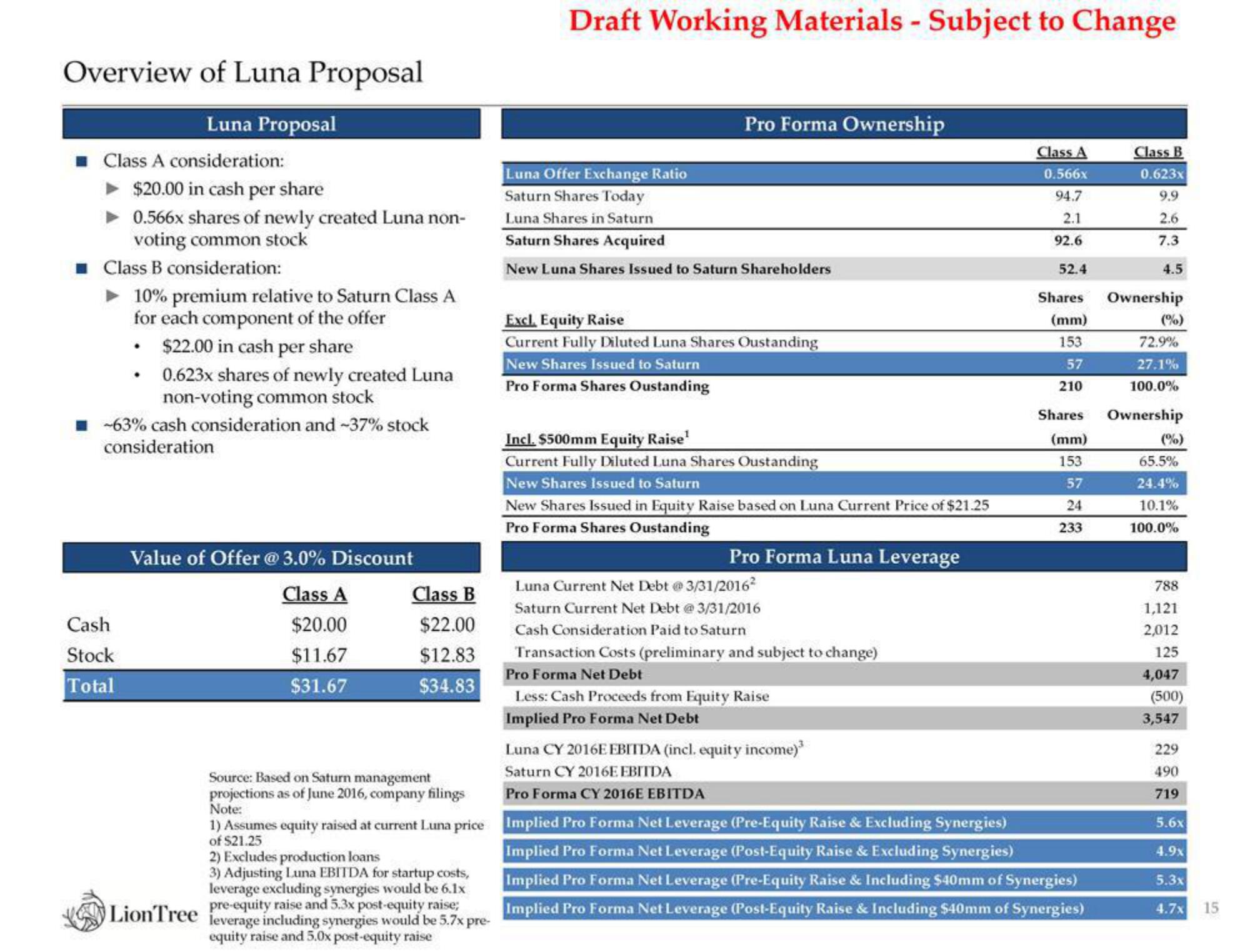

Luna Proposal

■ Class A consideration:

$20.00 in cash per share

0.566x shares of newly created Luna non-

voting common stock

Class B consideration:

► 10% premium relative to Saturn Class A

for each component of the offer

• $22.00 in cash per share

.

Cash

Stock

Total

0.623x shares of newly created Luna

non-voting common stock

-63% cash consideration and -37% stock

consideration

Value of Offer @ 3.0% Discount

Class A

$20.00

$11.67

$31.67

Class B

$22.00

$12.83

$34.83

Source: Based on Saturn management

projections as of June 2016, company filings

Note:

1) Assumes equity raised at current Luna price

of $21.25

2) Excludes production loans

3) Adjusting Luna EBITDA for startup costs,

leverage excluding synergies would be 6.1x

pre-equity raise and 5.3x post-equity raise;

LionTree leverage including synergies would be 5.7x pre-

equity raise and 5.0x post-equity raise

Draft Working Materials - Subject to Change

Pro Forma Ownership

Luna Offer Exchange Ratio

Saturn Shares Today

Luna Shares in Saturn

Saturn Shares Acquired

New Luna Shares Issued to Saturn Shareholders

Excl, Equity Raise

Current Fully Diluted Luna Shares Oustanding

New Shares Issued to Saturn

Pro Forma Shares Oustanding

Incl. $500mm Equity Raise¹

Current Fully Diluted Luna Shares Oustanding

New Shares Issued to Saturn

New Shares Issued in Equity Raise based on Luna Current Price of $21.25

Pro Forma Shares Oustanding

Pro Forma Luna Leverage

Luna Current Net Debt @ 3/31/2016²

Saturn Current Net Debt @ 3/31/2016

Cash Consideration Paid to Saturn

Transaction Costs (preliminary and subject to change)

Pro Forma Net Debt

Less: Cash Proceeds from Equity Raise

Implied Pro Forma Net Debt

Luna CY 2016E EBITDA (incl. equity income)³

Saturn CY 2016E EBITDA

Pro Forma CY 2016E EBITDA

Class A

0.566x

94.7

2.1

92.6

52.4

Shares

(mm)

153

57

210

Shares

(mm)

153

57

24

233

Implied Pro Forma Net Leverage (Pre-Equity Raise & Excluding Synergies)

Implied Pro Forma Net Leverage (Post-Equity Raise & Excluding Synergies)

Implied Pro Forma Net Leverage (Pre-Equity Raise & Including $40mm of Synergies)

Implied Pro Forma Net Leverage (Post-Equity Raise & Including $40mm of Synergies)

Class B

0.623x

9.9

2.6

7.3

4.5

Ownership

(%)

72.9%

27.1%

100.0%

Ownership

(%)

65.5%

24.4%

10.1%

100.0%

788

1,121

2,012

125

4,047

(500)

3,547

229

490

719

5.6x

4.9x

5.3x

4.7x

15View entire presentation