Mesirow Private Equity

($ in millions)

Core Strategy

Torus Insurance Holdings Limited

21st Century Oncology Holdings, Inc.

Pivot3, Inc.

Private Bancorp, Inc.

VWR International

Notes on Performance Data

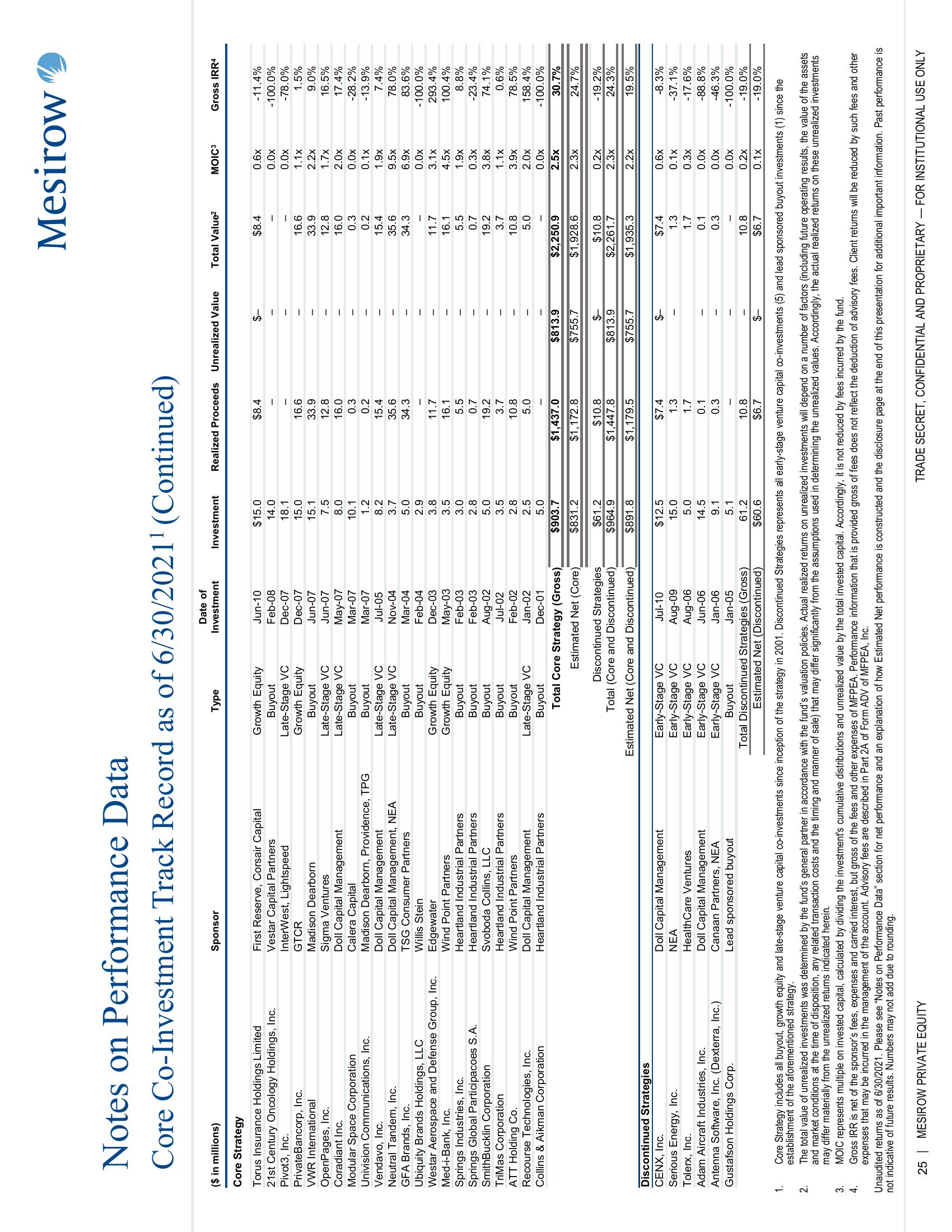

Core Co-Investment Track Record as of 6/30/2021¹ (Continued)

OpenPages, Inc.

Coradiant Inc.

Modular Space Corporation

Univision Communications, Inc.

Vendavo, Inc.

Neutral Tandem, Inc.

GFA Brands, Inc.

Ubiquity Brands Holdings, LLC

Westar Aerospace and Defense Group, Inc.

Med-i-Bank, Inc.

Springs Industries, Inc.

Springs Global Participacoes S.A.

SmithBucklin Corporation

TriMas Corporation

ATT Holding Co.

Recourse Technologies, Inc.

Collins & Aikman Corporation

Discontinued Strategies

CENX, Inc.

Serious Energy, Inc.

Tolerx, Inc.

Adam Aircraft Industries, Inc.

Antenna Software, Inc. (Dexterra, Inc.)

Gustafson Holdings Corp.

1.

2.

3.

4.

Sponsor

First Reserve, Corsair Capital

Vestar Capital Partners

InterWest, Lightspeed

GTCR

Madison Dearborn

Sigma Ventures

Doll Capital Management

Calera Capital

Madison Dearborn, Providence, TPG

25 MESIROW PRIVATE EQUITY

Doll Capital Management

Doll Capital Management, NEA

TSG Consumer Partners

Willis Stein

Edgewater

Wind Point Partners

Heartland Industrial Partners

Heartland Industrial Partners

Svoboda Collins, LLC

Heartland Industrial Partners

Wind Point Partners

Doll Capital Management

Heartland Industrial Partners

Doll Capital Management

NEA

HealthCare Ventures

Doll Capital Management

Canaan Partners, NEA

Lead sponsored buyout

Type

Growth Equity

Buyout

Late-Stage VC

Growth Equity

Buyout

Late-Stage VC

Late-Stage VC

Buyout

Buyout

Late-Stage VC

Late-Stage VC

Buyout

Buyout

Growth Equity

Growth Equity

Buyout

Buyout

Buyout

Buyout

Buyout

Late-Stage VC

Buyout

Date of

Investment

Total Core Strategy (Gross)

Estimated Net (Core)

Early-Stage VC

Early-Stage VC

Jun-10

Feb-08

Dec-07

Dec-07

Jun-07

Jun-07

May-07

Mar-07

Mar-07

Jul-05

Nov-04

Mar-04

Feb-04

Dec-03

May-03

Feb-03

Feb-03

Aug-02

Jul-02

Feb-02

Jan-02

Dec-01

Discontinued Strategies

Total (Core and Discontinued)

Estimated Net (Core and Discontinued)

Early-Stage VC

Early-Stage VC

Early-Stage VC

Buyout

Jul-10

Aug-09

Aug-06

Jun-06

Jan-06

Jan-05

Total Discontinued Strategies (Gross)

Estimated Net (Discontinued)

Investment

$15.0

14.0

18.1

15.0

15.1

7.5

8.0

10.1

1.2

8.2

3.7

5.0

2.9

3.8

3.5

3.0

2.8

5.0

3.5

2.8

2.5

5.0

$903.7

$831.2

$61.2

$964.9

$891.8

$12.5

15.0

5.0

14.5

9.1

5.1

61.2

$60.6

Realized Proceeds Unrealized Value Total Value²

$8.4

16.6

33.9

12.8

16.0

0.3

0.2

15.4

35.6

34.3

11.7

16.1

5.5

0.7

19.2

3.7

10.8

5.0

$1,437.0

$1,172.8

$10.8

$1,447.8

$1,179.5

$7.4

1.3

1.7

0.1

0.3

-

10.8

$6.7

$-

III

||||

$813.9

$755.7

$-

$813.9

$755.7

IIII.

Mesirow

$-

$8.4

16.6

33.9

12.8

16.0

0.3

0.2

15.4

35.6

34.3

11.7

16.1

5.5

0.7

19.2

3.7

10.8

5.0

$2,250.9

$1,928.6

$10.8

$2,261.7

$1,935.3

$7.4

1.3

1.7

0.1

0.3

-

10.8

$6.7

MOIC3

0.6x

0.0x

0.0x

1.1x

2.2x

1.7x

2.0x

0.0x

0.1x

1.9x

9.5x

6.9x

0.0x

3.1x

4.5x

1.9x

0.3x

3.8x

1.1x

3.9x

2.0x

0.0x

2.5x

2.3x

0.2x

2.3x

2.2x

0.6x

0.1x

0.3x

0.0x

0.0x

0.0x

0.2x

0.1x

Gross IRR4

-11.4%

-100.0%

-78.0%

1.5%

9.0%

16.5%

17.4%

-28.2%

-13.9%

7.4%

78.0%

83.6%

-100.0%

293.4%

100.4%

8.8%

-23.4%

74.1%

0.6%

78.5%

158.4%

-100.0%

30.7%

24.7%

-19.2%

24.3%

19.5%

-8.3%

-37.1%

-17.6%

-88.8%

-46.3%

-100.0%

-19.0%

-19.0%

Core Strategy includes all buyout, growth equity and late-stage venture capital co-investments since inception of the strategy in 2001. Discontinued Strategies represents all early-stage venture capital co-investments (5) and lead sponsored buyout investments (1) since the

establishment of the aforementioned strategy.

The total value of unrealized investments was determined by the fund's general partner in accordance with the fund's valuation policies. Actual realized returns on unrealized investments will depend on a number of factors (including future operating results, the value of the assets

and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale) that may differ significantly from the assumptions used in determining the unrealized values. Accordingly, the actual realized returns on these unrealized investments

may differ materially from the unrealized returns indicated herein.

MOIC represents multiple on invested capital, calculated by dividing the investment's cumulative distributions and unrealized value by the total invested capital. Accordingly, it is not reduced by fees incurred by the fund.

Gross IRR is net of the sponsor's fees, expenses and carried interest, but gross of the fees and other expenses of MFPEA. Performance information that is provided gross of fees does not reflect the deduction of advisory fees. Client returns will be reduced by such fees and other

expenses that may be incurred in the management of the account. Advisory fees are described in Part 2A of Form ADV of MFPEA, Inc.

Unaudited returns as of 6/30/2021. Please see "Notes on Performance Data" section for net performance and an explanation of how Estimated Net performance is constructed and the disclosure page at the end of this presentation for additional important information. Past performance is

not indicative of future results. Numbers may not add due to rounding.

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation