Tradeweb Investor Presentation Deck

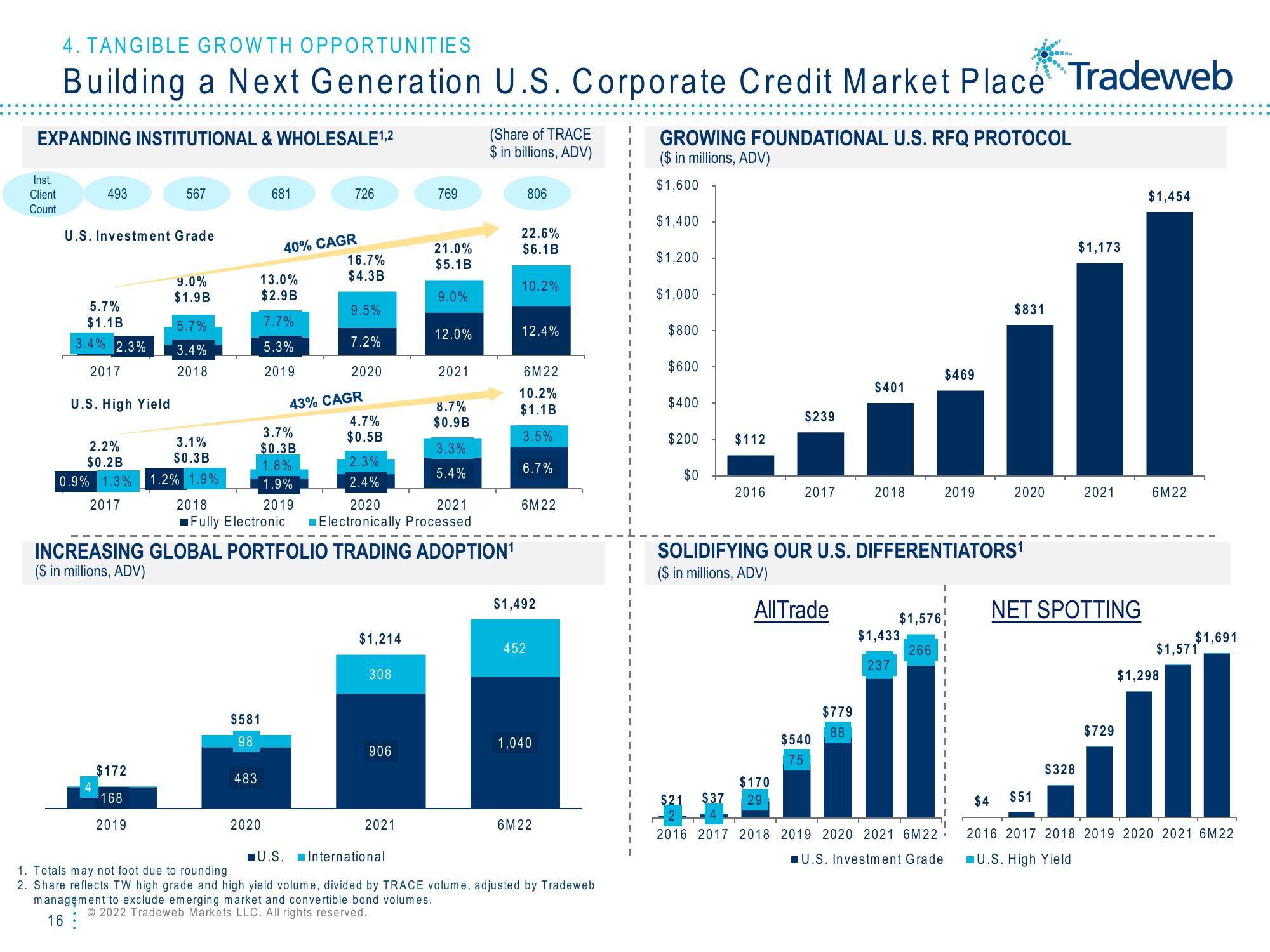

4. TANGIBLE GROWTH OPPORTUNITIES

Building a Next Generation U.S. Corporate Credit Market Place Tradeweb

EXPANDING INSTITUTIONAL & WHOLESALE ¹,2

Inst.

Client

Count

493

U.S. Investment Grade

5.7%

$1.1B

3.4% 2.3%

2017

U.S. High Yield

2.2%

$0.2B

0.9% 1.3%

2017

4

567

$172

168

2019

9.0%

$1.9B

5.7%

3.4%

2018

3.1%

$0.3B

1.2% 1.9%

681

13.0%

$2.9B

7.7%

5.3%

2019

3.7%

$0.3B

1.8%

1.9%

2018

2019

■Fully Electronic

$581

98

483

40% CAGR

2020

726

16.7%

$4.3B

9.5%

7.2%

2020

43% CAGR

4.7%

$0.5B

2.3%

2.4%

INCREASING GLOBAL PORTFOLIO TRADING ADOPTION¹

($ in millions, ADV)

$1,214

308

769

906

21.0%

$5.1B

9.0%

2020

2021

Electronically Processed

2021

12.0%

2021

8.7%

$0.9B

3.3%

5.4%

(Share of TRACE

$ in billions, ADV)

806

22.6%

$6.1B

10.2%

12.4%

6M22

10.2%

$1.1B

3.5%

6.7%

6M22

$1,492

452

1,040

6M22

U.S.

International

1. Totals may not foot due to rounding

2. Share reflects TW high grade and high yield volume, divided by TRACE volume, adjusted by Tradeweb

management to exclude emerging market and convertible bond volumes.

Ⓒ2022 Tradeweb Markets LLC. All rights reserved.

16

I

I

GROWING FOUNDATIONAL U.S. RFQ PROTOCOL

($ in millions, ADV)

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

$112

2016

$239

2017

$170

$21 $37 29

All Trade

$540

75

$401

$779

88

2018

SOLIDIFYING OUR U.S. DIFFERENTIATORS¹

($ in millions, ADV)

$1,576

266

$469

$1,433

237

2019

I

$831

2016 2017 2018 2019 2020 2021 6M22.

U.S. Investment Grade

2020

$51

$1,173

NET SPOTTING

$328

2021

$729

$1,454

6M22

$1,691

$1,571

$1,298

$4

2016 2017 2018 2019 2020 2021 6M22

U.S. High YieldView entire presentation