Inovalon Results Presentation Deck

Q3 2019 Financial Highlights

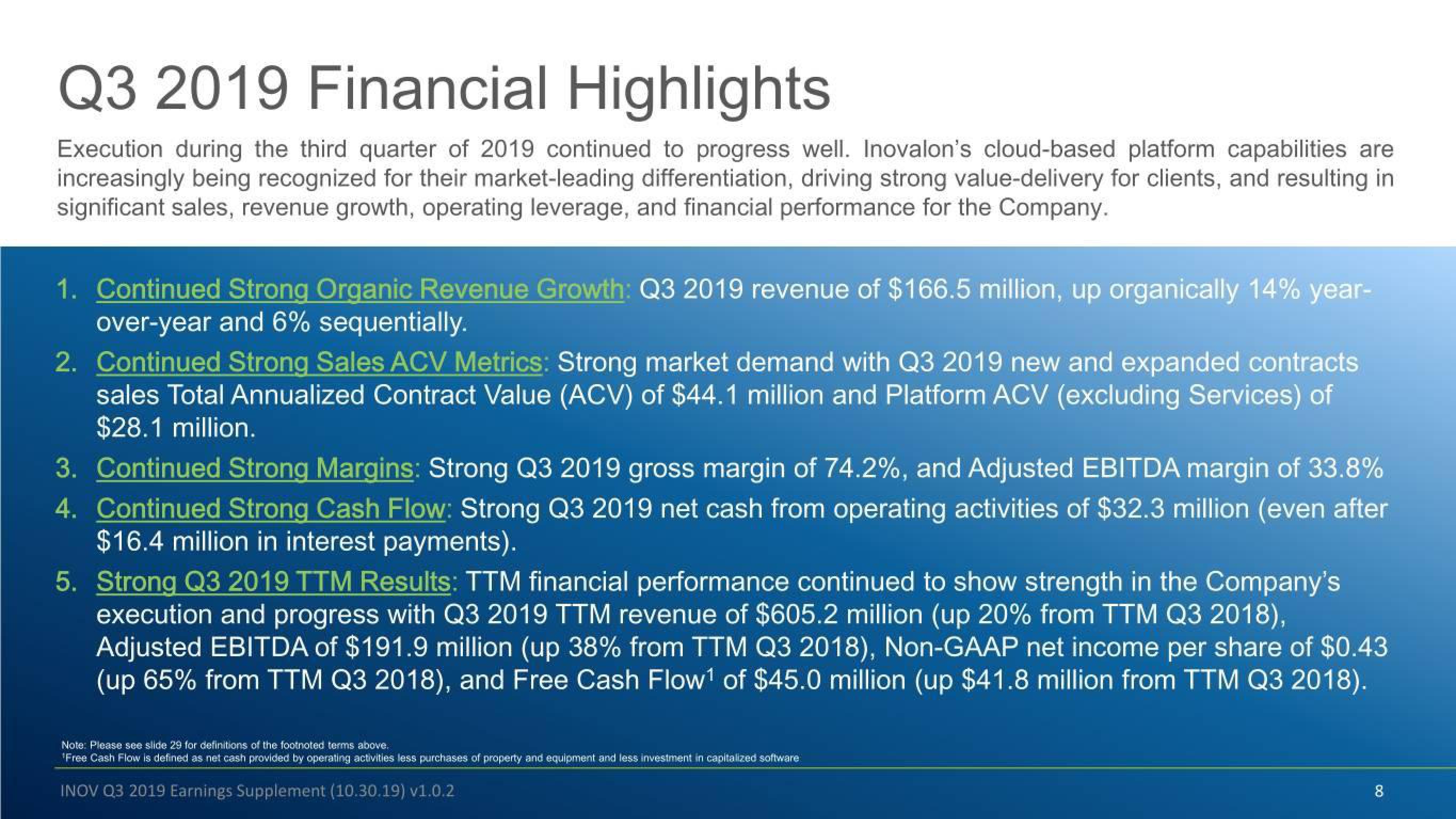

Execution during the third quarter of 2019 continued to progress well. Inovalon's cloud-based platform capabilities are

increasingly being recognized for their market-leading differentiation, driving strong value-delivery for clients, and resulting in

significant sales, revenue growth, operating leverage, and financial performance for the Company.

1. Continued Strong Organic Revenue Growth: Q3 2019 revenue of $166.5 million, up organically 14% year-

over-year and 6% sequentially.

2. Continued Strong Sales ACV Metrics: Strong market demand with Q3 2019 new and expanded contracts

sales Total Annualized Contract Value (ACV) of $44.1 million and Platform ACV (excluding Services) of

$28.1 million.

3. Continued Strong Margins: Strong Q3 2019 gross margin of 74.2%, and Adjusted EBITDA margin of 33.8%

4. Continued Strong Cash Flow: Strong Q3 2019 net cash from operating activities of $32.3 million (even after

$16.4 million in interest payments).

5. Strong Q3 2019 TTM Results: TTM financial performance continued to show strength in the Company's

execution and progress with Q3 2019 TTM revenue of $605.2 million (up 20% from TTM Q3 2018),

Adjusted EBITDA of $191.9 million (up 38% from TTM Q3 2018), Non-GAAP net income per share of $0.43

(up 65% from TTM Q3 2018), and Free Cash Flow¹ of $45.0 million (up $41.8 million from TTM Q3 2018).

Note: Please see slide 29 for definitions of the footnoted terms above.

*Free Cash Flow is defined as net cash provided by operating activities less purchases of property and equipment and less investment in capitalized software

INOV Q3 2019 Earnings Supplement (10.30.19) v1.0.2

8View entire presentation